Dive into the intricate world of financial markets with our monthly analysis that provides a comprehensive view of the S&P 500 12-month forecast along with a nuanced outlook and commentary. This article combines quantitative data and qualitative insights to guide investors through the potential opportunities and challenges on the horizon.

Disclaimer: The views expressed in this article are my personal opinions and should not be considered financial advice. Always conduct your research and consult with a financial professional before making investment decisions.

S&P 500 Outlook and Charts

Various algorithms are employed for the computations in this forecasting model. Beyond relying on historical S&P 500 values from the last five years, the forecast incorporates additional variables, including stock market indices and economic data, to generate its projections. It’s essential to note that this model is a product of my own creation and is currently a work-in-progress.

Disclaimer: The forecast provided by this model is based on historical data, algorithms, and various economic indicators. However, it should be noted that all forecasts inherently carry a degree of uncertainty, and the model is a work-in-progress, subject to adjustments and improvements over time. Users are advised to exercise caution and consider multiple sources of information before making any financial decisions based on the forecast.

Key Takeaways

| Key Takeaways | Implications |

|---|---|

| S&P 500 Forecast Overview | – Market exhibits initial caution, gradually adapting to challenges. – Mid to late summer sees notable confidence surges. – Overall, a strong upward trend emerges towards the end of 2024. |

| Federal Reserve and Interest Rates | – Fed’s plan to cut rates in 2024 signals caution and economic stimulus. – Monitoring timing and extent provides insights into economic outlook. |

| Economic Resilience | – Despite early 2023 gloom, the U.S. is expected to avoid a recession in 2024. – Economic resilience contributes to positive market sentiment. |

| Global Economic Uncertainty | – Slowing global growth presents challenges for the U.S. market. – International developments can have a ripple effect on the S&P 500. |

| Geopolitical Tensions | – Ongoing geopolitical uncertainties (e.g., Russia-Ukraine, Israel-Hamas) add complexity. – Events can inject volatility, requiring investor vigilance. |

| Conclusion | – Diversified and resilient approach crucial for navigating 2024. – Economic and geopolitical landscape introduces elements of unpredictability. – Informed decision-making key for success in dynamic markets. |

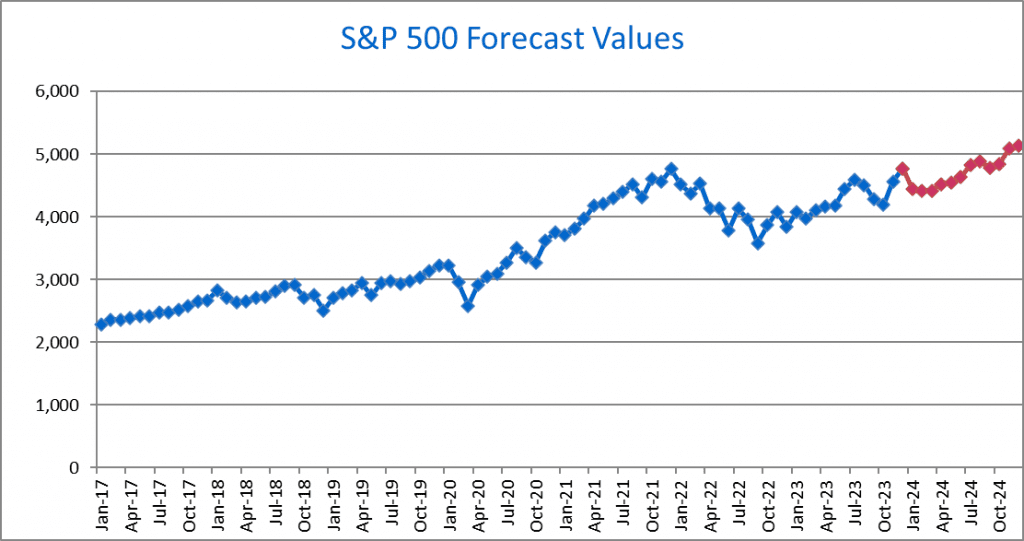

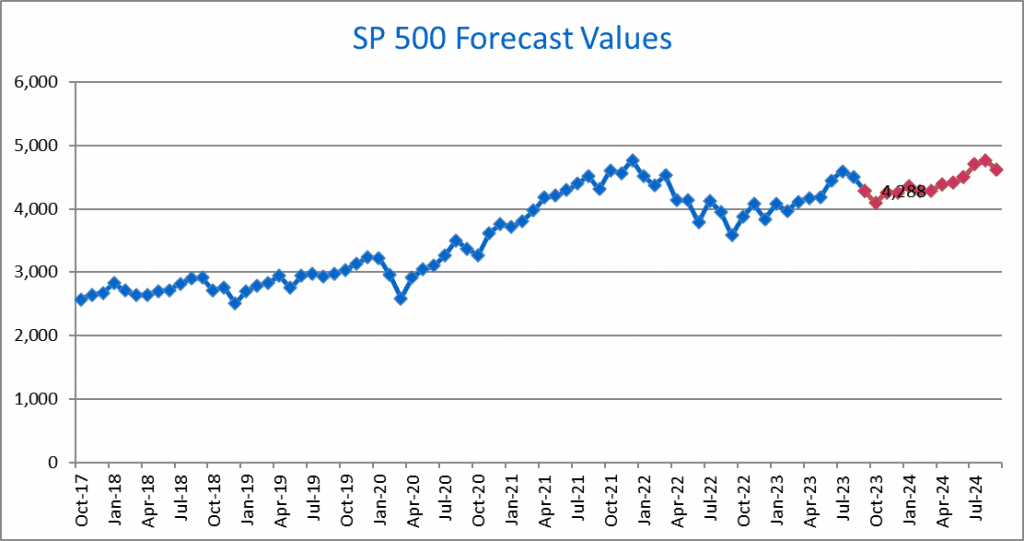

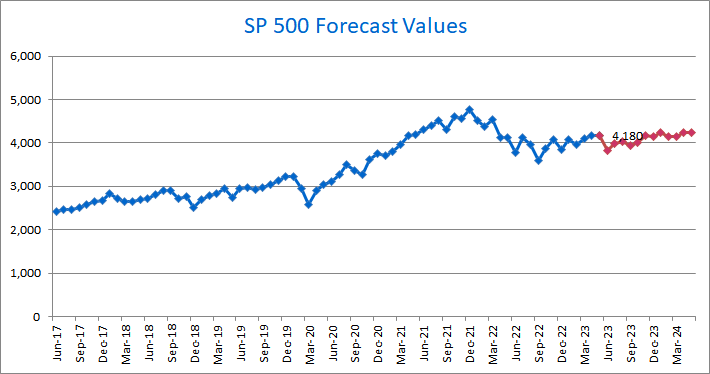

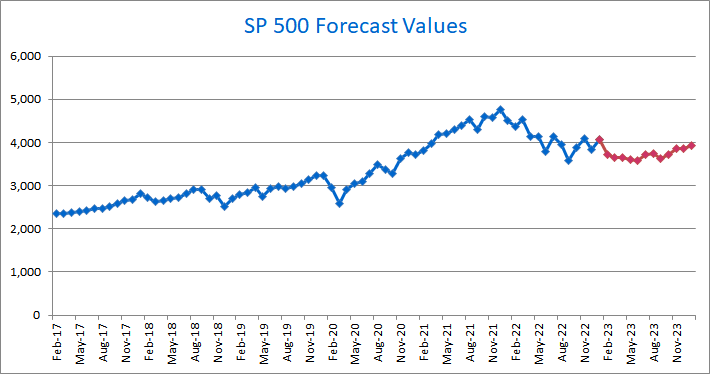

January 2024, S&P 500 Outlook

As we step into the unpredictable terrain of 2024, investors find themselves at a crossroads with a blend of economic optimism and looming uncertainties. The S&P 500 is anticipated to undergo fluctuations throughout 2024, reflecting a dynamic and evolving market environment. The year begins with a cautious stance, but gradual upticks suggest resilience and adaptability in the face of economic and geopolitical challenges. As we progress through the months, a positive trajectory emerges, with notable surges in confidence during the mid to late summer. While minor dips and stabilizations occur in certain periods, the overall trend points toward a strong upward movement as we approach the conclusion of 2024.

Economic and Fundamental Factors:

Federal Reserve and Interest Rates:

The Federal Reserve’s plan to cut rates in 2024 is a notable factor. While rate cuts are often seen as a stimulant for the market, they also signal caution about economic conditions. Investors will closely monitor the timing and extent of these cuts for insights into the Fed’s economic outlook.

Economic Resilience:

Despite gloomy forecasts in early 2023, the expectation that the U.S. will avoid a recession in 2024 is a positive sign. The economy’s ability to weather challenges and sustain growth contributes to the overall market sentiment.

Global Economic Uncertainty:

Slowing global growth presents a headwind for the U.S. market. The interconnected nature of economies means that international developments can have a ripple effect on the S&P 500. Investors will need to assess the impact of global factors on their portfolios.

Geopolitical Tensions:

Geopolitical uncertainties, such as the Russia-Ukraine war, Israel-Hamas conflict, North Korea, and China-Taiwan tensions, add an extra layer of complexity. These events can inject volatility into the markets, requiring investors to stay vigilant and agile in response to unfolding developments.

As investors navigate the twists and turns of 2024, a diversified and resilient approach will be key. While the S&P 500 forecast provides a roadmap, the economic and geopolitical landscape introduces elements of unpredictability. Staying informed, maintaining a balanced portfolio, and adjusting strategies in response to changing conditions will be crucial for success in the dynamic year ahead.

Month Forecast Jan-24 4,453 Feb-24 4,410 Mar-24 4,424 Apr-24 4,521 May-24 4,553 Jun-24 4,635 Jul-24 4,834 Aug-24 4,892 Sep-24 4,779 Oct-24 4,846 Nov-24 5,088 Dec-24 5,131

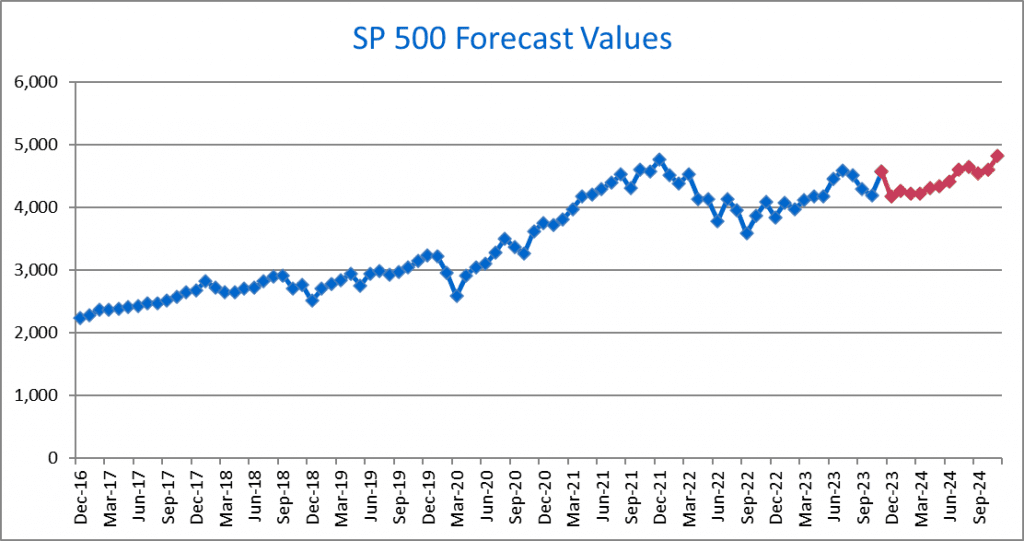

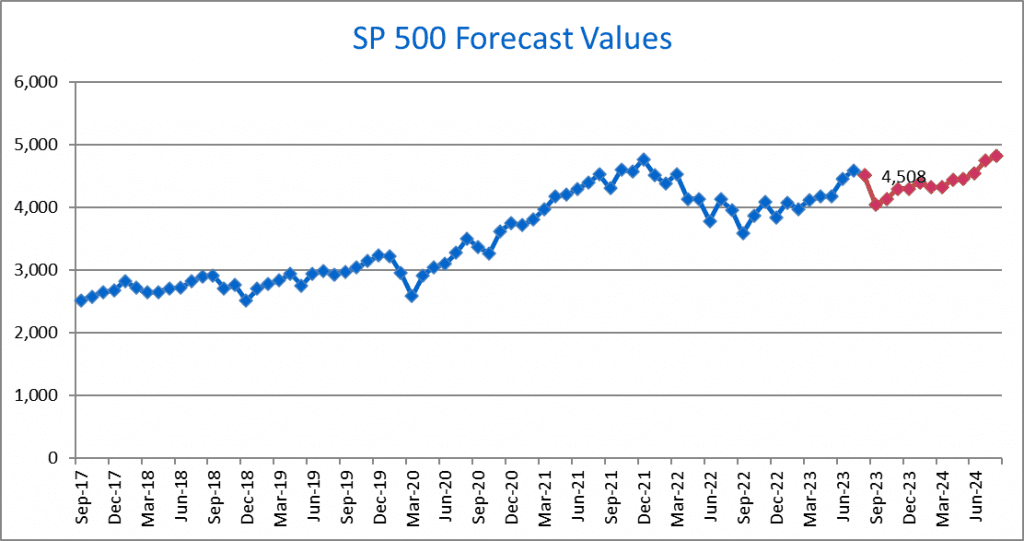

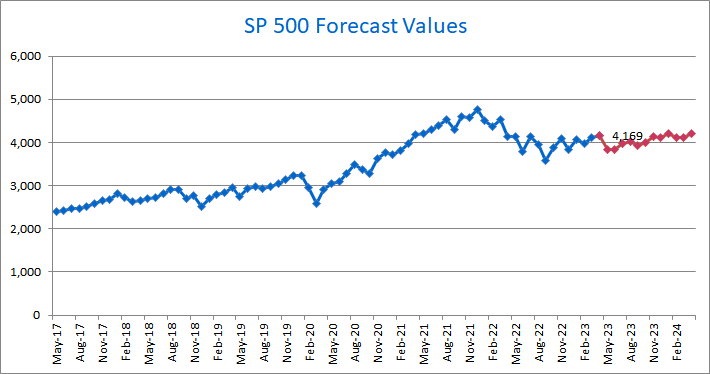

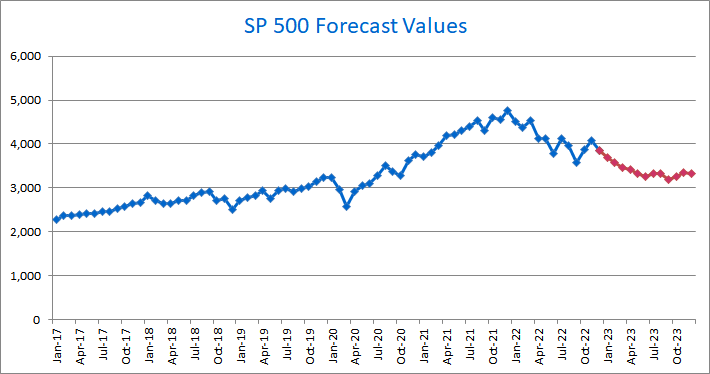

December 2023, S&P 500 Outlook

The S&P 500 12-month forecast values suggest a generally positive outlook for the market over the specified period. However, the accompanying macroeconomic factors and geopolitical events introduce complexities and uncertainties.

Inflation and Fed Policy:

The information indicates that inflation has moderated but remains above the Federal Reserve’s target of 2%. Despite this, Fed Chair Powell has conveyed a reluctance to cut rates soon due to persistently high inflation. The readiness to hike rates when necessary reflects a cautious approach. The market’s expectation of a rate cut in the first quarter of 2024 suggests a divergence between market sentiment and the Fed’s communicated stance. Investors may need to closely monitor inflation trends and the Fed’s policy decisions for potential market impacts.

Geopolitical Tensions:

The resumption of the Israel-Hamas conflict introduces geopolitical risks to the market. Geopolitical events, especially those involving conflict in significant regions, can lead to market volatility. Investors often react to such uncertainties by adjusting their portfolios, and the situation in the Middle East could influence global market sentiment.

Market Forecast:

Looking at the S&P 500 forecast, the values generally show an upward trend over the next 12 months. This suggests an optimistic outlook, but market conditions can be influenced by a multitude of factors. The forecast indicates an expectation of economic growth, but the market’s reaction to inflation, Fed policies, and geopolitical events may deviate from this baseline.

Conclusion:

Investors should maintain a balanced and diversified portfolio, considering both the positive market outlook and the potential impact of external factors. Keeping a close eye on developments in inflation, Fed policies, and geopolitical events will be crucial for making informed investment decisions in this dynamic environment. It’s essential to stay vigilant, adapt strategies as needed, and be prepared for market shifts in response to changing economic and geopolitical conditions.

Month Forecast Dec-23 4,172 Jan-24 4,264 Feb-24 4,218 Mar-24 4,223 Apr-24 4,314 May-24 4,339 Jun-24 4,415 Jul-24 4,597 Aug-24 4,648 Sep-24 4,541 Oct-24 4,595 Nov-24 4,819

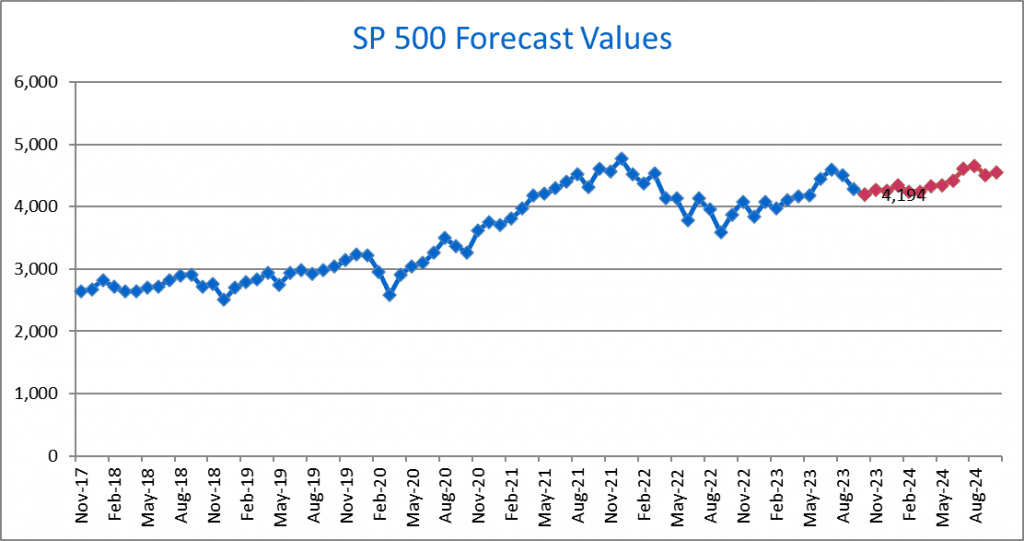

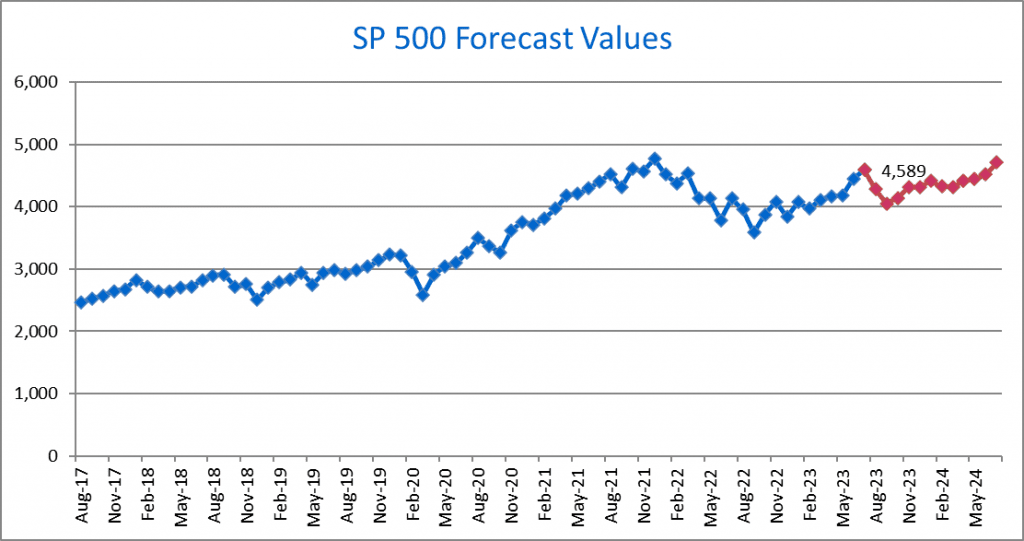

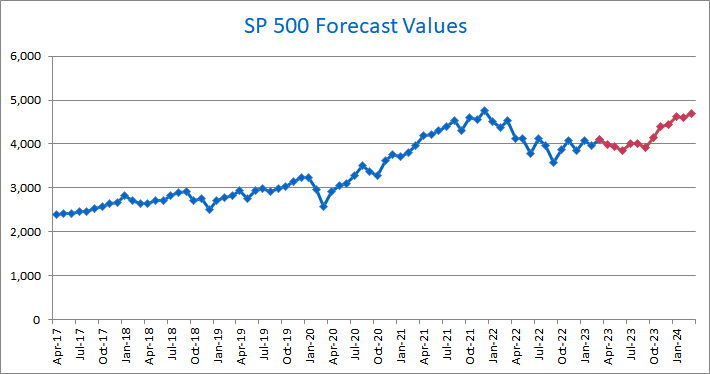

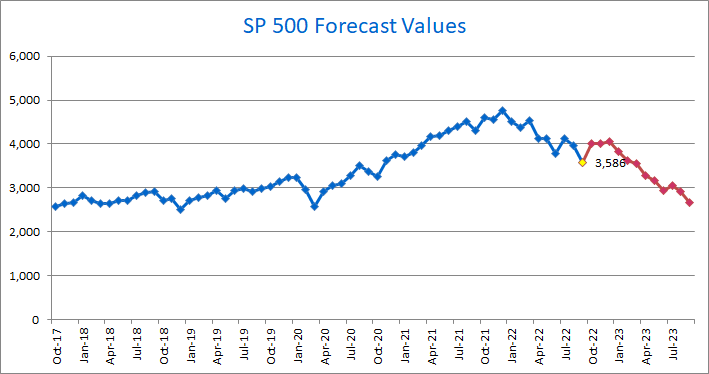

November 2023, S&P 500 Outlook

This forecast suggests that the S&P 500 index will see fluctuations in the coming year, with some months showing modest gains while others experience slight declines. To better understand these predictions, let’s delve into the factors that are likely to impact the index’s performance.

Prolonged High-Interest Rate Environment

The Federal Reserve’s interest rate policies play a crucial role in stock market performance. A prolonged high-interest rate environment tends to have a dampening effect on equities. Higher interest rates can lead to reduced corporate profits and increased borrowing costs. The forecasts for the S&P 500 appear to reflect this, with fluctuations in performance, especially in the first half of the forecasted period.

Healthy Labor Markets

A healthy labor market is generally associated with robust consumer spending and economic growth. As more people find employment, consumer confidence and disposable income tend to rise. This can boost corporate earnings, which in turn can support stock market performance. The S&P 500’s overall positive trend in the forecasted months could be a reflection of expectations for a strong labor market.

Israel-Hamas Conflict

Geopolitical events can have a significant impact on financial markets. The Israel-Hamas conflict is one such factor. The escalation of this conflict, particularly if it continues amid hostage situations, can introduce uncertainty into the market. Investors tend to react nervously to geopolitical instability, which may lead to sudden downturns or corrections in the S&P 500.

Persistent Inflation and High Costs of Living

Inflation has been a major concern in recent times. Persistent inflation erodes purchasing power and raises the cost of living. This can negatively impact consumer spending, corporate profit margins, and, by extension, the stock market. The predicted fluctuations in the S&P 500 may reflect ongoing concerns about inflation’s effects.

The forecasted performance of the S&P 500 over the next 12 months is subject to multiple influences. A prolonged high-interest rate environment and the specter of inflation, in particular, are likely to contribute to volatility in the index. The healthy labor market may act as a stabilizing force, while the Israel-Hamas conflict introduces an element of geopolitical risk. As always, it’s essential for investors to keep a close eye on these factors and adapt their strategies accordingly. The S&P 500, as a reflection of the broader market, will continue to respond to the ever-changing economic and geopolitical landscape.

Month Forecast Nov-23 4,273 Dec-23 4,256 Jan-24 4,337 Feb-24 4,246 Mar-24 4,241 Apr-24 4,333 May-24 4,343 Jun-24 4,420 Jul-24 4,608 Aug-24 4,657 Sep-24 4,507 Oct-24 4,548

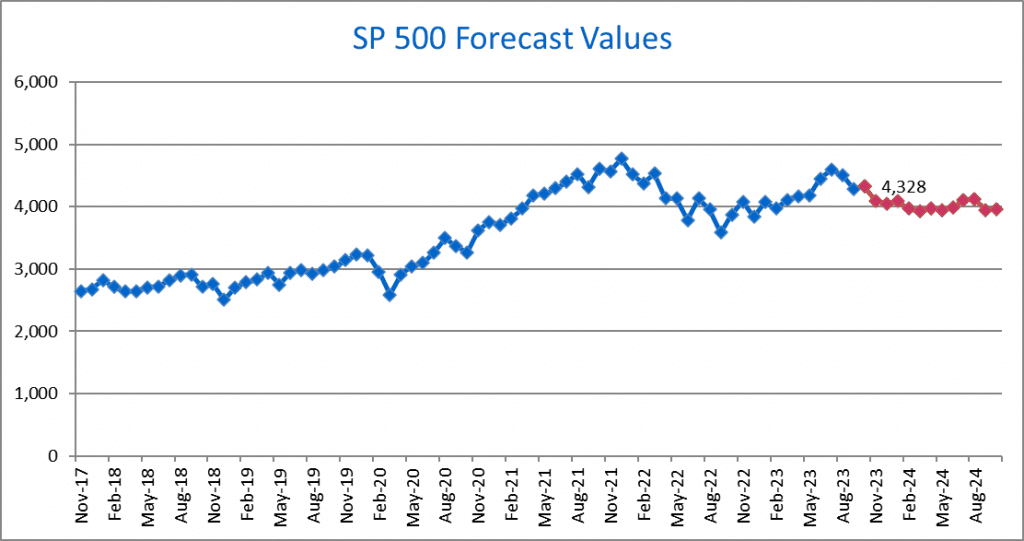

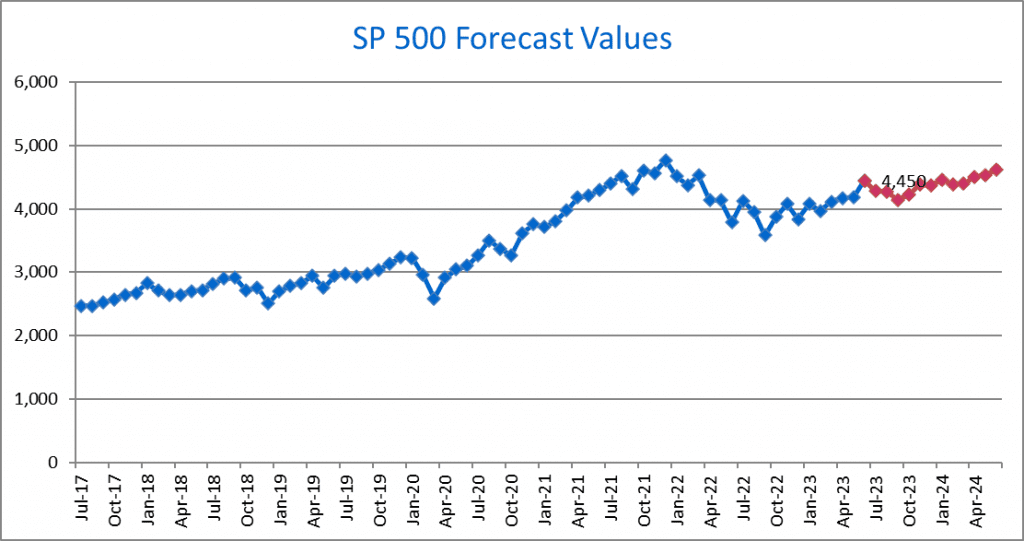

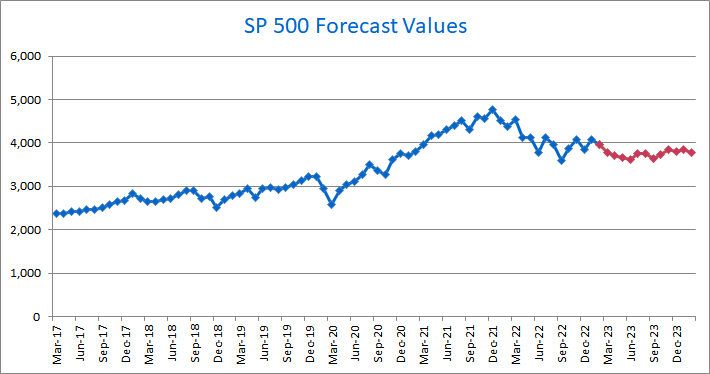

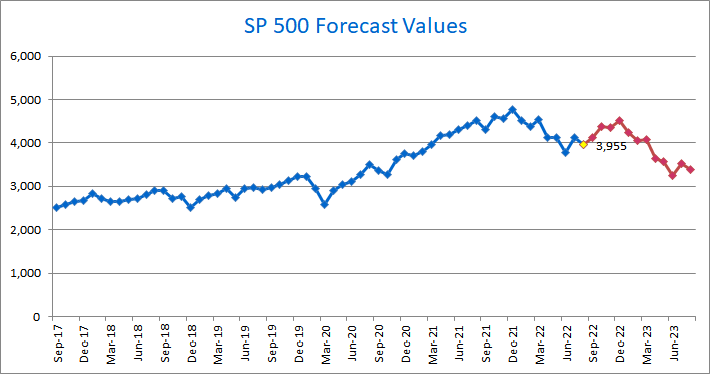

October 2023, SP 500 Outlook – A Mid-Month Analysis

S&P 500 Outlook: Navigating Turbulent Waters

Inflation Remains a Concern

One of the primary concerns for the S&P 500 is the persistent high inflation rates. Inflation erodes purchasing power and can lead to reduced consumer spending and lower corporate profits. As inflation remains elevated, investors are wary of its potential impact on businesses’ costs, profit margins, and overall economic growth. Rising inflation can also affect interest rates and monetary policy decisions, adding an additional layer of uncertainty.

The Federal Reserve’s Interest Rate Decision

The Federal Reserve’s indication of a planned interest rate increase later in the year has brought both anticipation and apprehension. The central bank has signaled its intention to raise interest rates to curb inflation, aiming for a balance between economic growth and price stability. However, the prospect of higher interest rates can dampen investor confidence, affecting borrowing costs for businesses and consumers alike. The timing and extent of these rate hikes will be crucial in determining market sentiment and performance.

Labor Market Resilience

Despite concerns about inflation, the labor market has displayed remarkable resilience. It has remained robust and seemingly unaffected by the high inflation and impending interest rate hikes. A strong labor market can bolster consumer spending and sustain economic growth. However, striking the right balance between a strong labor market and managing inflation will be a delicate task for policymakers.

Geopolitical Factors: Israel-Hamas War

Geopolitical events, such as the Israel-Hamas conflict, can have ripple effects on global markets, including the S&P 500. Geopolitical tensions often introduce uncertainty and can lead to heightened volatility in financial markets. Investors will closely monitor developments in the Middle East and assess potential impacts on various sectors, including energy, defense, and technology, among others.

Market Forecast and Projection

Looking at the provided forecast for the S&P 500, the projections indicate a fluctuating trend over the upcoming months. The market seems to face challenges, particularly in February and March of 2024, with a dip in the index. However, there is an expected recovery in the subsequent months, indicating resilience and potential for growth in the latter half of the forecast period.

The S&P 500 outlook is influenced by a delicate balance of economic indicators and geopolitical events. Investors are carefully weighing the impact of high inflation, the Federal Reserve’s interest rate decisions, the strength of the labor market, and ongoing geopolitical conflicts. Monitoring these factors and their interplay will be crucial in navigating the uncertain and evolving landscape of the S&P 500 in the coming months.

Month Forecast Nov-23 4,092 Dec-23 4,044 Jan-24 4,089 Feb-24 3,968 Mar-24 3,927 Apr-24 3,977 May-24 3,949 Jun-24 3,982 Jul-24 4,111 Aug-24 4,116 Sep-24 3,946 Oct-24 3,959

October 2023, SP 500 Outlook

In September, the Federal Reserve announced its intention to implement another rate hike in 2023, signaling a proactive stance to curb inflation and maintain economic stability. This decision suggests an anticipation of higher interest rates that might impact borrowing costs for businesses and consumers alike. As rates remain high for a significant period, there’s concern about how this might affect companies’ ability to meet high earnings expectations.

Oil prices have remained elevated, posing a challenge for various sectors of the economy that heavily rely on energy resources. These elevated prices can lead to increased operational costs for businesses, potentially impacting profit margins and overall market sentiment. The repercussions of these high oil prices on the S&P 500 Index need to be carefully monitored as they can influence market dynamics.

Considering the forecasted values for the S&P 500 Index, it’s evident that despite the potential challenges posed by the Federal Reserve’s hawkish stance on interest rates and elevated oil prices, the index is projected to demonstrate resilience and growth. However, fluctuations in the market are expected, particularly in response to changes in interest rates and energy costs.

Investors and stakeholders should remain vigilant, keeping a close eye on economic indicators, policy updates, and global events that may impact the market’s trajectory. Diversification of portfolios and adopting a prudent investment strategy will be crucial for navigating potential market volatility in the coming months.

Please note that this content is for informational purposes only and should not be considered as financial or investment advice. It’s essential to consult with a qualified financial advisor before making any investment decisions.

Month Forecast Oct-23 4,094 Nov-23 4,260 Dec-23 4,257 Jan-24 4,356 Feb-24 4,277 Mar-24 4,282 Apr-24 4,389 May-24 4,409 Jun-24 4,499 Jul-24 4,699 Aug-24 4,761 Sep-24 4,619

September 2023, SP 500 Outlook

The S&P 500 index is expected to exhibit a generally upward trend over the next year. Starting at 4508 in September 2023, it is forecasted to experience some fluctuations but maintain an overall positive trajectory. By October 2023, the index is projected to rise to 4128, and November 2023 should see further gains at 4298.

December 2023 is anticipated to remain stable around 4296, with January 2024 showing potential for growth to 4397. February and March 2024 may experience minor fluctuations but should remain in the mid-4300s.

As we move into the spring of 2024, the S&P 500 is expected to gain momentum, reaching 4550 by June and showing more significant gains by July 2024 at 4752. The upward trajectory continues into August 2024, with the index forecasted to reach 4817.

Overall, this forecast suggests a positive trend for the S&P 500 index over the specified period, with potential for growth and some fluctuations along the way.

It’s essential to remember that financial markets are influenced by various factors, and actual performance may vary. Always consult with a financial advisor and monitor market conditions for the most accurate guidance.

Month Forecast Sep-23 4,050 Oct-23 4,128 Nov-23 4,298 Dec-23 4,296 Jan-24 4,397 Feb-24 4,318 Mar-24 4,324 Apr-24 4,434 May-24 4,456 Jun-24 4,550 Jul-24 4,752 Aug-24 4,817

August 2023, SP 500 Outlook

Our models suggest that the SP 500 will see a brief decline before resuming its rising trajectory. The NASDAQ has a more optimistic outlook than the SP 500, as seen by the market’s continuous rise over the previous few months. Since major companies like JP Morgan and Walmart have just reported strong earnings, investors have a brighter outlook. The strong performance of the SP 500 so far this year lends credence to the notion that the index will see a temporary decline before resuming its upward trend.

Since inflation and interest rates are still on the rise, worries on Wall Street persist. The Federal Open Market Committee halted interest rate rises in May despite increases in both the consumer price index and the price index for discretionary spending. The Federal Reserve has upgraded its forecast for economic growth in 2023, and the job market continues to show resilience. The manufacturing sector is projected to rebound sooner and more strongly than expected, and the recession is predicted to be lighter than forecast.

Month Forecast Aug-23 4,281 Sep-23 4,053 Oct-23 4,138 Nov-23 4,312 Dec-23 4,316 Jan-24 4,414 Feb-24 4,328 Mar-24 4,317 Apr-24 4,412 May-24 4,441 Jun-24 4,514 Jul-24 4,712

July 2023, SP 500 Outlook

Month Forecast Jul-23 4,277 Aug-23 4,271 Sep-23 4,143 Oct-23 4,218 Nov-23 4,380 Dec-23 4,365 Jan-24 4,464 Feb-24 4,387 Mar-24 4,396 Apr-24 4,503 May-24 4,532 Jun-24 4,625

June 2023, SP 500 Outlook

Investors are optimistic about a solid market in June due to a decent first quarter earnings season and a possible Fed pause. However, concerns about a potential recession persist. Fed Chair Jerome Powell stated that inflation remains high, and the banking crisis has tightened credit markets, potentially affecting economic growth and inflation.

Our projections for the SP 500 Index have remained unchanged at a sideways market with a modest, gradual upward advance for the remainder of 2023.

Month Forecast Jun-23 3,835 Jul-23 3,989 Aug-23 4,036 Sep-23 3,946 Oct-23 4,008 Nov-23 4,163 Dec-23 4,148 Jan-24 4,234 Feb-24 4,147 Mar-24 4,139 Apr-24 4,237 May-24 4,246

May 2023, SP 500 Outlook

Month Forecast May-23 3,847 Jun-23 3,826 Jul-23 3,976 Aug-23 4,019 Sep-23 3,927 Oct-23 3,987 Nov-23 4,139 Dec-23 4,121 Jan-24 4,205 Feb-24 4,116 Mar-24 4,105 Apr-24 4,200

April 2023, SP 500 Outlook

For the rest of 2023, our model anticipates flat performance from the SP 500, followed by an upward trend in 2024. The model has apparently gone cautiously bullish on the SP 500 outlook for the future.

However, the market still shows signs of being affected by the recent financial banking catastrophe. Investors remain concerned about which bank will collapse next. In March by itself, Charles Schwab’s equity price dropped 31%. Investors are wary of the banking sector at the moment. Even after the financial crisis has subsided, inflation and interest rates will continue to be major market catalysts in the next few months. Recent banking disasters were mitigated by a robust labor market and historically low unemployment rates. Even though the Fed is planning to stop raising rates soon, the risk of a recession remains high.

Month Forecast Apr-23 3,981 May-23 3,938 Jun-23 3,858 Jul-23 4,003 Aug-23 4,017 Sep-23 3,926 Oct-23 4,138 Nov-23 4,390 Dec-23 4,450 Jan-24 4,619 Feb-24 4,606 Mar-24 4,682

March 2023, SP 500 Outlook

The Federal Reserve has signaled that it plans to keep hiking interest rates, in part due to the recent robust jobs report that once again emphasized the strength of the labor market. Wall Street is having trouble finding clear directions, so the investment climate is unstable right now. Yet, inflation has kept prices high for shoppers. Nonetheless, the solid job market shows no signs of an imminent recession.

Due to the different fundamental signals and stock market performance, our S&P 500 forecast model has continued to predict that the market will move in a sideways direction.

Month Forecast Mar-23 3,774 Apr-23 3,710 May-23 3,654 Jun-23 3,606 Jul-23 3,749 Aug-23 3,753 Sep-23 3,636 Oct-23 3,728 Nov-23 3,837 Dec-23 3,795 Jan-24 3,854 Feb-24 3,769

February 2023, SP 500 Outlook

In the past month, our forecast model has shown a moderate shift in its projection of the direction of the SP 500 index. It indicated that the downward momentum was weakening, and the index was expected to drift sideways going forward. For this month’s forecast, the predicted sideways movement of the index is emphasized even more strongly. This was reflected in January’s gain of over 6% for the S&P 500. Most likely, a change in market trend is on the horizon.

High mortgage rates, a cooling housing market, and cautious consumers may bring real GDP down to near zero in 2023. If consumers drastically cut back on their purchases, it could have a negative impact on a company’s bottom line in the long run. As a result, this may cause analysts to lower their expectations, which would have a negative impact on the stock’s performance.

Month Forecast Feb-23 3,728 Mar-23 3,649 Apr-23 3,651 May-23 3,615 Jun-23 3,582 Jul-23 3,715 Aug-23 3,737 Sep-23 3,628 Oct-23 3,719 Nov-23 3,869 Dec-23 3,852 Jan-24 3,930

January 2023, SP 500 Outlook

Throughout 2022, investors sold off their holdings repeatedly due to worries about rising interest rates, declining economic growth, and persistently high inflation. The S&P 500 ended 2022 with its poorest annual result since 2008. In December alone, the benchmark index lost over 5%, bringing its total loss for 2022 to about 20%.

Inflation appears to be leveling off as we enter 2023. A recession could occur in the first half of the year because the Federal Reserve’s fight against rising prices is far from over. The first three months of 2023 are likely to see inflation and interest rates as two of Wall Street’s top concerns. Job growth has continued to defy expectations. The labor market could be the final domino to fall, triggering a U.S. recession in the first half of 2023, as speculated by economists.

In 2023, the S&P 500 index is expected to fall further, according to the model’s projections. The forecast for this month is better than the one made in October last year.

Month Forecast Jan-23 3,696 Feb-23 3,569 Mar-23 3,455 Apr-23 3,408 May-23 3,326 Jun-23 3,250 Jul-23 3,332 Aug-23 3,317 Sep-23 3,189 Oct-23 3,248 Nov-23 3,360 Dec-23 3,322

October 2022, SP 500 Outlook

The markets have been volatile for months due to concerns over surging inflation, rising interest rates, and the possibility of a recession. And this trend will continue. Not unexpectedly, inflation is still the market’s determining factor. Since the next Fed meeting isn’t scheduled to happen until November, everyone will continue to worry about soaring inflation. It’s possible that in October, we’ll learn whether the Fed’s aggressive strategy has pushed the U.S. economy into recession. We may gain a sense of the economy’s growth rate and other indicators in October.

A lot of attention will be paid to the next CPI report and the Fed’s preferred personal consumption expenditures (PCE) price index. The primary attention of Wall Street is on these reports because of their impact on interest rates and the Federal Reserve’s response to the economy. High inflation is still not expected to drastically decrease. Investors should brace for far greater volatility as a soft landing is impossible. When it comes to 2023, though, investors should be most concerned about the possibility of a recession. And the market hasn’t factored that in yet. In the final three months of the year, information related to economic expansion will be crucial.

The model’s latest projections still allowed for the possibility of a brief relief rally in the index before a sustained decline throughout the remainder of 2022 and into 2023. Choosing the right stocks to invest in is crucial in a market as unstable as the current one. Covered calls and married puts are examples of risk-mitigating strategies that could be used together to boost profit potential or reduce losses.

Month Forecast Oct-22 4,005 Nov-22 4,015 Dec-22 4,063 Jan-23 3,818 Feb-23 3,626 Mar-23 3,565 Apr-23 3,288 May-23 3,174 Jun-23 2,931 Jul-23 3,047 Aug-23 2,929 Sep-23 2,672

September 2022, SP 500 Outlook

The year 2022 has been marked by a lot of volatility and uncertainty. People in the market don’t know if the U.S. economy is slowing or not. On the one hand, there are signs that supply could catch up with slowing demand in many parts of the U.S. economy, such as the housing market. As interest rates have gone up in the past few months, there has been a big drop in demand for homes. On the other hand, demand for workers hasn’t slowed down much yet in the job market. How quickly the Fed can change its monetary policy depends on how well the job market is doing.

Since July, people worry less about a recession. The markets will be paying close attention to see if the Fed’s plans to stop inflation will hurt the economy. Powell was telling the markets that the Fed wouldn’t change its policy until it was sure inflation was under control, even if that hurt the U.S. economy.

The forecast model still suggested that the index would go up again before going down slowly and steadily for the rest of 2022 and into 2023. In a volatile market like this one, it’s very important to find the ideal stocks to invest in. Commodity, energy, and value stocks are good candidates, but combining them with covered calls or married puts could reduce risk and increase profit potential.

August 2022, SP 500 Outlook

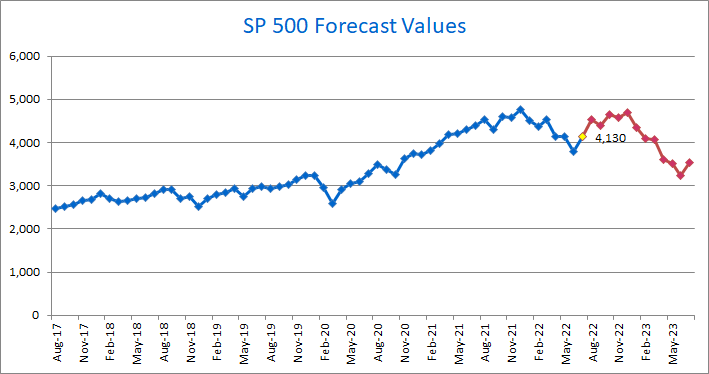

July ended with the SP 500 index closing at 4,130. The actual closing was approximately 200 points lower than what was predicted by the model in July. According to the forecast model, the index will continue to rise before settling into a sideways downhill pattern for the rest of 2022 and into 2023.

July ended with talk of a U.S. recession, but the stock market rallied. The S&P 500 rose 9.1% in July despite dire economic data. Our model has long predicted a high bound. July brought it. The index was 200 points below the forecast.

Multiple factors affect markets. GDP was negative in the second quarter, marking the second consecutive quarter of decline in US growth. Many bet the Fed will abandon its aggressive rate-hiking strategy in response to a weakening economy. A better-than-expected earnings season is also giving investors hope that the market’s sell-off is over.

Along with a strong earnings season, the labor market suggests the economy isn’t slowing. Fed policymakers must now weigh further interest rate hikes against growth and inflation.

Month Forecast Aug-22 4,524 Sep-22 4,382 Oct-22 4,638 Nov-22 4,583 Dec-22 4,698 Jan-23 4,349 Feb-23 4,101 Mar-23 4,060 Apr-23 3,602 May-23 3,516 Jun-23 3,229 Jul-23 3,534

July 1, 2022, SP 500 Forecast

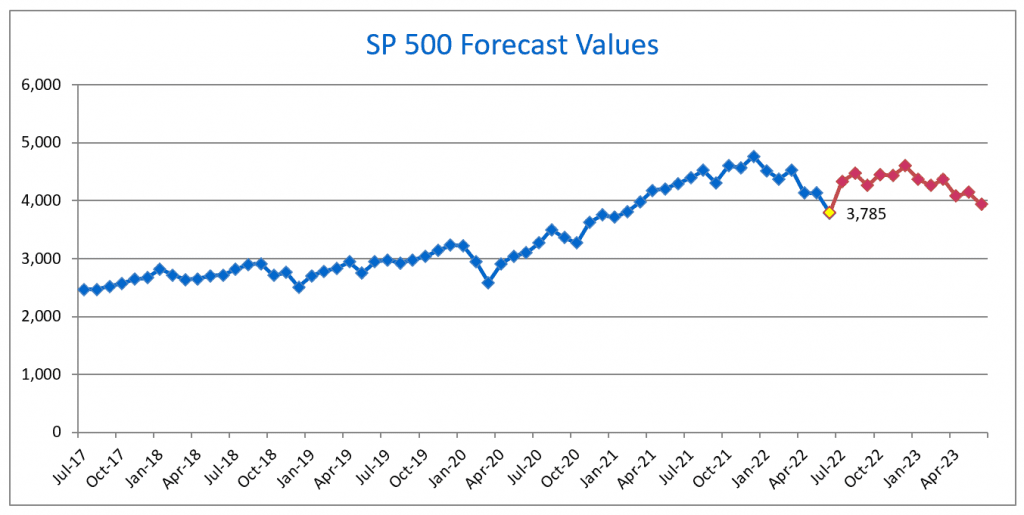

On June 30, 2022, the SP 500 index closed at 3,785. The actual results were nearly 600 points lower than the model’s prediction for May 1, 2022. Since reaching an all-time high of 4,766 in 2021, the Standard & Poor’s 500 index has remained under pressure. According to the forecast model, the index will rise slightly before settling into a sideways but downward pattern for the remainder of 2022.

As long as the crisis in Ukraine and inflationary pressures persist, the macroeconomic picture is extremely uncertain, leading central banks to tighten monetary policy and compounding fears of a global recession. We are facing higher inflation, higher interest rates, and more volatile economic cycles as a result of persistent supply shocks, slowing globalization, and high commodity prices. Since the Fed raised interest rates by 75 basis points on June 15, the chances of two consecutive quarters of negative economic growth have more than doubled, raising the prospect of a stock market downturn.

Month Forecast Jul-22 4,338 Aug-22 4,470 Sep-22 4,263 Oct-22 4,450 Nov-22 4,436 Dec-22 4,605 Jan-23 4,372 Feb-23 4,262 Mar-23 4,370 Apr-23 4,079 May-23 4,146 Jun-23 3,939

June 1, 2022, SP 500 Forecast

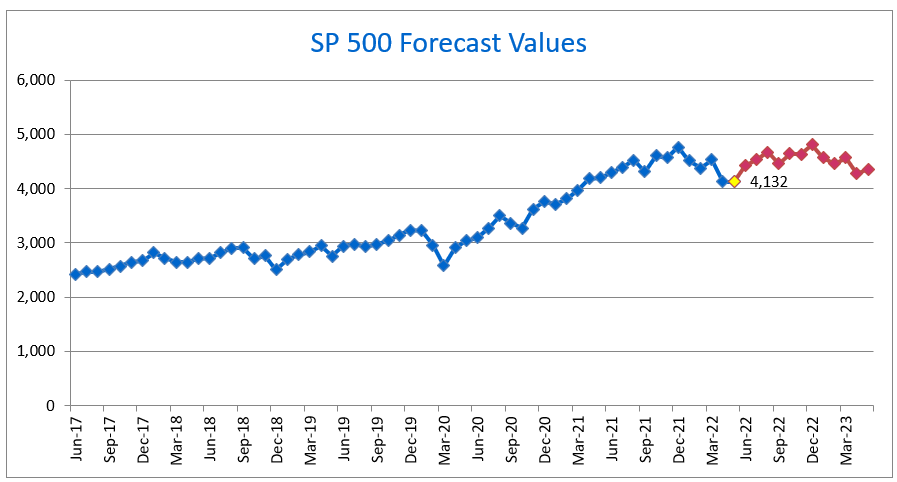

The SP 500 index closed at 4,132 on May 31, 2022. The actual results were nearly 400 points lower than the model’s prediction for May 1, 2022. The Standard & Poor’s 500 index has remained under pressure since reaching an all-time high of 4,766 in 2021. The forecast model predicts that the index will rise slightly before settling into a sideways pattern for the rest of 2022.

Inflation – Growth – Interest Rate

The Federal Reserve needs to bring prices under control and increase employment. After months of concentrating on inflation, the Federal Reserve is once again facing concerns about the economy and its aim to create growth. The Federal Reserve has to strike a balance between the imperative to combat inflation by increasing interest rates and the danger of stifling economic growth. Inflation dropped for the first time in eight months in April, while first-quarter GDP performance was less than impressive.

Investors anticipate that the Federal Open Market Committee will raise the fed funds rate at a more measured pace. Traders anticipated a hike of 75 basis points in both June and July, but they now anticipate a hike of only 50 basis points.

Recession

The banks on Wall Street have provided their forecasts for a recession. The expectation is that an economic slowdown will likely begin in 2023. This explains why markets have been punishing stock values in recent months. It is possible that there will be no recession in the US economy in the coming year, or that there will be a moderate recession. The stock market has been volatile over the past few months given the Federal Reserve’s intention to raise interest rates and signals of weakening in the economy. Expect more volatility on the market as people keep figuring out if the economy can handle higher interest rates without going into a contractionary phase.

Month Forecast Jun-22 4,426 Jul-22 4,531 Aug-22 4,673 Sep-22 4,459 Oct-22 4,647 Nov-22 4,637 Dec-22 4,812 Jan-23 4,570 Feb-23 4,458 Mar-23 4,568 Apr-23 4,276 May-23 4,357

May 1, 2022, SP 500 Forecast

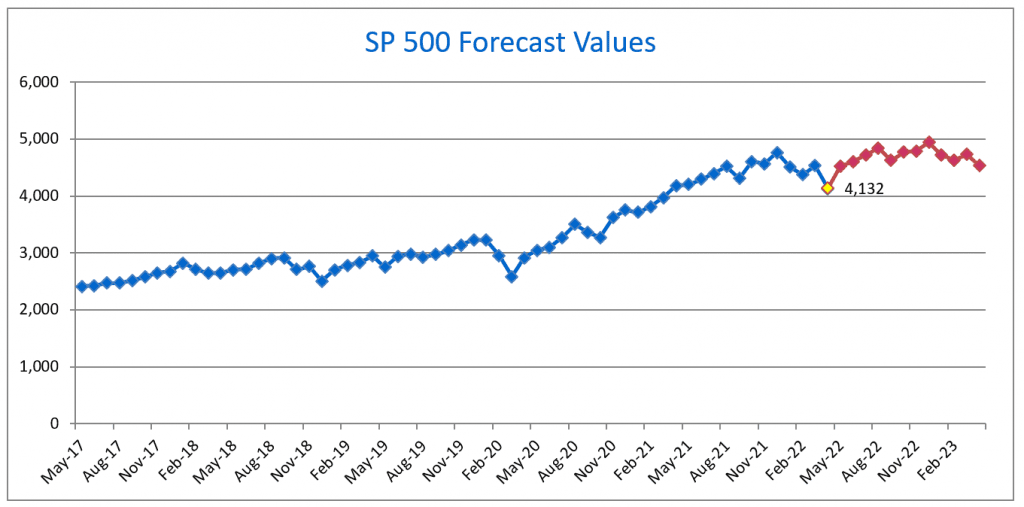

On April 29, 2022, the SP 500 index closed at 4,132. When compared to the model’s prediction for April 1, 2022, the actual results were nearly 600 points lower. Despite reaching an all-time high of 4,766 in 2021, the Standard & Poor’s 500 index has remained under pressure ever since. The forecast model still predicts that the index will see a modest increase before settling into a sideways pattern for the remainder of 2022.

In April, the SP 500 index fell sharply, while the model’s forecast stayed flat. A stock market decline in 2022 is anticipated due to rising prices and fears over the economic implications of Russia’s invasion of Ukraine. Consumers may be forced to cut back on spending in the near future, affecting corporate profits and slowing economic growth. The stock market is headed for a rough ride due to the Federal Reserve’s aggressive monetary policy tightening. Concerns about supply chain disruptions and inflation will undoubtedly persist. Price and market volatility are likely to continue in the near future.

Month Value Forecast May-22 4,517 Jun-22 4,602 Jul-22 4,715 Aug-22 4,845 Sep-22 4,622 Oct-22 4,767 Nov-22 4,791 Dec-22 4,942 Jan-23 4,721 Feb-23 4,632 Mar-23 4,732 Apr-23 4,531

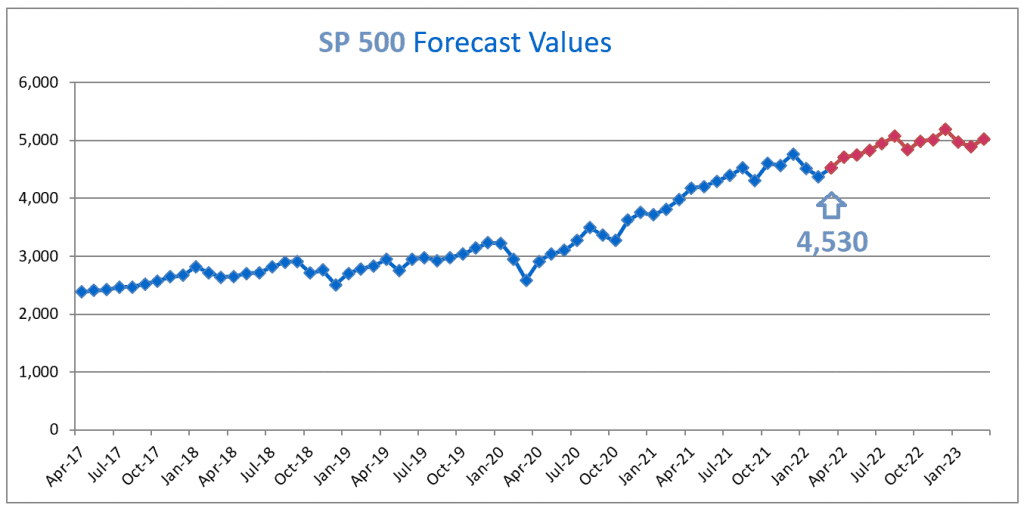

April 1, 2022, SP 500 Forecast

The S & P 500 index finished at 4,530 on March 31, 2022. The results were 12 points higher than the model’s projection for March 1, 2022. The SP 500 index, which reached an all-time high of 4,766 in 2021, has remained under pressure since then. The forecast model still suggested there would be a small rise in the index before it settled into a steady pattern for the rest of 2022.

The index remained rangebound, while the model prediction stayed sideways. A reduced stock market return in 2022 is quite likely as the Federal Reserve boosts interest rates to combat rising inflation and warns about the economic impact of Russia’s invasion of Ukraine. Consumers may be forced to cut spending in the near future, affecting company earnings and hence slowing economic growth. With the Federal Reserve’s aggressive monetary policy tightening, equities face a double danger. The Russia-Ukraine conflict is likely to hamper economic growth. Concerns about supply chain disruptions and inflation will undoubtedly persist. Price instability and market volatility are likely to continue.

Month Forecast Apr-22 4,714 May-22 4,747 Jun-22 4,834 Jul-22 4,945 Aug-22 5,074 Sep-22 4,836 Oct-22 4,988 Nov-22 5,014 Dec-22 5,189 Jan-23 4,967 Feb-23 4,895 Mar-23 5,022

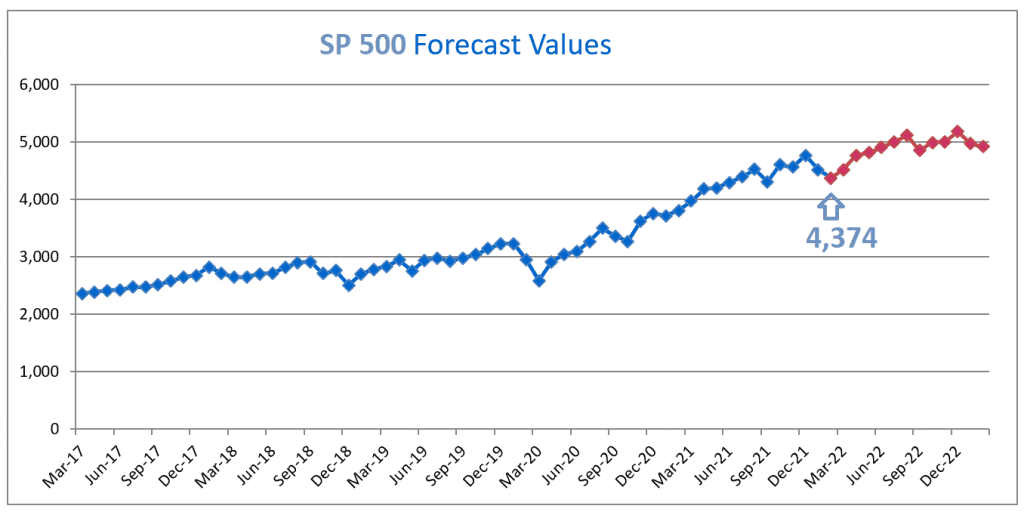

March 1, 2022, SP 500 Forecast

The S & P 500 index closed February 2022 at 4,374. The results were 400 points below the February 1, 2022, prediction model. After hitting an all-time high of 4,766 in 2021, the SP 500 index continued to fall. Despite this, the forecast model predicted a modest rise in the index before a sideways trend for the rest of 2022.

The model remained sideways, with the index remaining rangebound. Fundamentally, the Ukraine conflict will likely prolong supply chain issues and inflationary pressures. In the near term, central banks are expected to raise interest rates, but the longer-term outlook is more uncertain. Market volatility will likely continue, with the possibility of price instabilities.

Month Forecast Mar-22 4,518 Apr-22 4,770 May-22 4,816 Jun-22 4,904 Jul-22 5,005 Aug-22 5,117 Sep-22 4,855 Oct-22 4,995 Nov-22 5,004 Dec-22 5,186 Jan-23 4,970 Feb-23 4,921

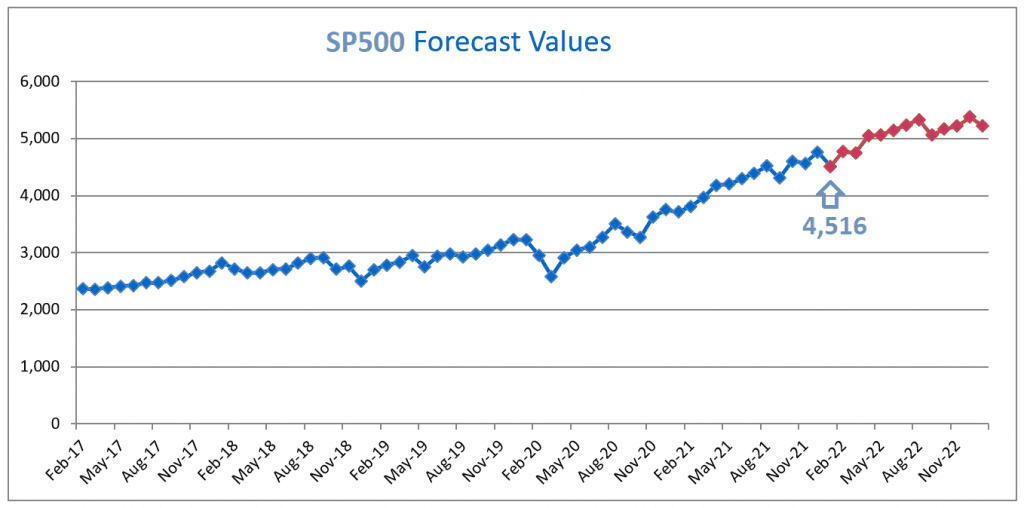

February 1, 2022

At the end of January 2022, the S&P 500 index stood at 4,516. The outcomes were 300 points lower than the prediction model created on January 1, 2022. It had previously indicated a very slight upward trend in January before coming to a grinding halt in February. The correction, on the other hand, came considerably sooner. Despite this, the forecast model continued to predict that the index would climb modestly in the future.

It should be noted that the difference between this month’s projection and the prior months’ forecast is that the index was predicted to continue rising in the prior months’ forecast. This February’s projection, on the other hand, showed a sideways shift, with the index remaining in a rangebound state. When it comes to the fundamentals, inflation is rising, interest rates are rising, and some firms’ earnings reports are beginning to show symptoms of weakness; all of these indicators should prompt us to exercise extreme caution when making an investment decision.

Month Forecast Feb-22 4,771 Mar-22 4,751 Apr-22 5,047 May-22 5,071 Jun-22 5,150 Jul-22 5,241 Aug-22 5,331 Sep-22 5,061 Oct-22 5,166 Nov-22 5,218 Dec-22 5,381 Jan-23 5,225

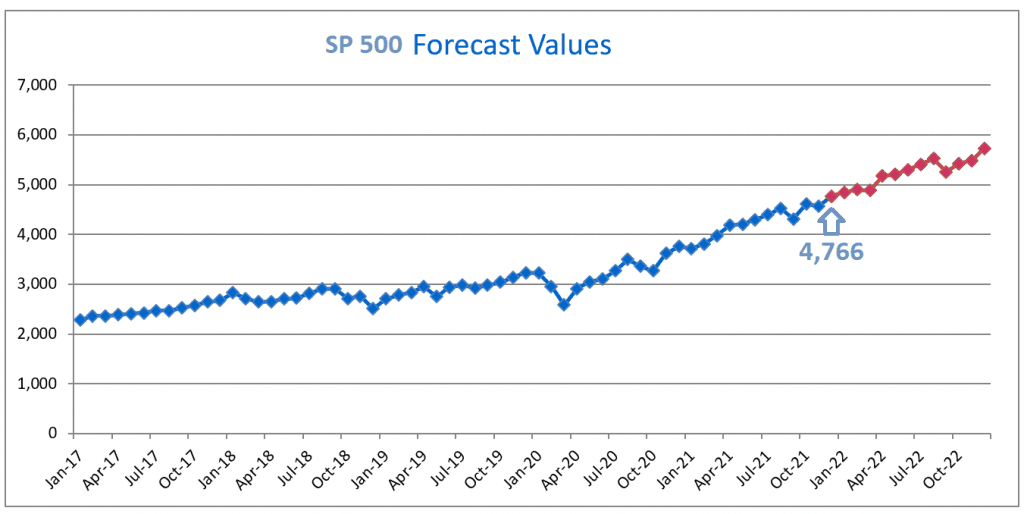

January 1, 2022

At the end of December, the SP 500 index finished at 4,766. The results were quite similar to the prediction model developed on December 20, “… As of right now, it is still expected to close somewhere in the neighborhood of 4,800…” Nonetheless, the first projection, which was released immediately after the end of November, indicated that the index would close near 4,900. We were aware at the time that it was very aggressive.

Based on the closing price of the SP 500 index for the month of December, the forecast model continued to suggest that the index would rise. However, it suggested a very tiny upward movement in January before coming to a grinding stop. This might indicate that we will have a setback in the coming months. Because of the uncertainties, investors should proceed with caution from here on out. The use of a covered call strategy is one of the options that can be looked into and considered.

Month Forecast Jan-22 4,844 Feb-22 4,897 Mar-22 4,882 Apr-22 5,173 May-22 5,208 Jun-22 5,297 Jul-22 5,405 Aug-22 5,524 Sep-22 5,259 Oct-22 5,420 Nov-22 5,488 Dec-22 5,725

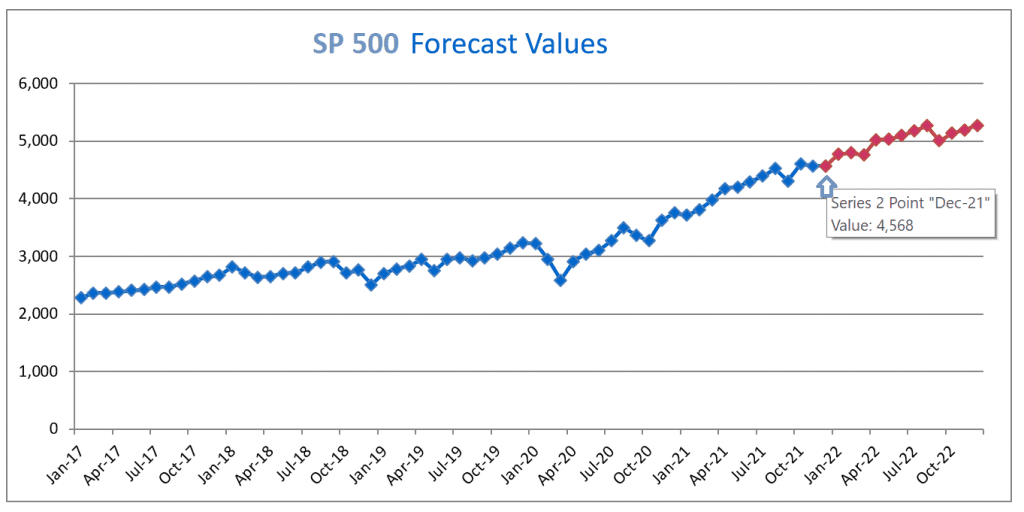

December 20, 2021

Included in the forecast model is the $SPX’s closing price of 4,568 on today’s trading day, which keeps the prognosis on par with the predictions made by the previous forecast models. The upward trend has been observed to have continued.

According to the model’s projections made on December 1, the index was projected to rise strongly in December and reach near 4,900 by the end of December. That appeared to be a little too aggressive. As of right now, it is still expected to close somewhere in the neighborhood of 4,800. Because of the current circumstances, it appears quite unlikely at this point. However, the likelihood that the SP 500 may reach 4,800 in the next 11 days cannot be ruled out, because anything is possible in the market.

There are other aspects that continue to stand out, one of which is the forecast model’s halting near the 5,000, which is one of the most noteworthy of them all. It will be intriguing to observe how things develop over the next few months…

Prior SP 500 Forecast

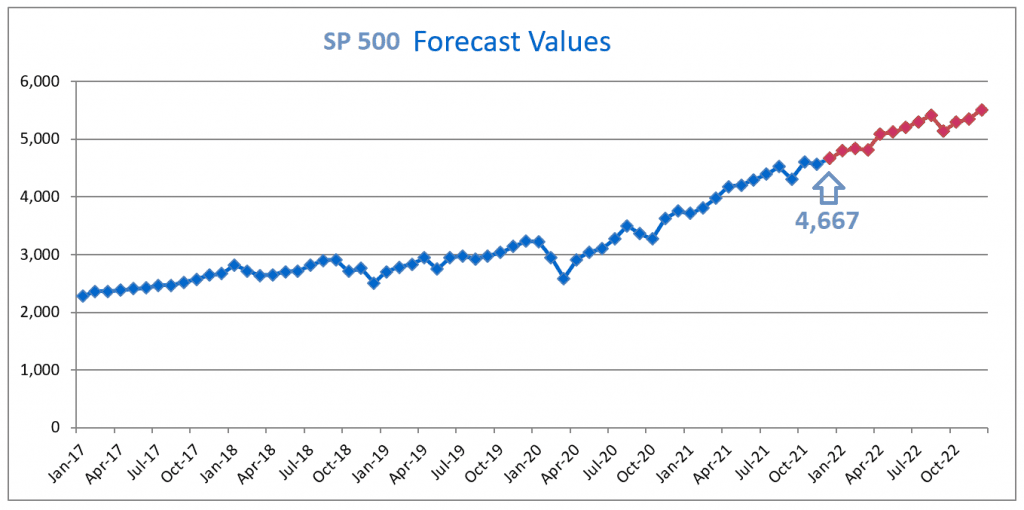

December 9, 2021

By incorporating today’s closing price of the $SPX, which was 4,667, into the forecast model, the prognosis remains comparable to the predictions made by the previous models. Continued upward movement is evident. One thing that continues to stand out, however, is the halt in the index near 5,000. When the SP 500 is close to 5,000, it is likely that the model is indicating some sort of correction or retracement in the market. What is the severity of the correction? At this point, we don’t know what to expect. It will be interesting to see how things progress over the next few months.

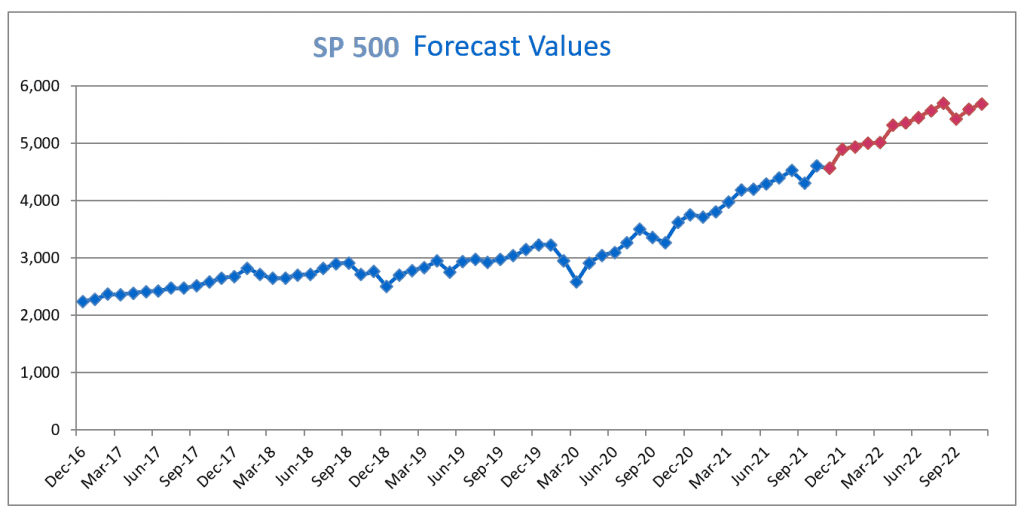

December 1, 2021

The forecast for today is based on the closing price of the SP 500 for November, which was 4,567. As can be seen on the chart, it continued to show signs of a sharp upward move in December before beginning to stall near the 5,000 level.

Month Forecast Dec-21 4,902 Jan-22 4,941 Feb-22 5,009 Mar-22 5,009 Apr-22 5,318 May-22 5,356 Jun-22 5,453 Jul-22 5,569 Aug-22 5,697 Sep-22 5,429 Oct-22 5,601 Nov-22 5,690

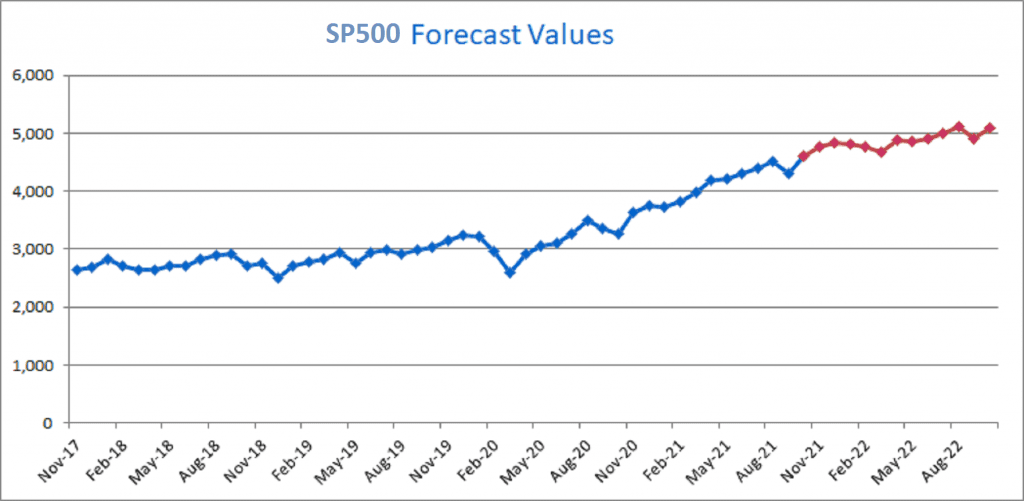

November 15, 2021

The first S&P 500 forecast was completed in early November, immediately following the previous month’s close. It is anticipated that the $SPX will continue its upward trend in the foreseeable future, according to the forecast model depicted below. However, it appears that there is only a limited amount of room for upward movement left, and that the trend will begin to plateau in the coming months. It represented an upward movement that was followed by a retracement.

At that point in time, we have no way of knowing when the retracement will take place or how severe the ramifications will be. However, the fact remains that it is sending a message to investors, advising them to proceed with caution in the meantime.

Month Forecast Nov-21 4,775 Dec-21 4,838 Jan-22 4,812 Feb-22 4,762 Mar-22 4,677 Apr-22 4,892 May-22 4,851 Jun-22 4,896 Jul-22 4,987 Aug-22 5,116 Sep-22 4,912 Oct-22 5,080

Disclaimer: The views expressed in this article are my personal opinions and should not be considered financial advice. Always conduct your research and consult with a financial professional before making investment decisions.