What is a covered call ETF strategy? It’s an income approach where an ETF holds a basket of dividend-paying stocks and sells call options on them to generate option premiums. The goal is to create steadier cash flow while accepting limited upside during strong rallies. In this guide, we’ll explore 5 proven covered call ETF strategies that combine high dividend yields with reduced volatility—and help you decide if this approach is right for your portfolio in 2025.

- Covered call ETFs combine high-dividend stocks with options premiums to deliver monthly income.

- QYLD, JEPI, XYLD, RYLD, and DIVO are five of the most popular high-yield covered call ETFs in 2025.

- They’re ideal for retirees and income-focused investors seeking predictable, recurring cash flow.

- This guide explains how the strategy works, compares ETF options, and highlights common pitfalls to avoid.

Table of Contents

🔍 What Are Covered Call ETFs and How Do They Work?

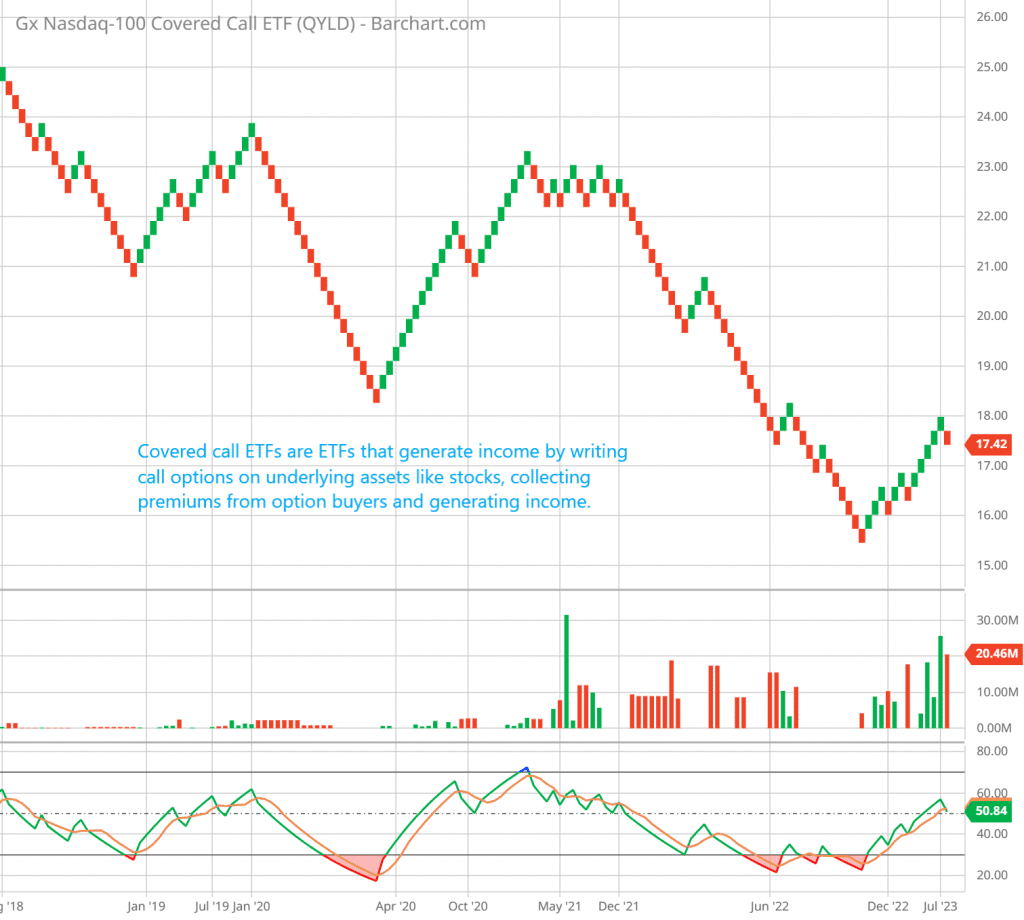

Covered call ETFs are a unique breed of exchange-traded funds (ETFs) designed to generate income by writing (selling) call options on a basket of underlying assets, such as stocks. Here’s how they work:

- The ETF manager owns a portfolio of stocks.

- They write call options on these stocks, essentially agreeing to sell them at a predetermined price (the strike price) if the option buyer chooses to exercise the option.

- In exchange for writing these call options, the ETF collects premiums from option buyers, which become part of the fund’s income.

A popular example of a covered call ETF is the Global X NASDAQ-100 Covered Call ETF (QYLD), which generates income by selling covered calls on the NASDAQ-100 Index.

🟢 High-Dividend Covered Call ETFs for Reliable Income

Looking for high dividend income with less market risk? Covered call ETFs generate monthly income by selling call options on their stock holdings—and passing that premium to investors.

They’re ideal for income-focused investors seeking predictable, recurring cash flow, especially in a sideways or mildly bullish market.

🎯 Covered Call ETF Strategy: 5 Proven Ways to Boost Income

This section breaks down 5 proven covered call ETF strategies you can use to grow reliable monthly income while managing risk. Each example highlights yield, approach, and trade-offs.

💸 5 High-Dividend Covered Call ETFs Paying Monthly Income

Each of these covered call ETFs follows a slightly different approach but shares one goal: delivering reliable monthly income. Here’s how they compare:

🥇 1. QYLD – Global X Nasdaq 100 Covered Call ETF

- Yield: ~11–12%

- Dividend Frequency: Monthly

- Focus: Nasdaq-100 (tech-heavy)

- Summary: Offers some of the highest income among covered call ETFs. Trades upside for premium income. Best suited for aggressive income seekers.

📊 2. XYLD – Global X S&P 500 Covered Call ETF

- Yield: ~10–11%

- Dividend Frequency: Monthly

- Focus: Large-cap U.S. stocks (S&P 500)

- Summary: A more diversified take on covered call income. Slightly lower yield than QYLD, with broader market exposure.

📉 3. RYLD – Global X Russell 2000 Covered Call ETF

- Yield: ~11%

- Dividend Frequency: Monthly

- Focus: Small-cap stocks

- Summary: Higher yield, higher volatility. Great for investors seeking income from small-cap exposure but willing to ride out price swings.

🧩 4. JEPI – JPMorgan Equity Premium Income ETF

- Yield: ~8–10%

- Dividend Frequency: Monthly

- Focus: Large-cap value and low-volatility stocks

- Summary: Combines options income with a defensive equity strategy. More conservative than QYLD/RYLD, ideal for income with downside protection.

🛡️ 5. DIVO – Amplify CWP Enhanced Dividend Income ETF

- Yield: ~5%

- Dividend Frequency: Monthly

- Focus: Dividend growth stocks + tactical options

- Summary: Prioritizes capital preservation and high-quality companies. Great for conservative investors or those near retirement.

📊 Top 10 Covered-Call ETFs in 2025

Data updated 31 July 2025

| Ticker | Fund | 12-M Yield* | Expense Ratio | AUM | Div. Freq. | Launch Date |

|---|---|---|---|---|---|---|

| JEPI | JPMorgan Equity Premium Income | 8.34 % | 0.35 % | $41.3 B | Monthly | 20 May 2020 |

| JEPQ | JPMorgan Nasdaq Equity Premium Income | 11.19 % | 0.35 % | $28.8 B | Monthly | 3 May 2022 |

| QYLD | Global X Nasdaq-100 Covered Call | 13.35 % | 0.60 % | $8.34 B | Monthly | 11 Dec 2013 |

| RYLD | Global X Russell 2000 Covered Call | 12.81 % | 0.60 % | $1.26 B | Monthly | 17 Apr 2019 |

| XYLD | Global X S&P 500 Covered Call | 13.40 % | 0.60 % | $3.09 B | Monthly | 21 Jun 2013 |

| DIVO | Amplify CWP Enhanced Dividend Income | 4.62 % | 0.56 % | $4.75 B | Monthly | 14 Dec 2016 |

| SPYI | NEOS S&P 500 High Income | 12.15 % | 0.68 % | $4.56 B | Monthly | 30 Aug 2022 |

| QQQI | NEOS Nasdaq-100 High Income | 13.91 % | 0.68 % | $3.40 B | Monthly | 30 Jan 2024 |

| QDTE | Roundhill Innovation-100 0DTE Covered Call | 41.20 % | 0.97 % | $0.78 B | Weekly | 7 Mar 2024 |

| XYLG | Global X S&P 500 Covered Call & Growth | 24.47 % | 0.35 % | $53.7 M | Monthly | 18 Sep 2020 |

*Trailing-12-month distribution yield.

Data sources: StockAnalysis, fund fact-sheets and issuer pages as of 30–31 July 2025.

For a practical example, check out my test using GPT with DVN: GPT + Renko + Covered Call Options.

💸 Highest-Yield Covered-Call ETFs: Why 12 %+ Isn’t “Free Money”

Covered-call funds that advertise double-digit distribution rates (think QYLD, XYLD, the “0-DTE” newcomers like QDTE, or YieldMax’s single-stock products) juice payouts by selling deeper-in-the-money calls or running weekly option cycles. The higher the premium, the less upside the fund keeps—and the more its net-asset value (NAV) can drift sideways or even fall over time.

Key trade-offs to remember

| What fuels the lofty yield | Potential consequence |

|---|---|

| Sells calls closer to—or below—the current price | Caps most of the index/stock’s upside |

| Distributes a lot of return of capital (ROC) | NAV erosion if market rises |

| Runs option cycles every week (or even daily) | Higher transaction costs & turnover |

| Charges higher fees ( ≈ 0.75 %–1 % ) | Drag on total return |

| Concentrates on volatile sectors or single stocks | Bigger drawdowns in sell-offs |

“Target-income” ETFs aim for a fixed payout—sometimes 15 % or even 20 %—but investors must surrender a chunk of capital growth and accept higher complexity.” :contentReference[oaicite:0]{index=0}

Barron’s calls these products “target-income funds”: attractive when bond yields feel skimpy, but they lag traditional index ETFs in bull markets and come with steeper expense ratios. Always judge them on total return, not yield alone—an insight echoed in this article’s earlier caution against yield-chasing. :contentReference[oaicite:3]{index=3}

Data checked 31 July 2025

📅 Monthly-Dividend Covered-Call ETFs: Predictable Cash-Flow Every 30 Days

Covered-call funds that pay monthly make cash-flow planning simple—dividends land about the same time each month rather than quarterly.

Their managers finance those checks by selling call-option premium plus the underlying stocks’ dividends.

| Ticker | Fund | 12-M Yield* | Dividend Freq. |

|---|---|---|---|

| JEPI | JPMorgan Equity Premium Income | 8.1 % | Monthly |

| JEPQ | JPMorgan Nasdaq Equity Premium Income | 11.3 % | Monthly |

| QYLD | Global X Nasdaq-100 Covered Call | 13.9 % | Monthly |

| RYLD | Global X Russell 2000 Covered Call | 12.8 % | Monthly |

| XYLD | Global X S&P 500 Covered Call | 13.4 % | Monthly |

| SPYI | NEOS S&P 500 High Income | 12.1 % | Monthly |

| QQQI | NEOS Nasdaq-100 High Income | 14.7 % | Monthly |

| IDVO | Amplify International Enhanced Dividend Income | 5.9 % | Monthly |

*Trailing-12-month distribution rate, fact-sheet data as of 30–31 July 2025.

Why monthly matters

- Budget-friendly: predictable cash for bills or reinvestment.

- Option-cycle agility: managers can reset strike prices every four weeks to reflect volatility.

- Snowball effect: automatic DRIP adds shares 12× a year, compounding faster than quarterly payers.

JEPI “seeks to deliver a monthly income stream from option premiums and stock dividends.”

QYLD has “made monthly distributions 11 years running.”

🌐 International & Global-Flavor Covered-Call ETFs

Most buy-write funds hug U.S. benchmarks, but a handful now export the strategy to non-U.S. or “all-world” equity baskets. They can help diversify currency and regional risk, though yields are usually lower than the mega-yield U.S. variants.

| Ticker | Fund & Market Focus | 12-M Yield* | Expense Ratio | Div. Freq. | Launch |

|---|---|---|---|---|---|

| SPYI | NEOS S&P 500 High Income – broad U.S. blue chips with 50-delta calls | 12.1 % | 0.68 % | Monthly | 30 Aug 2022 |

| QQQI | NEOS Nasdaq-100 High Income – tech-heavy global revenues | 14.7 % | 0.68 % | Monthly | 30 Jan 2024 |

| IDVO | Amplify International Enhanced Dividend Income – ex-U.S. dividend growers with covered calls | 5.9 % | 0.66 % | Monthly | 8 Sep 2022 |

*Trailing-12-month distribution rate. SPYI & QQQI stats from July 30 2025 fact-sheets; IDVO yield from Dividend.com snapshot. NEOS InvestmentsDividend

Why consider them?

- Regional diversification – IDVO tilts toward developed Europe & Asia, reducing over-reliance on U.S. mega-caps.

- Different volatility regimes – non-U.S. indexes often have fatter option premia in periods when the S&P 500 is calm, supporting payout stability.

- Currency kicker – overseas dividends are received in local FX and converted to USD; when the dollar weakens you can see a yield “bonus.”

- Moderate total-return drag – because these funds overwrite just a slice of upside (usually 30–50 delta), NAV decay has been milder than deep-in-the-money approaches used by legacy products like QYLD.

❓ Covered-Call ETF FAQs

❓ Is a Covered Call ETF Strategy a Good Idea?

Yes — for the right investor. Covered call ETFs generate extra income by selling call options, but that caps your upside. They work best in sideways or gently rising markets and suit conservative, cash-flow-focused investors.

❓ Which Covered Call ETFs Pay Monthly Dividends?

Most of today’s headline funds pay monthly, including JEPI, JEPQ, QYLD, RYLD, XYLD, SPYI and DIVO. Monthly payouts make budgeting smoother than quarterly payers.

❓ What Is the Highest-Yield Covered Call ETF Right Now?

The current yield leader is QDTE (Roundhill Innovation-100 0-DTE Covered Call) at roughly 40 % on a trailing-12-month basis — but that sky-high yield comes with steeper NAV decay and a 0.97 % fee. Compare total return, not just yield.

❓ Are There International Covered Call ETFs?

Yes. IDVO targets developed-ex-US dividend stocks, while SPYI and QQQI apply the buy-write overlay to S&P 500 and Nasdaq-100 baskets that earn a large share of revenue overseas — adding regional and currency diversification.

❓ What Are the Best Covered Call ETFs in 2025?

For balanced yield + growth: JEPI or DIVO.

For maximum income: QYLD, XYLD, RYLD or QDTE.

“Best” depends on your mix of income target, risk tolerance and fee sensitivity.

⚠️ Common Pitfalls and How to Avoid Them

While covered call ETFs offer steady income, they aren’t without drawbacks. Here are some key risks to be aware of—and how to manage them:

🧨 1. Capped Upside Potential

Covered call strategies limit your gains. If the underlying index or stock surges, your ETF won’t capture the full upside because the calls sold act as a ceiling.

How to avoid it:

Use covered call ETFs in income-focused portfolios—not in high-growth accounts where capital appreciation is the main goal.

📉 2. Underperformance in Strong Bull Markets

In fast-rising markets, these ETFs often lag traditional index funds due to the call-writing drag.

How to avoid it:

Balance your allocation. Pair covered call ETFs with growth or dividend ETFs so you’re not missing out on broader market rallies.

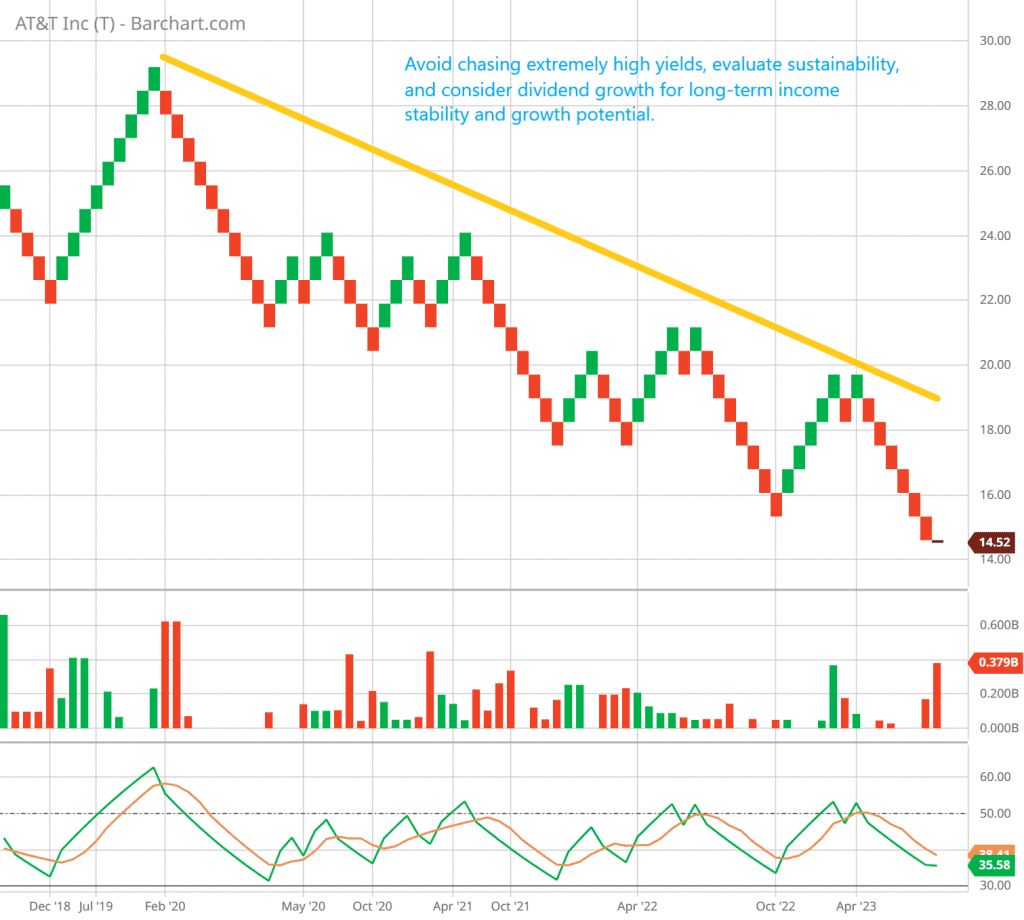

🔄 3. Yield Chasing Without Understanding Risk

Many investors are drawn to 10%+ yields, but don’t realize that those payouts can fluctuate or come at the cost of capital stability.

How to avoid it:

Focus on total return—not just yield. Consider factors like fund volatility, expense ratios, and drawdown history before investing.

🔗 Related Posts

- 5 Powerful Ways Dividend ETFs Enhance Covered Call Success

- Unleash Wealth with Covered Call ETFs and Dividend Stocks: 5X Income Boost

🔚 Final Thoughts

Covered call ETFs are a powerful way to earn monthly income—especially when focusing on high-dividend options like QYLD, RYLD, and JEPI. Whether you prefer aggressive yield or capital preservation, there’s likely a fund that fits your strategy in 2025.