Table of Contents

In this article, we delve into the world of Renko chart patterns, exploring their practical applications in crafting effective trading strategies. Renko charts offer a unique perspective, emphasizing price changes over time intervals. By grasping the intricacies of these patterns, traders can enhance their precision, simplify analysis, and develop a more acute awareness of market dynamics.

| Key Takeaways |

|---|

| 1. Renko Charts: Prioritize significant price changes for clearer trend analysis. |

| 2. Brick Size: Determine using Traditional or ATR Method based on volatility. |

| 3. Support & Resistance: Crucial for optimal entry/exit points, combined with trendlines. |

| 4. Reversal Patterns: W (double bottom), M (double top), Head and Shoulders, and Inverse Head and Shoulders indicate potential trend shifts. |

| 5. Risk Management: Set stop-loss based on patterns and support/resistance for optimized trades. |

Renko Chart Patterns Explained

Renko Chart Patterns stand as a testament to the art of highlighting price dynamics with remarkable clarity. By honing in on price shifts without the constraints of time intervals, Renko charts offer traders a unique perspective that can significantly influence trading strategies. Let’s delve into the essence of Renko charts and their key components:

| Key Point | Explanation | Example | Comparison |

|---|---|---|---|

| Prioritizing Price Changes | Rather than focusing on time intervals, Renko charts emphasize changes in price, allowing traders to uncover core trends. | In a 5-point Renko chart, a brick is added only when the price moves up or down by 5 points. | Traditional charts factor in time intervals, potentially masking crucial price movements. |

| Bricks: Building Blocks of Insight | Renko charts use “bricks” to represent price movements. Each brick signifies a predefined price shift. | A Renko chart shows a sequence of bricks: ▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | Other charts use continuous lines that can obscure individual price shifts. |

| Decoding Brick Size | Brick size determines the magnitude of price change needed for a new brick. Adjusting this size tailors analysis to market dynamics. | In a volatile market, a brick size of 10 points captures significant shifts. | Traditional charts lack the flexibility to customize the representation of price movements. |

| Unmasking the Signal from Noise | Renko charts reduce noise by focusing solely on significant price changes, providing a clearer view of trends. | Avoiding minor price fluctuations, Renko charts highlight major trend changes. | Conventional charts often include noise, making it challenging to discern essential trends. |

Prioritizing Price Changes

In the realm of Renko Chart Patterns, the spotlight is squarely on the fluctuations in price. Unlike conventional charts, Renko charts discard the influence of time, focusing solely on the changes in an asset’s value. This approach allows traders to peel away the time-bound layers and unearth the core shifts that drive markets.

Bricks: Building Blocks of Insight

Much like the construction of a mosaic, Renko charts are built using “bricks.” These bricks encapsulate price movements and are akin to the building blocks of a Point and Figure chart. Each brick represents a predetermined price shift, offering a visual representation of how the market moves in response to varying price increments.

Decoding Brick Size

A critical aspect of Renko charts is the concept of “brick size.” This parameter dictates the magnitude of price movement required for a new brick to be added to the chart. By adjusting the brick size, traders can fine-tune their analysis to align with the specific price dynamics of an asset. For instance, a larger brick size may be suitable for more volatile markets, while a smaller size might be appropriate for relatively stable ones.

Unmasking the Signal from Noise

In the cacophony of market data, Renko charts excel at reducing noise. By focusing solely on significant price changes, these charts eliminate the minor fluctuations that often cloud the bigger picture. This noise reduction empowers traders to discern the trends and patterns that truly matter, leading to more informed trading decisions.

In essence, Renko Chart Patterns provide a means to uncover the hidden rhythms of the market by emphasizing pivotal price changes. With their ability to strip away the clutter and present a clearer view of trends, these charts become invaluable tools for traders seeking a deeper understanding of market dynamics.

Utilizing Renko Chart Settings for Optimal Trading Strategy

When it comes to Renko charts, one of the critical aspects that traders need to understand is how to determine the brick size, a parameter that significantly influences the chart’s readability and the trading signals it generates. Let’s explore how this brick size is determined, the methodologies involved, and how traders can make informed decisions using these settings.

| Aspect | Traditional Method | Average True Range (ATR) Method |

|---|---|---|

| Brick Size Determination | Fixed brick size manually set by the trader. | Brick size adjusted dynamically based on ATR indicator. |

| Volatility Consideration | May not effectively capture changing market volatility. | Adapts to market volatility by considering recent price movements. |

| Adaptability | Less adaptable to rapidly changing market conditions. | Flexible and responsive to varying volatility levels. |

| Examples | Setting a fixed brick size of 10 points regardless of market conditions. | Using ATR to calculate brick size (e.g., ATR value = 20), resulting in larger bricks during high volatility and smaller bricks during low volatility. |

| Comparison | Simple but may not reflect current market dynamics accurately. | Dynamic and adaptable, aligning with changing volatility levels. |

| Considerations |

|

|

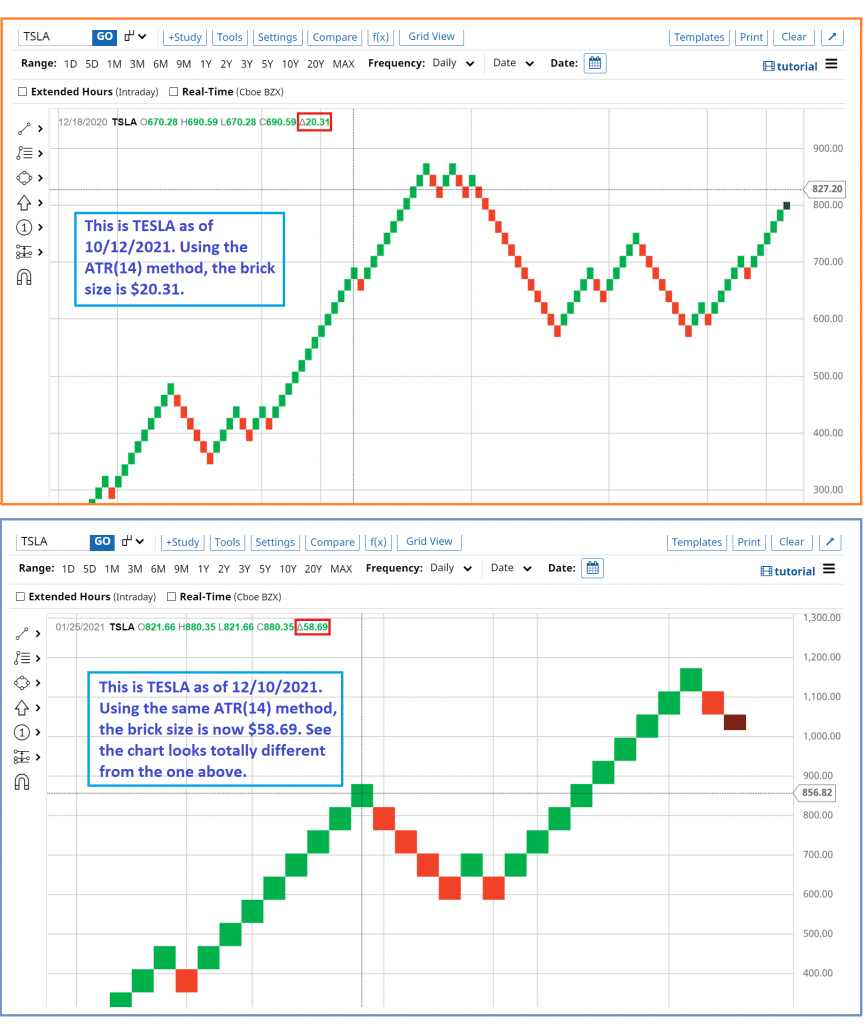

Brick Size Determination and Market Volatility

The brick size is a fundamental factor in Renko charts that determines the magnitude of price movements required to form a new brick. Market volatility plays a pivotal role in deciding the appropriate brick size. In more volatile markets, larger brick sizes might be suitable, as they accommodate the natural price fluctuations. On the other hand, in less volatile markets, smaller brick sizes can provide a clearer representation of trends.

Traditional Method vs. Average True Range (ATR) Method

Two primary methods are commonly employed to determine the brick size in Renko charts:

- Traditional Method: This approach involves manually setting a fixed brick size. Traders decide on a specific value that each brick represents, irrespective of market conditions. While this method offers simplicity, it may not effectively capture changing volatility levels.

- Average True Range (ATR) Method: A more dynamic approach, ATR uses the Average True Range indicator, typically calculated over a preset number of bars (often 14). The ATR indicator considers recent price movements and adjusts the brick size according to market volatility. As volatility increases, the brick size expands, allowing Renko charts to adapt to changing market conditions.

Considerations for Optimal Settings

When determining the appropriate brick size, traders should consider the following factors:

- Asset Volatility: Different assets exhibit varying levels of volatility. Currencies may have different volatility profiles compared to stocks, commodities, or cryptocurrencies. Tailor the brick size to the asset you’re trading.

- Trading Style: Your trading strategy and timeframes are crucial. If you’re a day trader looking for short-term price movements, you might lean towards smaller brick sizes. If you’re a swing trader seeking larger trends, larger brick sizes may be more suitable.

- Market Conditions: Recognize whether the market is currently experiencing high volatility due to economic events, earnings reports, or geopolitical factors. Adjust the brick size to accommodate these conditions.

By understanding these considerations and choosing an appropriate brick size determination method, traders can optimize their Renko charts for enhanced technical analysis and better decision-making. Remember, there’s no one-size-fits-all solution, as each trader’s preferences, risk tolerance, and strategies differ. The ability to adapt brick sizes to market conditions ensures that Renko charts remain a dynamic tool in a trader’s arsenal.

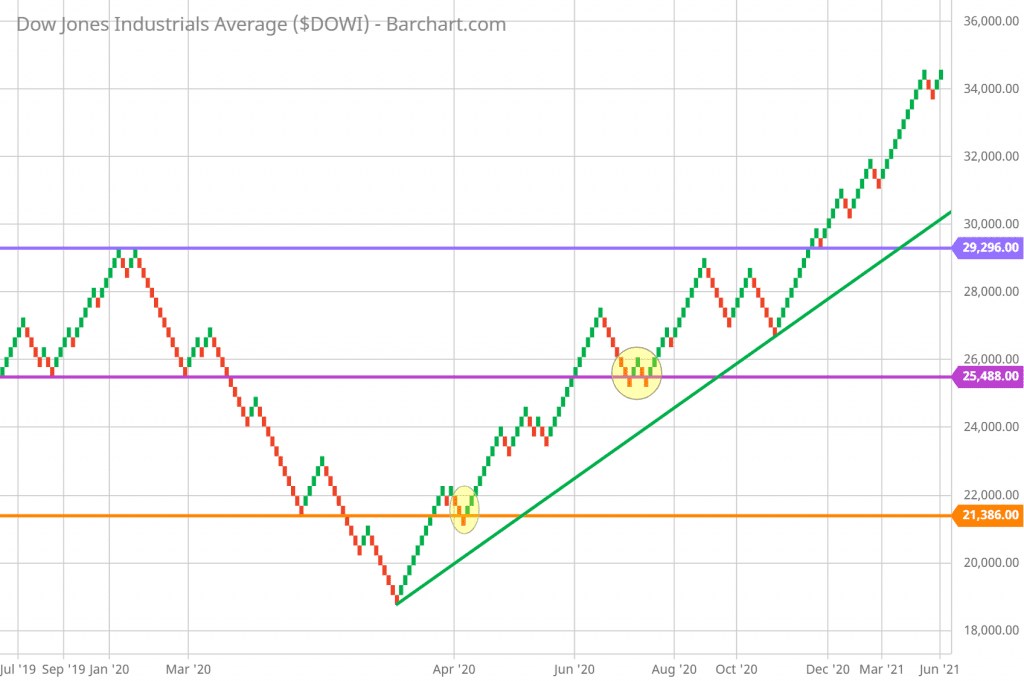

Recognizing Support and Resistance Zones for Enhanced Profitability

Understanding the Importance of Support and Resistance Levels

Support and resistance levels are foundational concepts in technical analysis that can significantly enhance profitability for traders utilizing Renko chart patterns. These levels provide crucial insights into market dynamics and help traders make informed decisions. Let’s delve into why these levels matter and how they can shape effective trading strategies.

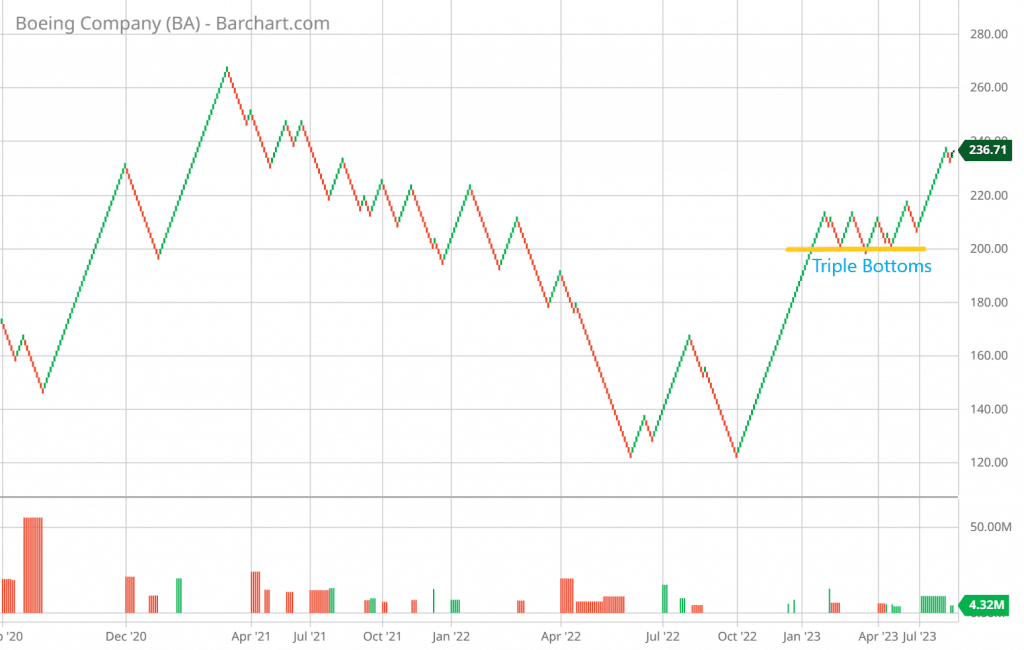

Identifying Support Zones: The Bedrock of Trading Insights

Support zones are pivotal price ranges where an asset’s downward movement tends to halt and reverse due to increased buying activity. Visualized as horizontal lines drawn slightly above the lowest points of a downtrend, these zones offer invaluable information about market sentiment. Consider the example of a stock whose price consistently rebounds when it approaches a specific level, indicating the presence of a robust support zone.

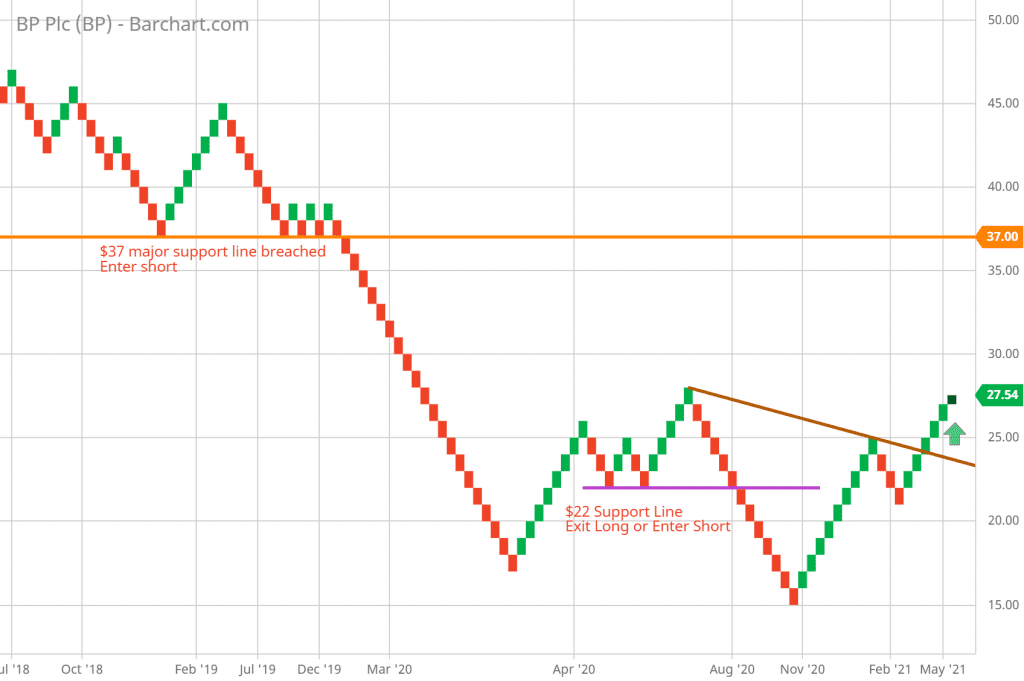

Predicting Trend Reversals with Breakouts

One of the most compelling aspects of recognizing support and resistance levels is their predictive power in spotting potential trend reversals. When an asset’s price breaches a well-established support level and starts moving upward, it signals a possible end to the prevailing downtrend. Traders often view this breakout as an opportunity to enter long positions, anticipating a shift in market sentiment. Such breakouts can be particularly potent when identified using Renko chart patterns.

Leveraging Trendlines for Informed Decisions

Complementing support and resistance analysis, trendlines are valuable tools for traders seeking precision in their trading decisions. By connecting previous highs or lows with diagonal lines, trendlines provide further validation for the strength of support zones. Imagine a scenario where an asset consistently bounces off a trendline during price declines. This alignment between support and trendlines reinforces the confidence in potential trades.

Crafted Entry and Exit Strategies

Support and resistance levels, combined with trendlines, offer valuable insights for determining optimal entry and exit points. When the price approaches a support zone and shows signs of upward movement, it’s a signal for traders to consider initiating buy positions. Conversely, as the price nears resistance levels and begins to decline, it becomes an opportunity to exit positions or explore short positions. This strategic approach helps traders maximize gains and manage risks effectively.

Conclusion

In the realm of Renko chart patterns, recognizing support and resistance levels is like deciphering the language of the market. These levels hold the key to understanding potential trend shifts, optimizing entry and exit points, and ultimately achieving greater profitability. Integrating support and resistance analysis with other technical tools equips traders with a well-rounded approach to navigating the complexities of the trading landscape.

Chart Patterns and Strategies: Enhancing Trading Insight

Renko charts offer a unique vantage point in understanding market dynamics, and within these charts lie patterns that hold the key to predicting trends and making informed trading decisions. Let’s explore some of the most prominent chart patterns that emerge from Renko charts, shedding light on potential trend reversals and opportunities:

Renko Chart Patterns

| Pattern | Details | Example | Pros | Cons |

|---|---|---|---|---|

| W Pattern (Double Bottom) | Anticipates trend reversal when price forms two troughs in a ‘W’ shape. | Price of Stock A shows two troughs forming a ‘W’ pattern. | – Indicates potential shift from bearish to bullish sentiment. – Points to buying interest preventing further decline. |

– False signals can occur in volatile markets. |

| M Pattern (Double Top) | Suggests trend reversal when price creates two peaks resembling an ‘M’ shape. | Stock B’s price forms two peaks forming an ‘M’ pattern. | – Alerts potential transition from bullish to bearish momentum. – Highlights resistance level inhibiting further rise. |

– False signals can occur, especially in volatile markets. |

| Head and Shoulders Pattern | Indicates bearish reversal with three peaks: a higher head between two lower shoulders. | Stock C’s price demonstrates a Head and Shoulders pattern. | – Strong predictor of impending bearish trend reversal. – Reflects seller influence gaining traction. |

– Not all patterns lead to significant reversals. |

| Inverse Head and Shoulders Pattern | Suggests bullish reversal with three troughs: a lower head between two higher shoulders. | Stock D’s price forms an Inverse Head and Shoulders pattern. | – Signals potential shift from bearish to bullish sentiment. – Indicates growing buyer enthusiasm. |

– Not all patterns lead to strong uptrends. |

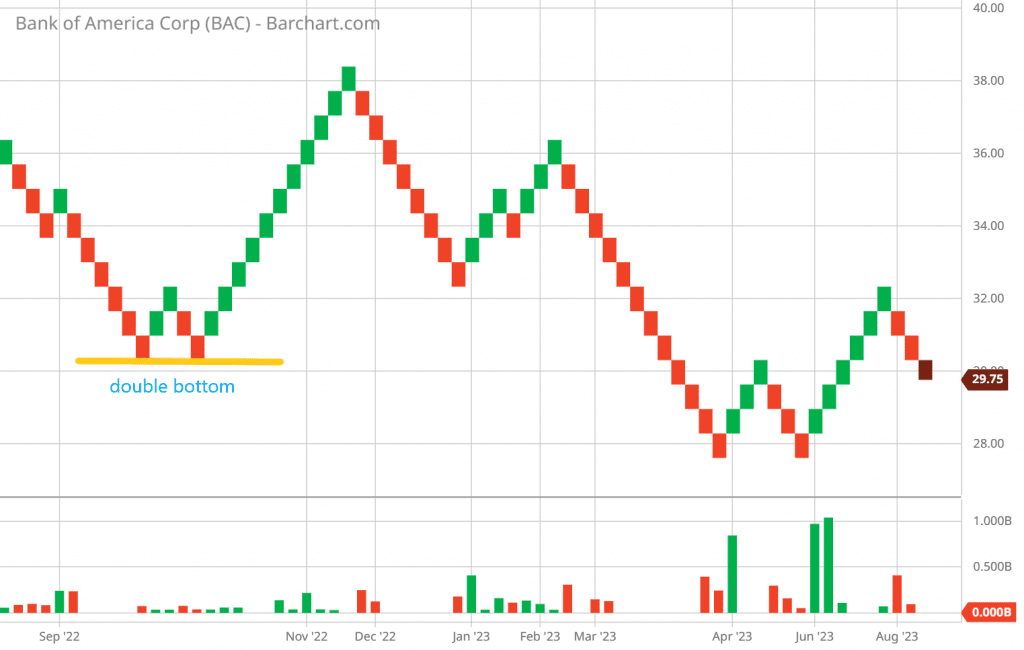

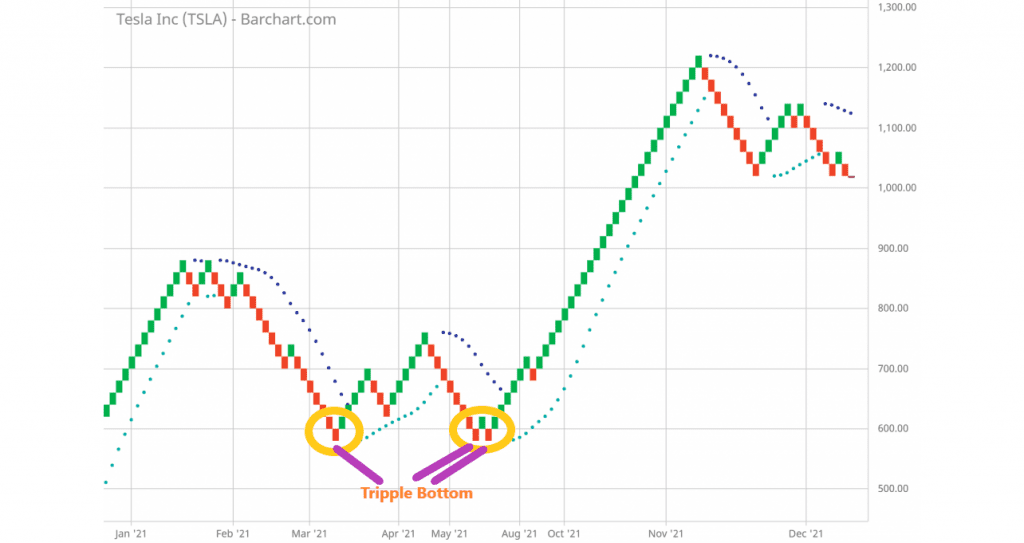

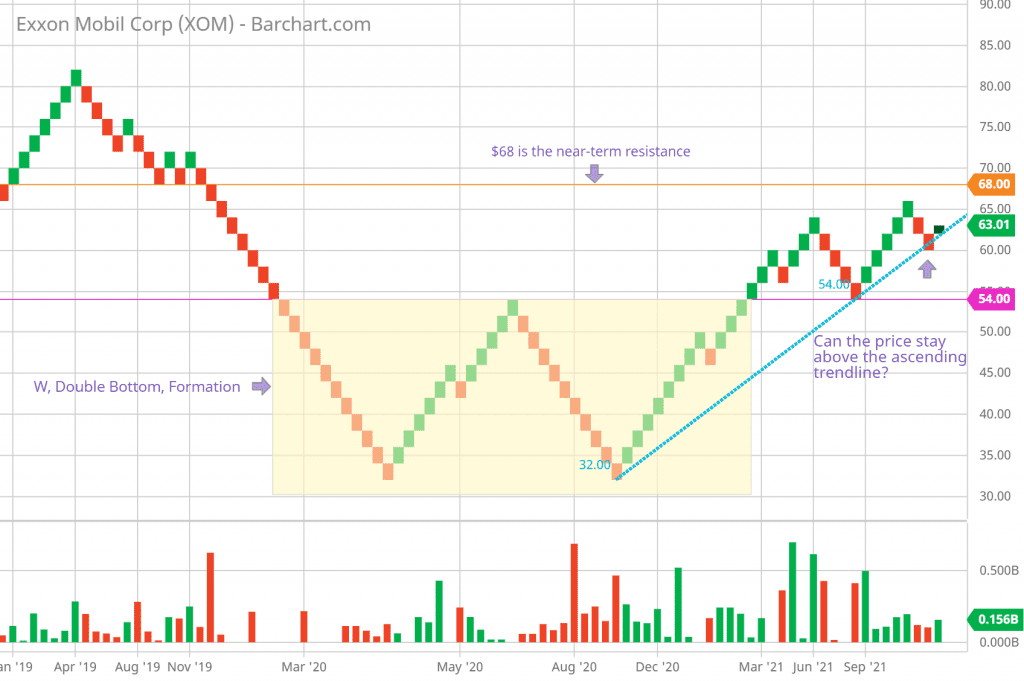

W Pattern (Double Bottom): Anticipating Trend Reversal

The W pattern, often referred to as a Double Bottom, is a powerful signal that indicates a potential trend reversal from a downtrend to an uptrend. In this pattern, the price forms two successive troughs, creating a ‘W’ shape. The first trough marks the end of the previous downward movement, and the second trough indicates that buyers have stepped in to prevent further decline.

Example: Imagine a stock’s price declining over time and reaching a point where it can’t go lower. Buyers then enter the scene, pushing the price up, creating the first trough. The price subsequently retraces, but this time buyers step in at a higher level, forming the second trough. This pattern signifies increased buying interest and often precedes an upward trend.

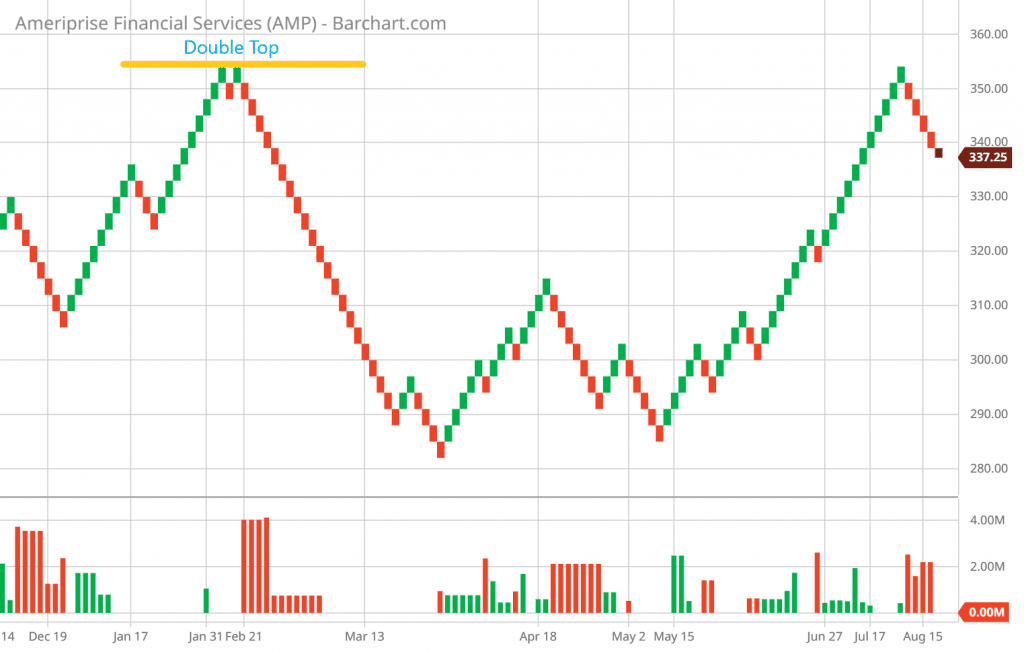

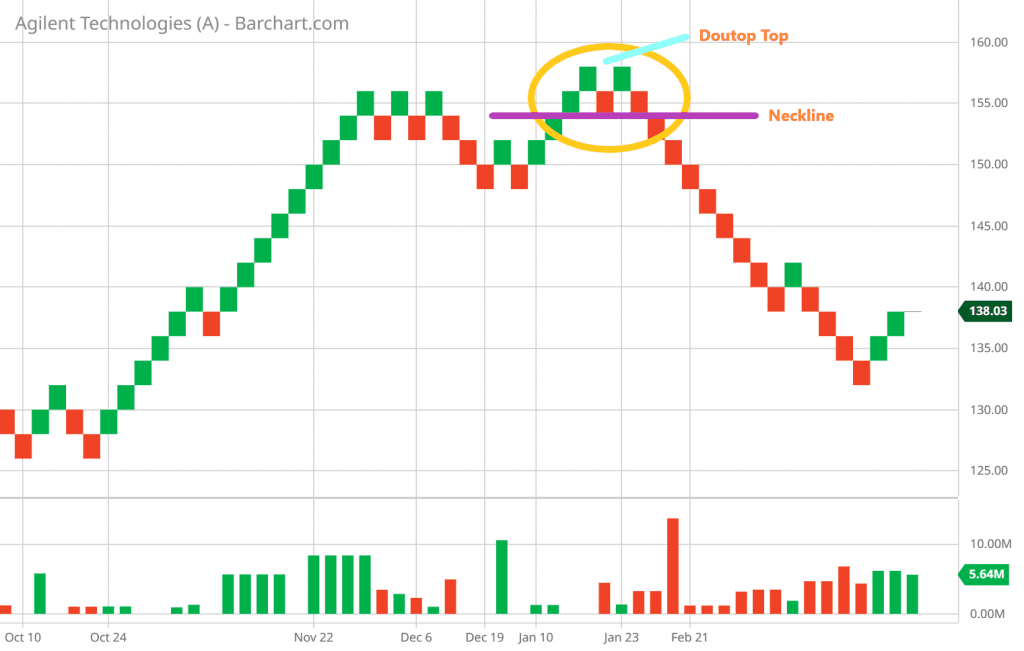

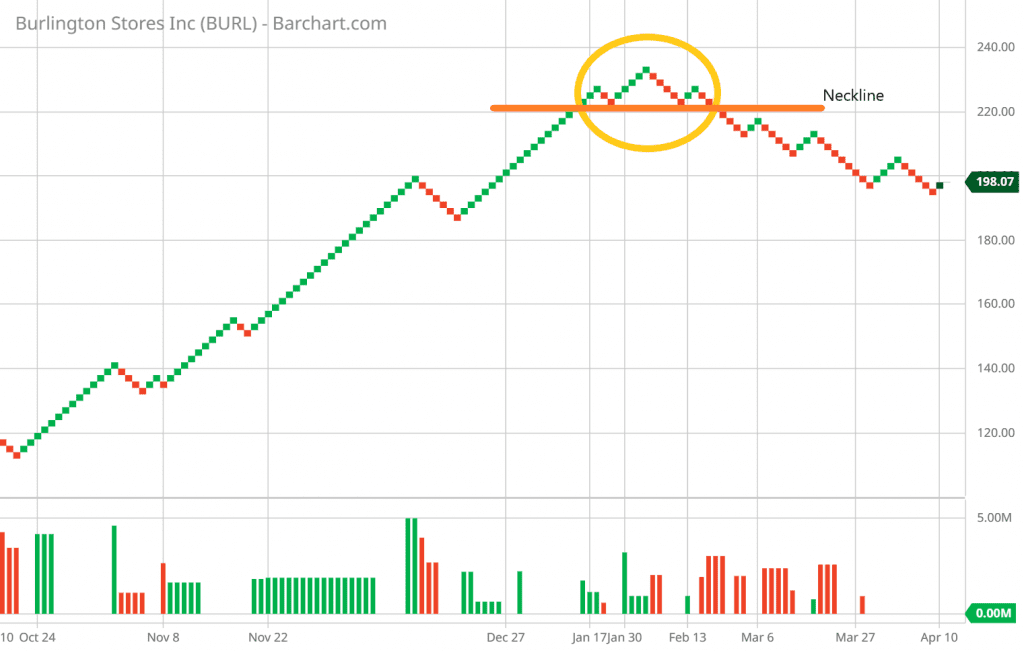

M Pattern (Double Top): Identifying Potential Trend Reversal

Conversely, the M pattern, known as the Double Top, indicates a potential reversal from an uptrend to a downtrend. This pattern forms when the price reaches two peaks at approximately the same level, resembling the letter ‘M.’ The first peak marks the end of the previous upward movement, and the second peak shows that sellers are preventing further upward movement.

Example: Consider a stock that has been on the rise, reaching a point where it encounters resistance. Sellers become more active, causing the price to dip, forming the first peak. The price then rallies, but stalls at a similar level due to increased selling pressure, forming the second peak. This pattern suggests that a downtrend might follow.

Head and Shoulders Pattern: Predicting Bearish Reversal

The Head and Shoulders pattern is a powerful indicator of an impending bearish reversal. It is formed by three peaks: a higher peak (the head) between two lower peaks (the shoulders). The pattern signifies that buyers are losing momentum, and sellers are gaining control.

Example: Imagine a stock’s price experiencing an uptrend, reaching a peak (the left shoulder), followed by a temporary decline. The price then surges to a higher peak (the head) before retreating again. A final attempt to rally results in a peak (the right shoulder) that’s lower than the head. This pattern indicates a transition from bullish sentiment to bearish sentiment.

Inverse Head and Shoulders Pattern: Indicating Bullish Reversal

The Inverse Head and Shoulders pattern is the bullish counterpart of the Head and Shoulders pattern. It signifies a potential reversal from a downtrend to an uptrend. The pattern consists of three troughs: a lower trough (the head) between two higher troughs (the shoulders).

Example: Picture a downtrending stock hitting a low (the left shoulder) before experiencing a modest rally. The price then dips again to create a lower trough (the head). However, the subsequent rally is more robust, forming a higher trough (the right shoulder). This pattern suggests a shift from bearish sentiment to bullish sentiment.

Renko charts, with their unique approach to displaying price trends, enhance our ability to identify these patterns and make informed trading decisions. By recognizing these patterns in conjunction with support, resistance, and trendlines, traders can elevate their technical analysis and seize trading opportunities.

Mastering Renko Charts Technical Analysis: A Comprehensive Guide

Implementing Effective Renko Chart Strategies

Crafting successful trading strategies with Renko charts involves a thoughtful blend of pattern recognition, trendline analysis, and utilization of support and resistance levels. These strategies empower traders to make informed decisions and navigate the complexities of the market with confidence. Here, we outline practical steps for trade management, strategies for loss mitigation, and methods for profit optimization.

| Aspect | Details | Example | Pros | Cons |

|---|---|---|---|---|

| Pattern Recognition and Analysis | Identifying patterns like W Pattern, M Pattern, Head and Shoulders, Inverse Head and Shoulders. | W Pattern indicates potential trend reversal in Company ABC’s stock. | Precise signals for potential trend reversals. | Patterns may not always guarantee accurate predictions. |

| Leveraging Trendlines and Support/Resistance | Using trendlines, support, and resistance to pinpoint entry and exit points. | Ascending trendline and support level in Company XYZ’s stock. | Enhanced precision in trading decisions. | Market volatility can lead to false breakouts. |

| Practical Trade Management | Setting stop-loss levels, adjusting positions based on evolving trends. | Using Inverse Head and Shoulders pattern for trade management. | Effective risk management and trade adjustment. | Overadjustment can result in missed opportunities. |

| Strategies for Loss Mitigation and Profit Optimization | Utilizing support/resistance for stop-loss orders, employing trailing stop orders. | Setting stop-loss below resistance-turned-support in Company DEF’s stock. | Limiting losses and securing profits with strategic orders. | Trailing stops might lead to premature exits in volatile markets. |

Pattern Recognition and Analysis

The cornerstone of a robust Renko chart strategy lies in pattern recognition. Renko charts, with their emphasis on significant price movements, offer a unique vantage point for identifying patterns that might not be as apparent on traditional charts. Patterns like the W Pattern (Double Bottom), M Pattern (Double Top), Head and Shoulders, and Inverse Head and Shoulders can be potent signals for potential trend reversals.

For instance, let’s consider an example involving a W Pattern. Assume Company ABC’s stock has experienced a downtrend, forming two successive troughs with a higher one in the middle. This W Pattern signifies that sellers attempted to drive the price lower but were met with strong buying interest. A break above the pattern’s neckline could indicate an impending upward trend, providing traders with a valuable buy signal.

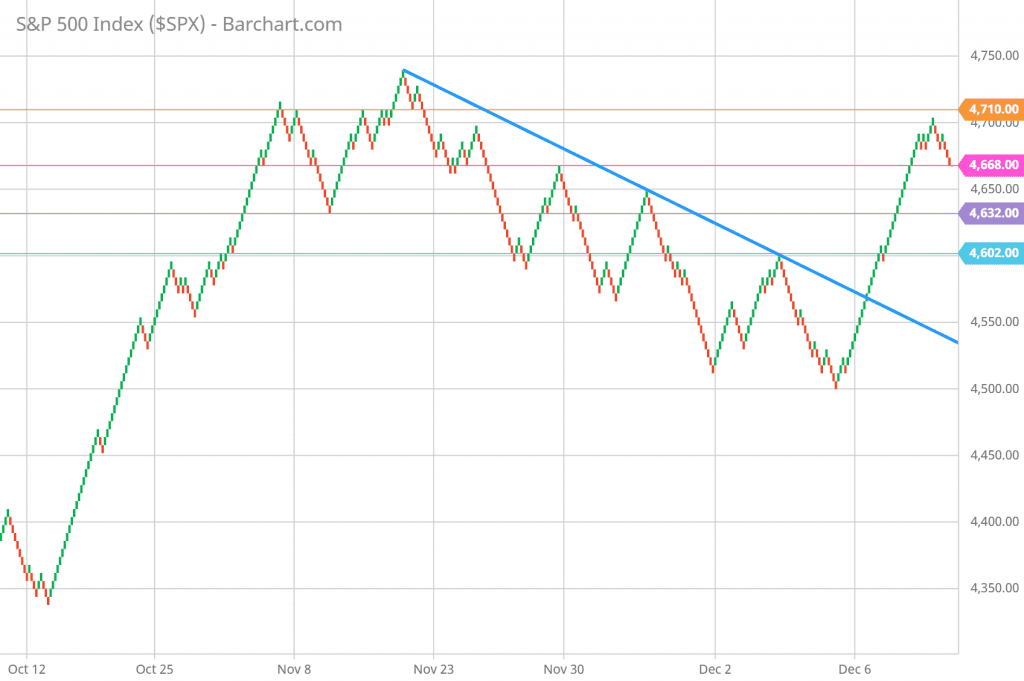

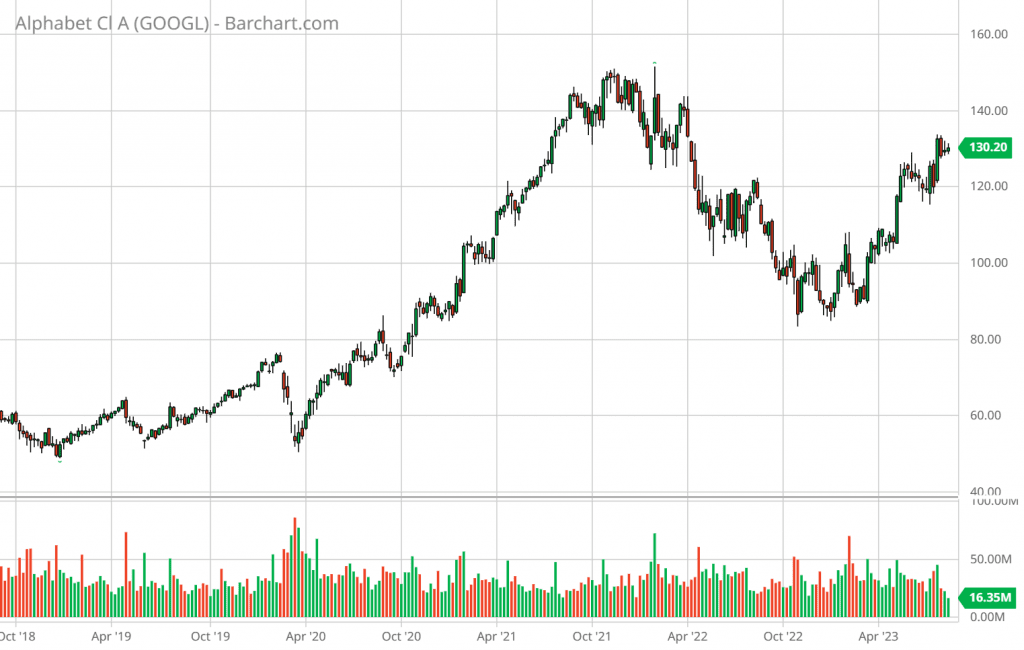

Leveraging Trendlines and Support/Resistance

Trendlines and support/resistance levels are invaluable tools for entry and exit points. By connecting highs or lows on Renko charts, traders can identify trends and potential turning points. For instance, an ascending trendline formed by linking successive higher lows indicates an uptrend, while a descending trendline suggests a downtrend. Combining these trendlines with support and resistance levels enhances the precision of trading decisions.

Imagine Company XYZ’s stock has displayed an ascending trendline on a Renko chart, indicating an uptrend. Simultaneously, a significant support level has been established at a particular price point. If the stock’s price approaches this support level and aligns with the trendline, it could present an opportune moment to initiate a long position, leveraging the confluence of trend and support.

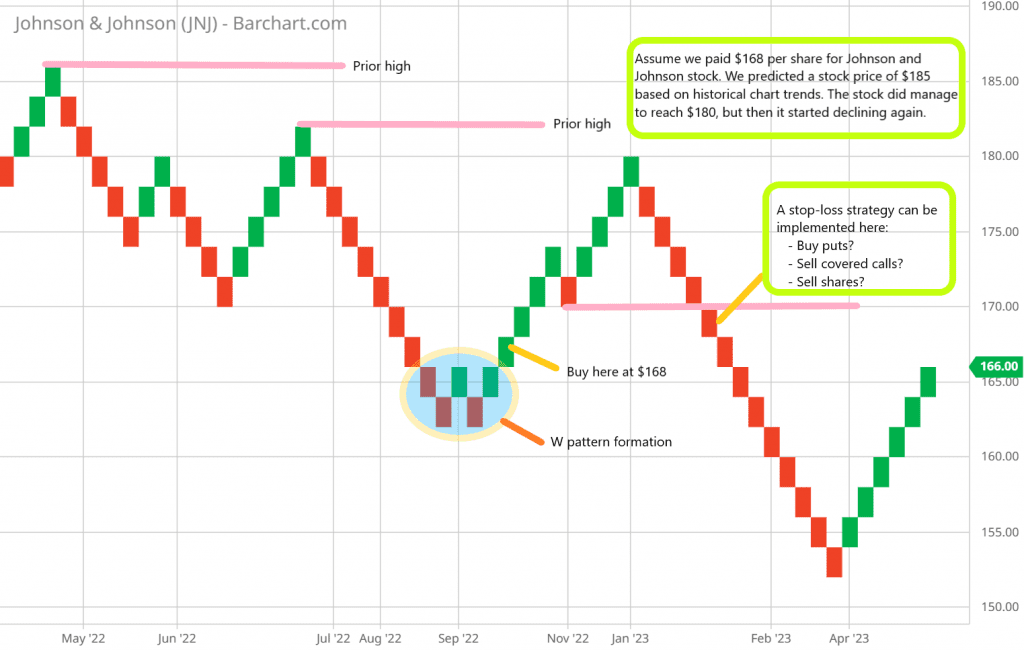

Practical Trade Management

Renko chart analysis doesn’t stop at pattern identification and entry points; practical trade management is crucial for success. Determine the appropriate stop-loss levels based on the Renko chart’s patterns and support/resistance zones. Adjust your positions according to the evolving trends and price movements to mitigate potential losses.

For instance, let’s say you’ve entered a trade based on an Inverse Head and Shoulders pattern. The neckline serves as your support level, and you’ve set your stop-loss slightly below this level to account for potential fluctuations. As the trade progresses and the stock’s price surges, consider trailing your stop-loss to protect your gains while still allowing room for upward movement.

Strategies for Loss Mitigation and Profit Optimization

Risk management is paramount in any trading strategy. Renko charts offer insights that can be instrumental in mitigating losses. By relying on established support and resistance levels, you can set stop-loss orders more strategically. Additionally, employing trailing stop orders that adjust as the price moves in your favor can help secure profits while allowing room for potential gains.

Let’s consider a scenario involving Company DEF’s stock. Using Renko charts, you’ve identified a strong resistance level that aligns with a recent peak. As you enter a short position, you set your stop-loss order just above this resistance-turned-support level. If the stock’s price breaks through this level, your trade is automatically exited, limiting potential losses.

In conclusion, Renko chart strategies revolve around insightful pattern recognition, effective use of trendlines, and careful consideration of support and resistance levels. By implementing practical trade management techniques and employing strategies for loss mitigation and profit optimization, traders can leverage Renko charts’ unique attributes to navigate the markets with precision and confidence.

Comparing Renko, Candlestick, and Heiken Ashi Charts

When it comes to analyzing market trends and making informed trading decisions, different chart types offer distinct advantages. In this section, we’ll explore how Renko charts stand out in comparison to two other popular chart types: Candlestick and Heiken Ashi.

| Chart Type | Details | Example | Pros | Cons |

|---|---|---|---|---|

| Renko Charts | Emphasizes price movements over time intervals by using bricks of fixed value. | Analyze a Renko chart for a forex pair over a month. |

|

|

| Candlestick Charts | Displays detailed price movements within specific time intervals using candlestick patterns. | Analyze a candlestick chart for a stock over a week. |

|

|

| Heiken Ashi Charts | Smooths out price movements by calculating average price within time frames. | Analyze a Heiken Ashi chart for a cryptocurrency. |

|

|

Candlestick Charts: Unveiling Fine Details and Precise Timing

Candlestick charts have long been a staple in the world of technical analysis. These charts provide intricate details about price movements within specific time intervals. Each candlestick on the chart represents a defined time period, such as an hour or a day, and includes information about the opening, closing, high, and low prices.

Example:

Imagine you’re analyzing a candlestick chart for a particular stock over a week. Each candlestick represents a single day of trading. You notice that a series of candlesticks with long upper shadows followed by short bodies and lower shadows signals potential price reversals. These patterns, known as “shooting stars,” often indicate a shift from bullish to bearish sentiment.

Heiken Ashi Charts: Smoothing Out Price Movements

Heiken Ashi charts are designed to provide traders with a clearer representation of trends by smoothing out the noise caused by volatile price fluctuations. These charts utilize a specific calculation method to generate candlestick patterns that focus on the average price movement within a given time frame.

Example:

Suppose you’re analyzing a Heiken Ashi chart for a cryptocurrency. The chart showcases a series of candlesticks with minimal wicks and smooth transitions between bullish and bearish trends. This visual simplicity aids in identifying the dominant trend direction and minimizing the impact of short-term price fluctuations.

Renko Charts: Excel in Trend-Following

Renko charts offer a unique approach by prioritizing price movements over time intervals. Each brick on a Renko chart represents a predefined price increment, and new bricks are only added when significant price changes occur. This approach eliminates the noise of minor price fluctuations and provides a clear visualization of the underlying trends.

Example:

Consider analyzing a Renko chart for a forex pair over a month. The chart consists of bricks that represent price movements of a set value, regardless of the time elapsed. You observe that the Renko chart showcases distinct trends more prominently than a traditional candlestick chart. This enhanced clarity aids in making accurate trend-following decisions.

Conclusion: Choosing the Right Chart Type

Selecting the appropriate chart type depends on your trading style, goals, and the level of detail you seek. Candlestick charts offer fine-grained insights into price movements and are suitable for various trading strategies. Heiken Ashi charts provide a smoothed perspective, aiding in trend identification. However, if trend-following is your primary objective, Renko charts excel by emphasizing significant price changes and minimizing noise.

Renko vs. Candlestick Charts: Which is Better for Trading?

Understanding Renko Chart Patterns for Enhanced Trading Insight

Renko chart patterns provide traders with a distinctive perspective on market trends, prioritizing price changes as the focal point. By highlighting significant movements, Renko charts offer a valuable tool for traders to refine their strategies and make more informed decisions.

Example 1:

Suppose you’re analyzing the price movement of Stock A using Renko charts. Instead of being constrained by fixed time intervals, Renko charts focus solely on price shifts. For instance, a Renko brick might represent a $5 price movement. This means that if Stock A’s price increases by $20 within a specific timeframe, four bricks will be added to the chart. By eliminating time-based fluctuations, Renko charts reveal substantial price trends that might be obscured in other charting methods.

Example 2:

Imagine you’re a forex trader assessing the EUR/USD currency pair’s performance. Renko charts can help you better visualize and interpret trends. For instance, if the brick size is set at 20 pips, and the currency pair experiences a series of upward movements of 60 pips, three bricks will be added to the chart. This streamlines the focus on consistent price movements, making it easier to identify trends and patterns.

Renko charts offer a versatile tool for traders seeking to better understand price trends without the interference of time-based fluctuations. By integrating Renko chart patterns with support, resistance, and trendlines, traders can unlock valuable insights and construct effective trading strategies.

Conclusion

In the realm of financial markets, where precision and informed decisions are paramount, Renko chart patterns emerge as a potent asset. Their emphasis on significant price changes and the ability to filter out noise make them an indispensable tool for traders seeking an edge.

Renko chart patterns hold the potential to unlock deeper insights into market trends, enabling traders to navigate the complex landscape with greater confidence. By integrating these patterns with established support, resistance, and trendline strategies, traders can harness a holistic approach that transcends traditional methods.

In the pursuit of optimal trading success, Renko chart patterns provide an exceptional avenue for pattern recognition and trend prediction. Their role in unveiling potential reversals and highlighting essential price movements is pivotal in cultivating a comprehensive trading strategy.

As you navigate the intricate world of trading, consider the strategic integration of Renko chart patterns as a cornerstone of your analytical toolkit. By mastering their nuances and aligning them with your trading objectives, you can harness the power of data-driven insights to make well-informed decisions.

In essence, Renko chart patterns illuminate a path toward more precise, confident, and profitable trading endeavors. Incorporate them judiciously, and witness how these patterns can transform your trading journey into one marked by enhanced precision and superior outcomes.