🎥 Watch the Video

In this post, we explore how GPT analyzes a Renko chart and covered call options for DVN (Devon Energy).

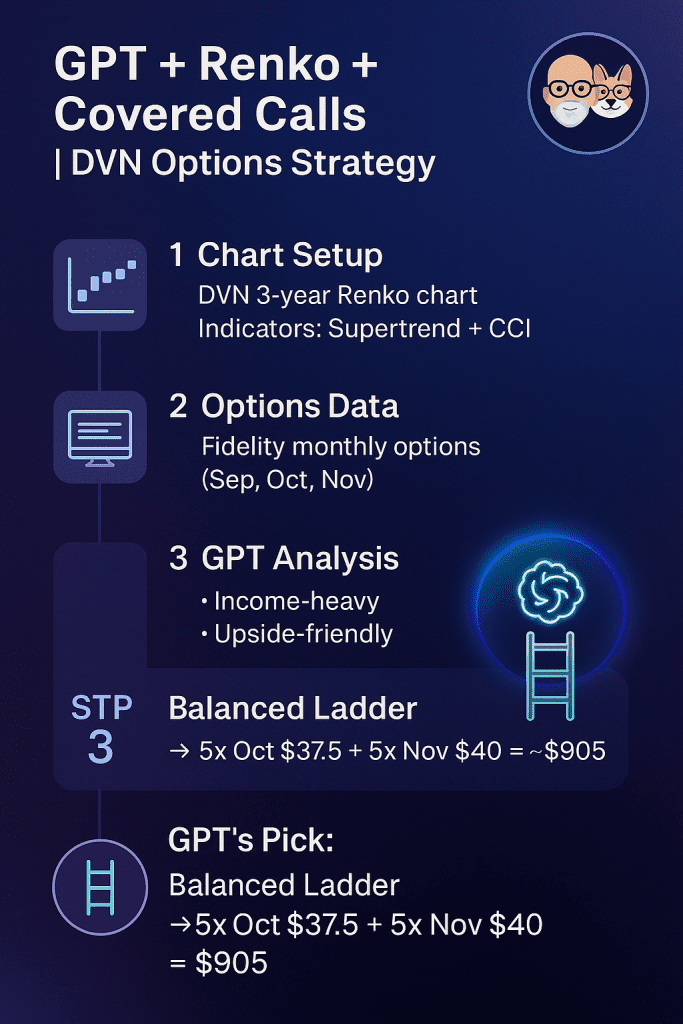

I uploaded a 3-year daily Renko chart with Supertrend and CCI indicators, plus Fidelity monthly options data for September, October, and November.

GPT reviewed the setup, compared several covered call options strategies, and picked its favorite: the Balanced Ladder.

✅ Key Takeaways

- GPT combines Renko chart signals + covered call options to propose structured strategies.

- The Balanced Ladder was GPT’s top choice: Oct $37.5 + Nov $40 calls, ~$905 premium.

- Covered call options can provide income and risk management, but every trader has a unique style and tolerance.

- Use GPT as a tool to spark ideas — not financial advice.

📚 Related Resources

- My Renko Trading Blog – more guides and experiments.

- Previous Video: GPT-3 SPX Analysis

⚠️ Disclaimer

This content is for educational purposes only. It is not financial advice.