Dive into the dynamic world of financial markets with our exclusive monthly report on the NASDAQ, providing a comprehensive 12-month forecast and insightful commentary. This article serves as your go-to resource for understanding the potential twists and turns of the NASDAQ, offering valuable insights for investors, traders, and anyone keen on staying ahead in the ever-evolving financial landscape.

Disclaimer: The opinions shared in this article are my own and should not be construed as financial advice. It is essential for readers to independently research and consult with financial experts before making investment decisions. This content is for informational purposes only, and individual financial situations may vary. Past performance is not indicative of future results. I am not a licensed financial advisor, and readers are advised to exercise caution and seek personalized guidance based on their specific financial circumstances.

NASDAQ Outlook and Charts

Various algorithms, including my own creation, are employed to perform the calculations for this forecast. Beyond incorporating historical NASDAQ values from the last five years, the model, which is still a work-in-progress, also considers additional variables such as stock market indices and economic data to generate accurate predictions.

Disclaimer: The forecast model mentioned herein is intended for informational purposes only and should not be considered as financial advice. It represents an ongoing work-in-progress, and its predictions are based on various algorithms, including my own creation. Users are strongly advised to exercise caution and conduct their own research before making any financial decisions. The model’s outputs may not account for individual financial circumstances, and its accuracy is subject to the inherent uncertainties of predicting market trends.

I am not a licensed financial advisor, and this model does not replace professional financial guidance. Any reliance on the information provided in the forecast is at the user’s own risk, and I disclaim any liability for financial decisions made based on the model’s outputs.

| Key Takeaways |

|---|

| NASDAQ 2024 forecast is dynamic, with fluctuating values throughout the year. |

| Economic uncertainty persists, prompting the Federal Reserve’s plan to cut rates in 2024. |

| Despite early 2023 concerns, the U.S. is expected to avoid a recession. |

| Geopolitical tensions (Russia-Ukraine, Israel-Hamas, North Korea, China-Taiwan) impact market volatility. |

| Investors advised to stay vigilant, as global events influence market sentiment unpredictably. |

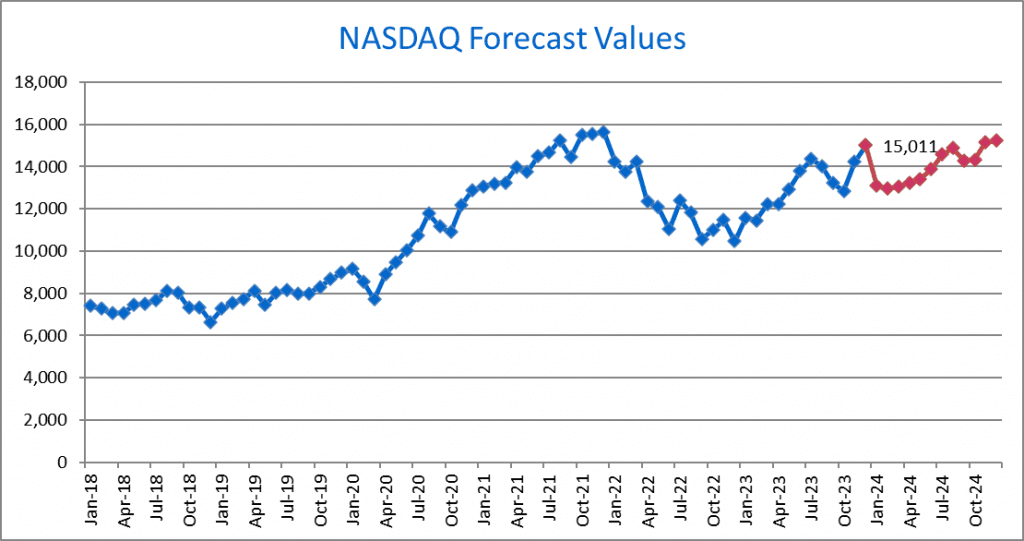

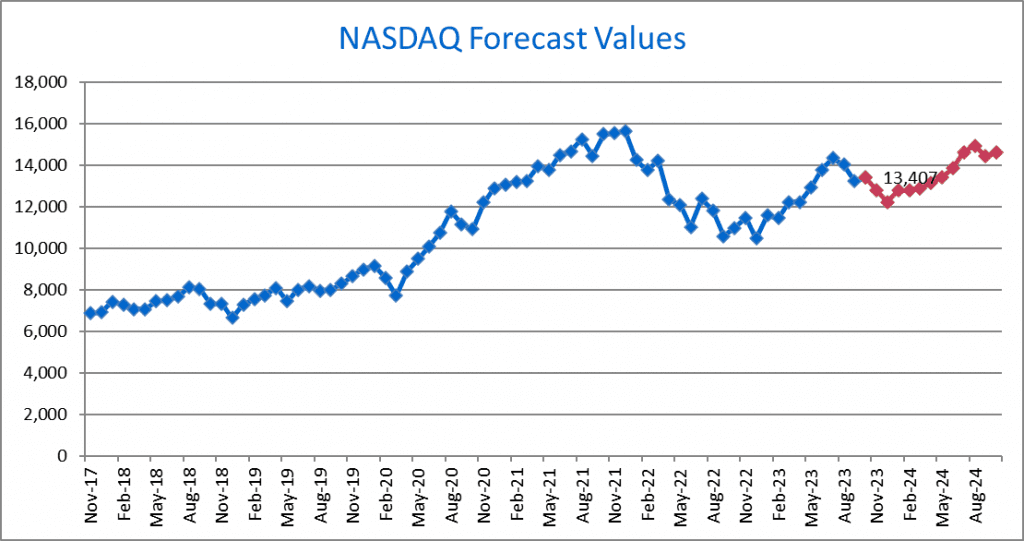

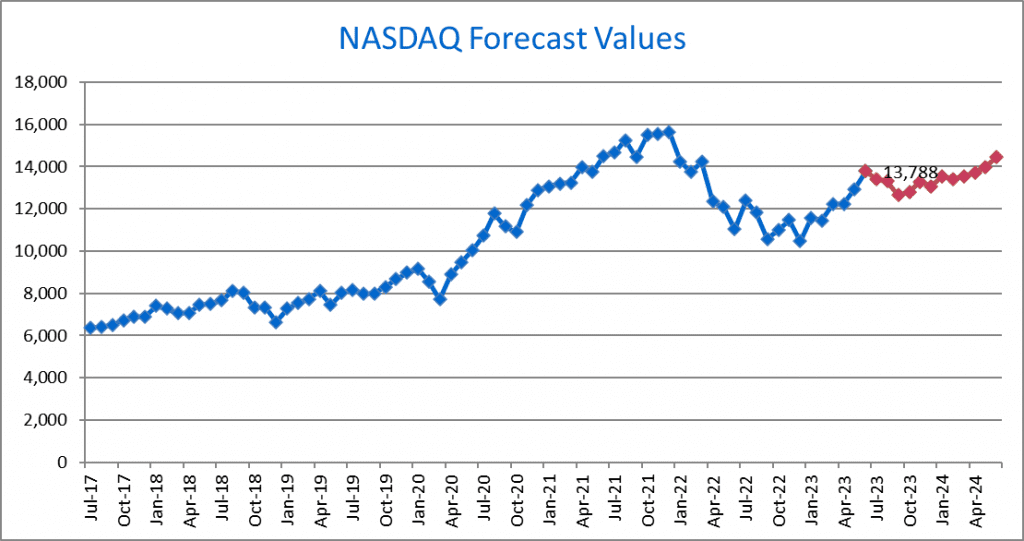

January 2024, NASDAQ Outlook

As we step into the new year, investors are closely eyeing the forecasted data for the NASDAQ, trying to decipher the intricate dance of economic indicators, geopolitical tensions, and global uncertainties. The NASDAQ forecast for 2024 presents a dynamic trajectory, characterized by fluctuations over the course of the year. The index is expected to experience variations, with peaks and troughs marking its journey. Investors should be prepared for a changing landscape, as the forecast hints at a market influenced by a range of factors throughout the year.

The Federal Reserve’s plan to cut rates in 2024 has stirred conversations among investors. Despite concerns stemming from the gloomy forecasts in early 2023, there is an expectation that the U.S. will manage to avoid a recession. The carefully orchestrated rate cuts are seen as a proactive measure to sustain economic growth. Investors are keenly watching the Federal Reserve’s moves, recognizing the pivotal role it plays in shaping market sentiment.

Economic uncertainty and a slowdown in global growth cast a shadow over the market outlook for 2024. The interconnected nature of the global economy means that events on the other side of the world can have a ripple effect on the NASDAQ. Geopolitical tensions, such as the Russia-Ukraine conflict, Israel-Hamas tensions, North Korea’s actions, and the ongoing China-Taiwan dispute, are additional variables contributing to market volatility. Investors are advised to keep a keen eye on these geopolitical developments, as they have the potential to sway market sentiment in unpredictable ways.

As we navigate through 2024, the NASDAQ forecast provides a roadmap that is both intriguing and challenging. The interplay between economic indicators, Federal Reserve decisions, and geopolitical events creates a complex tapestry that investors must carefully navigate. While the market outlook remains uncertain, staying informed and agile in response to changing circumstances will be crucial for those seeking to thrive in the ever-evolving landscape of the financial markets.

Month Forecast Jan-24 13,087 Feb-24 12,957 Mar-24 13,050 Apr-24 13,244 May-24 13,418 Jun-24 13,866 Jul-24 14,579 Aug-24 14,891 Sep-24 14,293 Oct-24 14,339 Nov-24 15,176 Dec-24 15,238

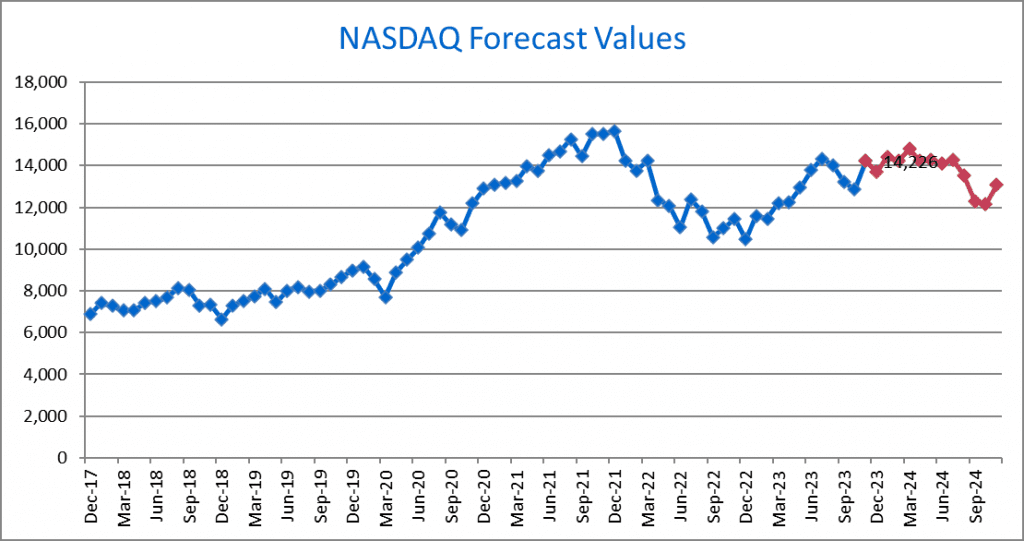

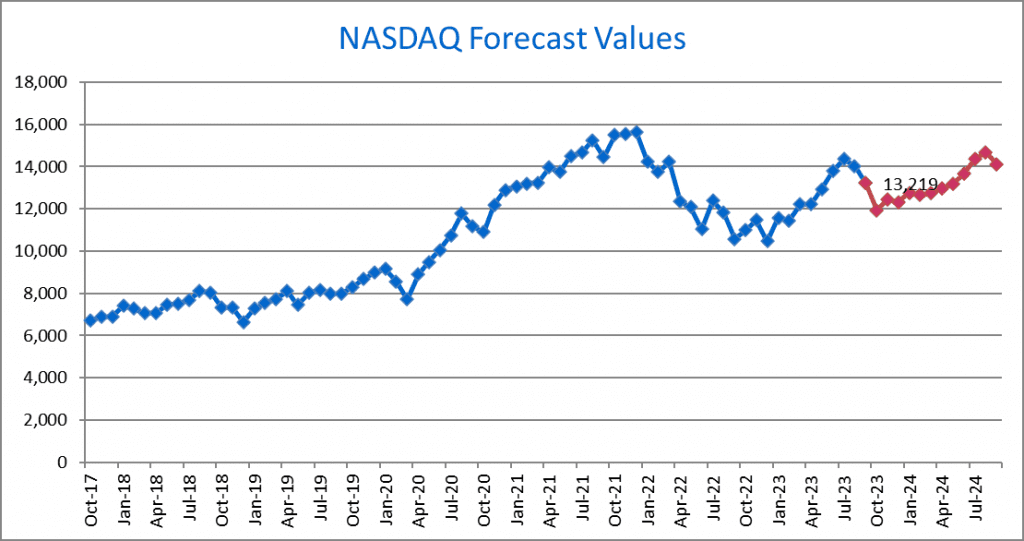

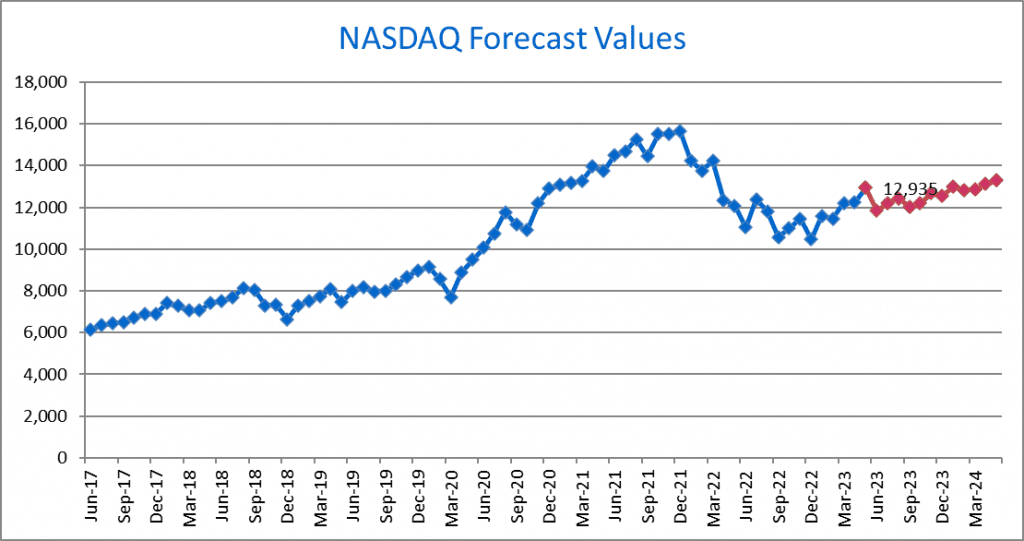

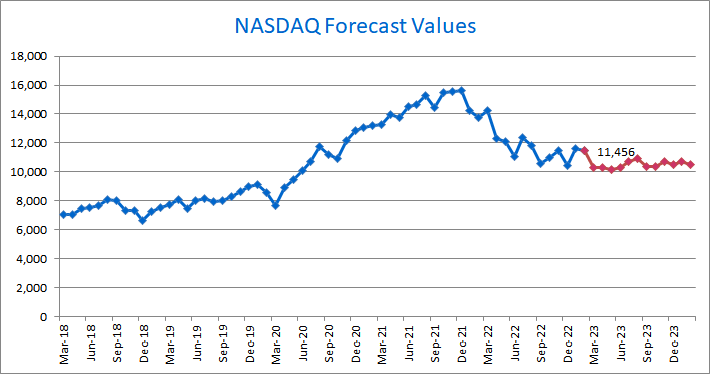

December 2023, NASDAQ Outlook

The NASDAQ’s 12-month forecast reveals a pattern of fluctuation, presenting a mixed trajectory over the upcoming year.

In the broader macroeconomic context, the market is navigating several influential factors. Despite a marginal reduction, inflation persists above the Federal Reserve’s target of 2%. Fed Chair Powell has communicated a reluctance to implement rate cuts in the near term, citing ongoing high inflation levels and expressing the central bank’s preparedness to hike rates when deemed necessary. However, there’s a dissonance between the Fed’s stance and market expectations, as investors anticipate rate cuts as early as the first quarter of 2024.

Adding to the complexity, geopolitical tensions, specifically the Israel-Hamas conflict, inject an additional layer of uncertainty into the market. The recent ebb and flow of hostilities, marked by a temporary ceasefire followed by a resumption of war, contribute to an environment where global events play a significant role in shaping market dynamics.

In summary, the NASDAQ’s forecasted values reflect a dynamic and potentially volatile market scenario. The interplay of inflation, Federal Reserve policy, and geopolitical events introduces conflicting signals, necessitating a vigilant approach from investors. Staying informed about economic indicators and global developments will be crucial for making well-informed investment decisions in the face of this multifaceted landscape.

Month Forecast Dec-23 13,686 Jan-24 14,420 Feb-24 14,224 Mar-24 14,808 Apr-24 14,219 May-24 14,279 Jun-24 14,094 Jul-24 14,283 Aug-24 13,535 Sep-24 12,307 Oct-24 12,137 Nov-24 13,077

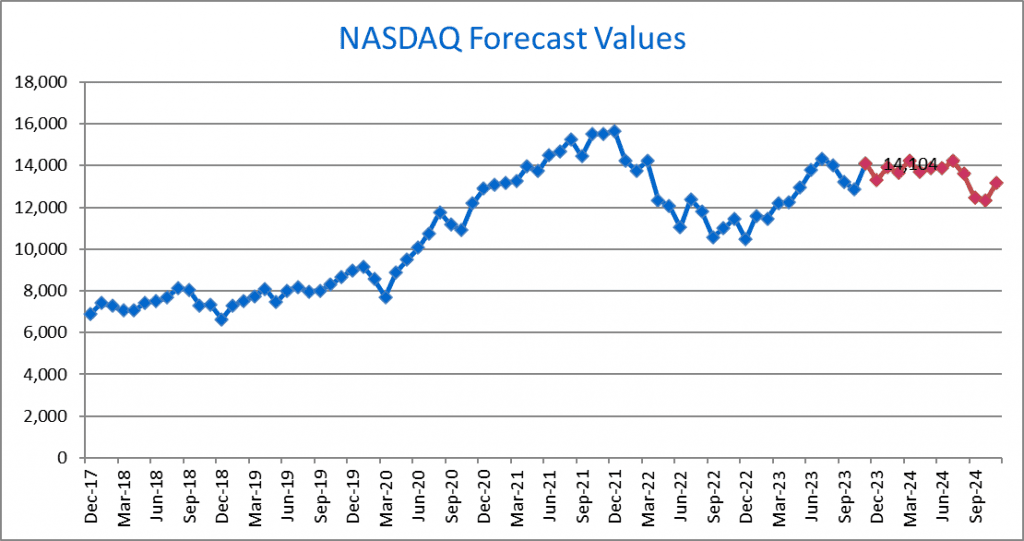

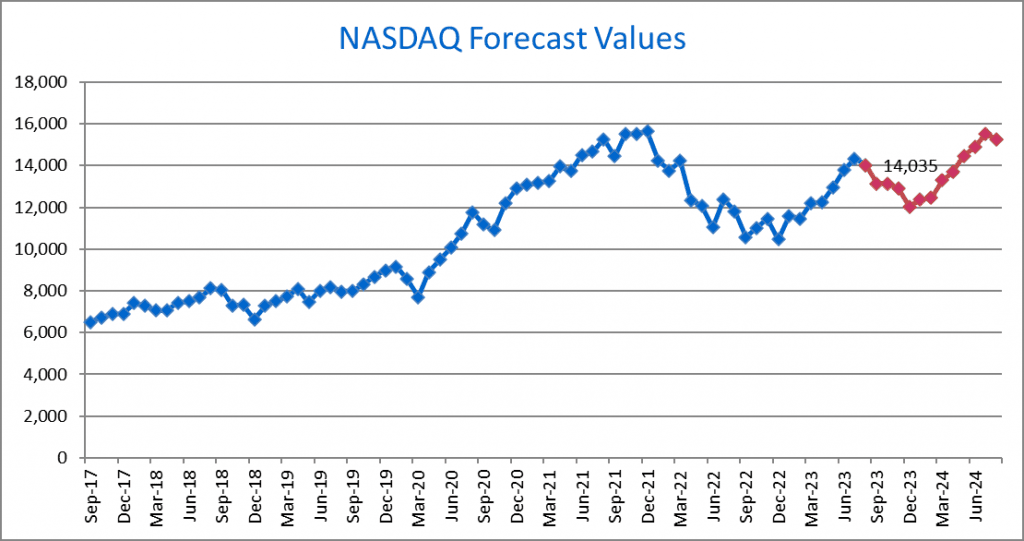

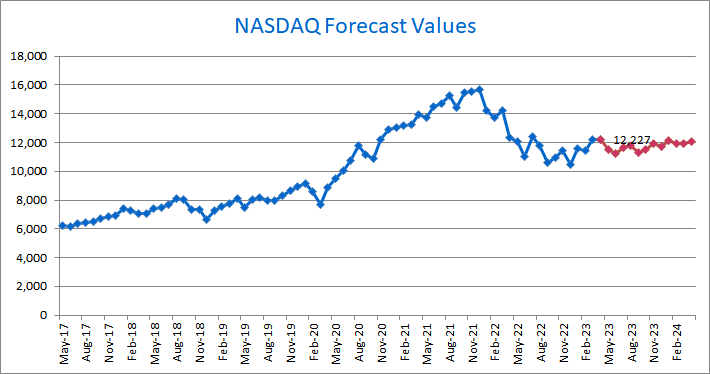

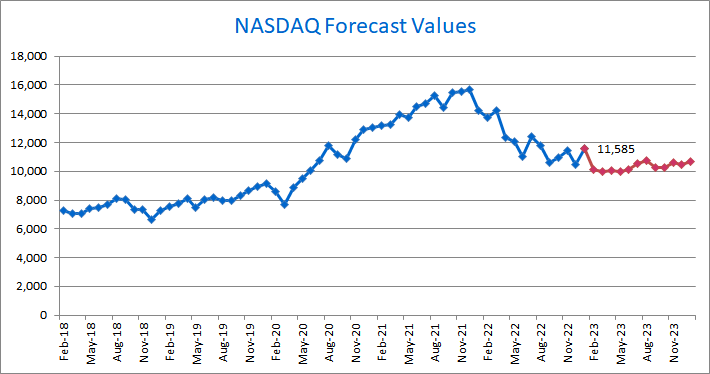

November 2023, NASDAQ Outlook

NASDAQ November Mid-Month Analysis:

The NASDAQ forecast for the next 12 months reveals a mix of optimism and concern, shaped by a variety of factors that influence the index. The key drivers include the high interest rate environment, potential Federal Reserve actions, trends in inflation, corporate earnings, consumer spending, and the geopolitical impact of the Israel-Gaza conflict on the global economy.

- Interest Rates and Federal Reserve Policy:

- The speculation around the Federal Reserve’s stance on interest rates is a central theme. The forecast reflects a cautious approach, with the index showing fluctuations in response to expectations of potential interest rate cuts. The upcoming months may witness a delicate balance as the market reacts to signals from the Federal Reserve regarding its monetary policy.

- Inflation Trends and Market Rally:

- The recent market rally, triggered by signs of slowing inflation, has contributed to the positive sentiment. However, there are lingering questions about the sustainability of this rally. Investors are likely to closely monitor inflation data in the coming months to assess whether the recent optimism is justified or if there are underlying risks that could impact market dynamics.

- Corporate Earnings and Consumer Spending:

- The ability of corporate earnings and consumer spending to maintain positive results in the high-interest rate environment is a critical concern. Higher interest rates can potentially affect borrowing costs for companies and consumers, impacting profitability and spending patterns. The index reflects a degree of uncertainty as investors evaluate the resilience of businesses and the consumer sector amid changing economic conditions.

- Geopolitical Impact of Israel-Gaza Conflict:

- The Israel-Gaza conflict introduces an additional layer of uncertainty to the forecast. Geopolitical events can have widespread economic implications, influencing investor sentiment and market behavior. The forecast appears to reflect this geopolitical risk, with potential impacts on global markets and the tech-heavy NASDAQ index.

Forecast Analysis:

- The NASDAQ forecast suggests a degree of volatility in the coming months, driven by a complex interplay of economic factors and geopolitical events.

- While the forecasted values show a general upward trend, there are notable declines projected in the latter part of the 12-month period. The dip in September and October could be indicative of increased uncertainty or specific challenges facing the market during that timeframe.

- Investors should remain vigilant, closely monitoring economic indicators, Federal Reserve communications, and geopolitical developments to make informed decisions. The forecast provides a roadmap, but it is subject to change based on evolving economic conditions and external events.

- The market’s response to interest rate dynamics, inflation trends, and global geopolitical events will likely shape the trajectory of the NASDAQ index in the coming months. Investors should consider a diversified approach and stay informed about the evolving economic landscape to navigate potential risks and opportunities in this dynamic market environment.

Month Forecast Dec-23 13,293 Jan-24 13,926 Feb-24 13,671 Mar-24 14,226 Apr-24 13,713 May-24 13,889 Jun-24 13,869 Jul-24 14,224 Aug-24 13,616 Sep-24 12,465 Oct-24 12,316 Nov-24 13,185

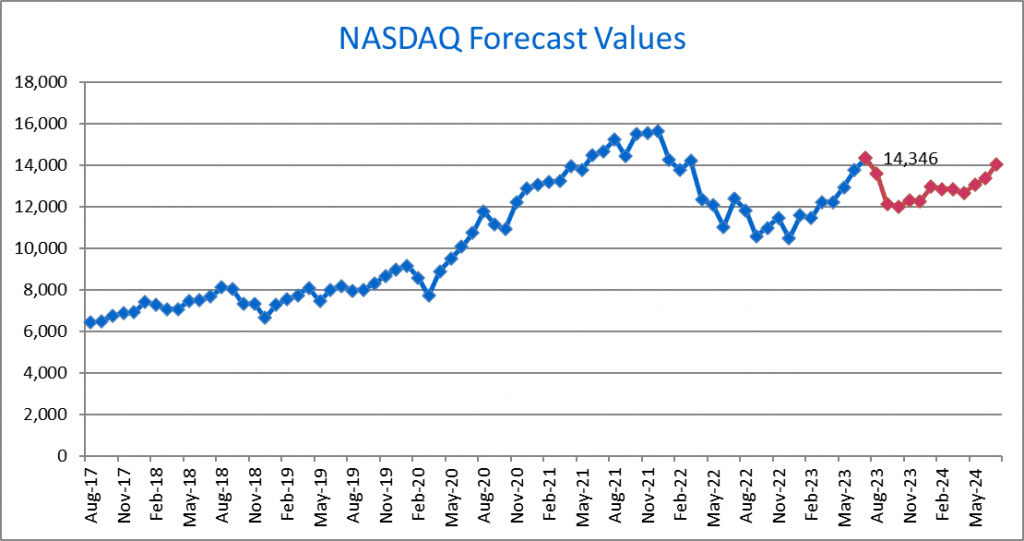

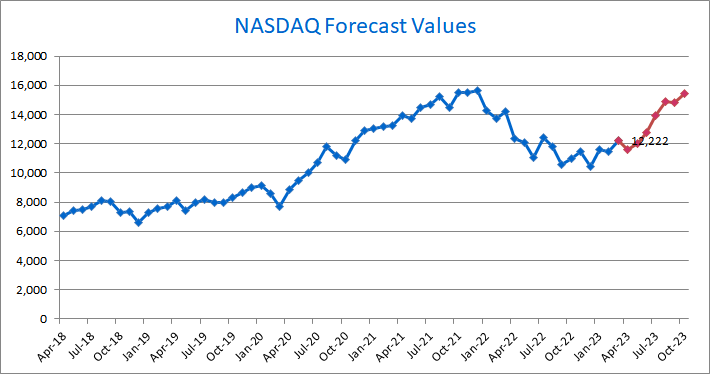

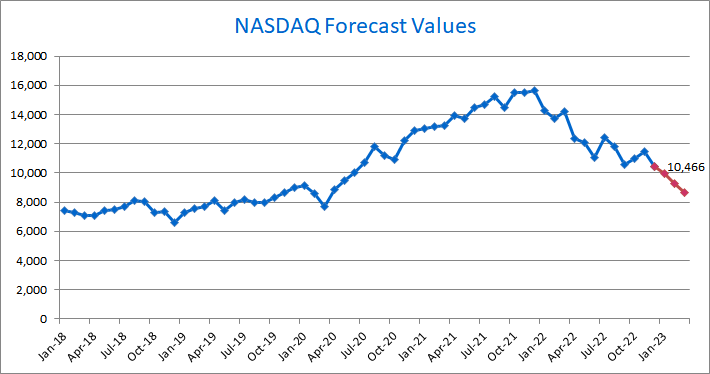

October 2023, NASDAQ Outlook

A Mid-Month Analysis: Navigating Through Economic Turbulence

Inflation Remains a Key Concern

One of the primary factors affecting the NASDAQ outlook is the persistently high inflation rates. Inflation erodes purchasing power and can negatively impact corporate profitability and consumer spending. With prices rising across various sectors, investors are closely monitoring how companies within the NASDAQ index are managing this inflationary pressure. The ability of technology companies to adapt and thrive in this environment will significantly influence the NASDAQ’s performance in the coming months.

Federal Reserve’s Interest Rate Policy

The Federal Reserve’s policy on interest rates is another major factor impacting the NASDAQ’s outlook. The Fed’s announcement of a potential interest rate hike later this year and a commitment to maintaining higher interest rates for an extended period reflects its efforts to manage inflation and sustain economic growth. While higher interest rates can sometimes dampen market sentiment, the Fed’s approach is aimed at ensuring long-term economic stability, which is ultimately favorable for investors and the stock market.

Labor Market Strength Amid Economic Challenges

The resilience and strength of the labor market in the face of high inflation and interest rates is a notable aspect of the current economic landscape. Despite the challenges posed by inflation, the labor market continues to demonstrate robustness. This stability bodes well for consumer confidence and spending, which are integral to the growth of technology companies within the NASDAQ and the broader market.

The Geopolitical Factor: Israel-Hamas Conflict and Its Impact on the NASDAQ Outlook

In addition to economic factors, geopolitical events often exert a significant influence on financial markets, including the NASDAQ Composite Index. The ongoing conflict between Israel and Hamas in the Middle East is a notable geopolitical event that can potentially affect market sentiment and investor confidence.

The Israel-Hamas Conflict: Background and Current Situation

The Israel-Hamas conflict has been a longstanding and complex issue involving Israel, a nation in the Middle East, and Hamas, an Islamist political organization and militant group primarily operating in the Gaza Strip. The conflict has deep-rooted historical, political, and religious dimensions, leading to periodic escalations of violence and tensions in the region.

In recent times, there have been renewed outbreaks of violence, resulting in casualties and heightened tension in the area. This ongoing conflict has implications not only for the people directly involved but also for global markets and investors, including those in the United States.

The Impact on the NASDAQ Composite Index

Geopolitical tensions can impact the NASDAQ Composite Index through several channels. First, uncertainties arising from geopolitical conflicts can lead to increased market volatility as investors react to the evolving situation. Heightened uncertainty can affect investor confidence, potentially leading to fluctuations in stock prices, including those of technology companies listed on the NASDAQ.

Moreover, the technology sector is sensitive to disruptions in global supply chains, which can be exacerbated during periods of geopolitical instability. The Israel-Hamas conflict, situated in a region with significant technology-related activities, could disrupt supply chains and operations of multinational tech companies, impacting their performance and subsequently influencing the NASDAQ Composite Index.

Strategies for Investors

Investors should remain vigilant and closely monitor developments in the Israel-Hamas conflict and its potential impact on the financial markets. It’s important to stay informed through reputable news sources and consult with financial advisors to make informed investment decisions.

Diversifying portfolios and considering investments across various sectors can help mitigate risks associated with geopolitical events. Additionally, having a well-defined risk management strategy and understanding the historical impact of geopolitical tensions on financial markets can aid in making rational investment choices during times of uncertainty.

In conclusion, geopolitical events like the Israel-Hamas conflict can introduce uncertainty and volatility into financial markets, including the NASDAQ Composite Index. While the market remains influenced by economic factors like inflation, interest rates, and the labor market, geopolitical events should also be carefully considered by investors as they navigate their investment strategies.

Forecasted NASDAQ Composite Index

Taking into account these key factors and the forecasted numbers, the NASDAQ Composite Index’s trajectory appears to show a consistent upward trend in the coming months. The forecasted values anticipate a gradual increase in the index, demonstrating the market’s confidence in the technology sector’s ability to weather the economic challenges.

Month Forecast Nov-23 12,778 Dec-23 12,224 Jan-24 12,789 Feb-24 12,792 Mar-24 12,903 Apr-24 13,135 May-24 13,417 Jun-24 13,848 Jul-24 14,635 Aug-24 14,941 Sep-24 14,429 Oct-24 14,618

These forecasted numbers illustrate a generally positive outlook for the NASDAQ Composite Index, projecting a gradual increase over the specified period. However, it’s important for investors and stakeholders to stay vigilant and adapt their strategies as economic conditions evolve, considering the dynamic nature of financial markets.

In conclusion, a combination of factors, including inflation rates, interest rate policies, and labor market stability, will significantly shape the NASDAQ’s outlook. Investors should remain informed and prepared to adjust their investment strategies based on market developments and economic indicators to optimize their returns and navigate through this economic landscape effectively.

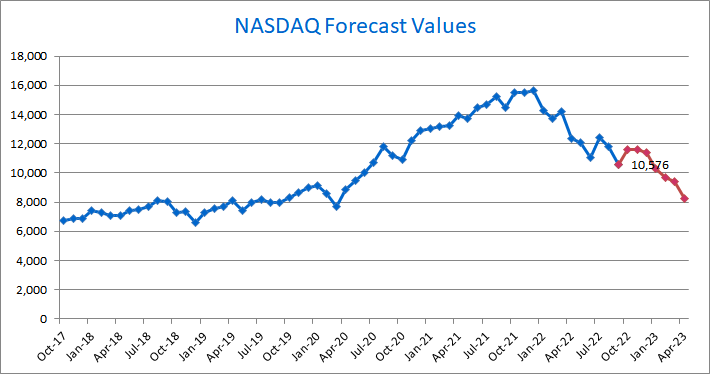

October 2023, NASDAQ Outlook

The Federal Reserve has announced plans for one more rate hike in 2023, intending to keep rates high for an extended period to combat inflation. This decision raises concerns about the ability of companies, particularly in the technology sector, to sustain earnings that meet high market expectations during these periods of elevated interest rates.

The technology sector, known for its sensitivity to interest rate changes, may face challenges in maintaining previous levels of growth and profitability. High interest rates can increase borrowing costs and subsequently impact investment decisions and consumer spending. Companies within this sector will need to adapt their strategies and optimize operations to navigate this environment successfully.

Another significant economic factor is the persistently high oil prices. Elevated oil prices can have a broad impact on various industries, affecting production costs, consumer spending, and inflation. Industries reliant on energy may experience increased operational expenses, potentially leading to margin pressures.

Given the combination of high interest rates and elevated oil prices, there are concerns regarding the potential for an economic slowdown or even a recession. The precise impact will depend on several factors, including the overall resilience of the market, fiscal policies, and the ability of businesses to adapt and innovate.

It’s crucial for stakeholders, investors, and businesses to monitor economic indicators closely, stay informed about policy developments, and remain flexible in their strategies to navigate the evolving economic landscape over the next 12 months.

Please note that this content is for informational purposes only and should not be considered as financial or investment advice. It’s essential to consult with a qualified financial advisor before making any investment decisions.

Month Forecast Oct-23 11,929 Nov-23 12,424 Dec-23 12,333 Jan-24 12,764 Feb-24 12,647 Mar-24 12,729 Apr-24 12,986 May-24 13,172 Jun-24 13,658 Jul-24 14,349 Aug-24 14,687 Sep-24 14,114

September 2023, NASDAQ Outlook

The NASDAQ Index appears to follow a somewhat fluctuating path in the months ahead, as per the provided forecast. Starting at 13,138 in September 2023, it remains relatively stable in October before experiencing a dip in November, reaching 12,910. December sees a further decline to 12,044.

However, the forecast suggests a potential reversal in the early months of 2024, with January at 12,356 and February at 12,457. The real turning point appears to be March, with a significant jump to 13,297. This upward trend continues, with April reaching 13,683, May at 14,466, and June at 14,888. July and August continue the positive momentum, hitting 15,525 and 15,243, respectively, by August 2024.

Investors can use this forecast as a guideline for their investment decisions. The anticipated fluctuation in the NASDAQ Index underscores the importance of a diversified portfolio to manage risk effectively. Consider aligning your investment strategy with these expected market movements, but remain cautious as unforeseen events can influence outcomes. Staying informed about economic and technological developments, along with monitoring individual stock performance, can also help you make informed investment choices.

Remember, forecasts are based on historical data and models, and market conditions can change rapidly. It’s advisable to consult with financial professionals and tailor your investment approach to your specific financial goals and risk tolerance.

Month Forecast Sep-23 13,138 Oct-23 13,142 Nov-23 12,910 Dec-23 12,044 Jan-24 12,356 Feb-24 12,457 Mar-24 13,297 Apr-24 13,683 May-24 14,466 Jun-24 14,888 Jul-24 15,525 Aug-24 15,243

August 2023, NASDAQ Outlook

Based on our forecasting algorithms, we expect the NASDAQ to have a temporary downturn before continuing its upward trend. The continued rebound of the technology sector over the past few months is indicative of a more upbeat mood on the NASDAQ than on the SP 500. Investors are feeling more optimistic after hearing the latest earnings results from industry giants like Google and Meta. While many IT companies reported healthy profits, others, like Microsoft, did not. The NASDAQ’s impressive year-to-date gain supports the expectation of a brief downturn before resuming its upward trajectory.

As the third quarter approaches, Wall Street is preoccupied with inflation and interest rates. In June, the Federal Open Market Committee (FOMC) decided to stop raising interest rates and instead keep them in a range of 5.25% to 5%. Even though the Fed’s rate hikes haven’t caused a recession, the increased cost of borrowing money is putting a strain on businesses. There is a 70.8% risk of a recession happening in the next 12 months, according to the New York Fed’s recession probability model.

The FOMC has boosted its prediction for economic growth in 2023, and it expects the unemployment rate to drop to 4.1% in that year. The US economy is demonstrating the labor market’s continued strength. Economist Stephen Juneau of Bank of America still anticipates a US recession, although he thinks it will be later and weaker than previously predicted.

Month Forecast Aug-23 13,594 Sep-23 12,121 Oct-23 11,997 Nov-23 12,283 Dec-23 12,275 Jan-24 12,964 Feb-24 12,842 Mar-24 12,850 Apr-24 12,645 May-24 13,061 Jun-24 13,355 Jul-24 14,059

July 2023, NASDAQ Outlook

Month Forecast Jul-23 13,401 Aug-23 13,308 Sep-23 12,641 Oct-23 12,814 Nov-23 13,277 Dec-23 13,074 Jan-24 13,545 Feb-24 13,418 Mar-24 13,536 Apr-24 13,717 May-24 13,988 Jun-24 14,465

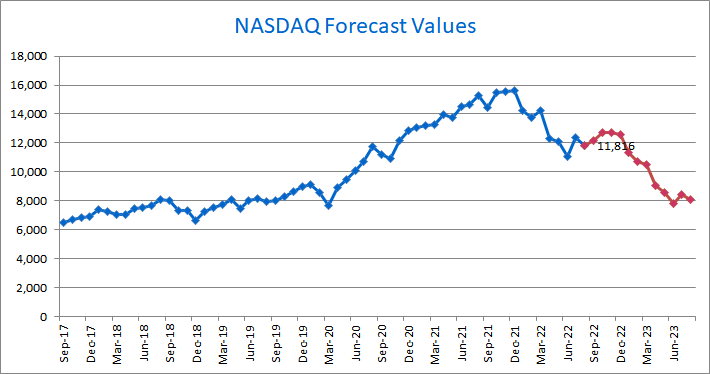

June 2023, NASDAQ Outlook

Despite fears of a recession in 2023, investors are focusing on the Fed’s decision to suspend hikes in rates and the solid first-quarter earnings season. Fed Chair Jerome Powell has stated that inflation is too high but that policy rates may not need to rise as much as they would otherwise owing to tightening credit markets, highlighting the continued importance of inflation and interest rates as catalysts.

Even though the NASDAQ had a wonderful month in May owing to Nvidia’s blowout earnings, our projection model still predicted a sideways market with a very steady upward climb for the remainder of 2023.

Month Forecast Jun-23 11,825 Jul-23 12,186 Aug-23 12,430 Sep-23 12,027 Oct-23 12,188 Nov-23 12,671 Dec-23 12,537 Jan-24 12,986 Feb-24 12,830 Mar-24 12,853 Apr-24 13,112 May-24 13,303

May 2023, NASDAQ Outlook

Our models now anticipate that the NASDAQ will trend sideways. A more optimistic outlook prevails on the NASDAQ than on the SP 500, as evidenced by the tech sector’s ongoing recovery in April. The turbulence in the financial sector is to blame for the slump in the SP 500. Earnings reports from major heavyweights like Microsoft, Meta, and Apple have fueled investor optimism. While many tech firms reported strong financial results, some did not. This lack of clarity about the NASDAQ’s future direction justifies the call for a sideways trend.

The market’s ongoing shockwaves from the recent banking crisis could have an impact on the tech-heavy NASDAQ. First Republic Bank was the failed bank that was, in turn, taken over by JPMorgan Chase. Investors betting on the next bank to fail drove down shares of PacWest Bancorp by 80% year to date as rumors spread. Inflation and high interest rates will continue to have a significant impact on the market in the coming months, in addition to the banking crisis. Earnings reports show that many businesses are experiencing declining profits and slower expansion. Even if the Federal Reserve expects to halt rate hikes soon, the probability of a recession remains high.

Month Value Forecast May-23 11,540 Jun-23 11,253 Jul-23 11,649 Aug-23 11,768 Sep-23 11,333 Oct-23 11,522 Nov-23 11,902 Dec-23 11,709 Jan-24 12,104 Feb-24 11,941 Mar-24 11,948 Apr-24 12,045

April 2023, NASDAQ Outlook

Our projections have become more optimistic about the NASDAQ. As the very robust tech sector rebound in March shows, sentiment is even more bullish on the NASDAQ than on the SP 500. In March, Meta’s shares rose 21%, while Google’s rose nearly 12%.

But there are still signs that the market is still reeling from the recent banking crisis, which could affect the tech-heavy NASDAQ. Even though the banking crisis may be over, inflation and interest rates will still have a big effect on the market in the coming months. Recent bank failures were not as bad as they could have been because unemployment rates and the job market were so strong. The risk of a recession is still significant, even though the Fed plans to stop raising rates shortly.

Month Forecast Apr-23 11,613 May-23 12,046 Jun-23 12,776 Jul-23 13,965 Aug-23 14,877 Sep-23 14,813 Oct-23 15,447

March 2023, NASDAQ Outlook

The fundamental preoccupation of markets is the Federal Reserve’s conundrum of reducing inflation without stifling the economy’s job growth or triggering a recession. Financial markets were unnerved after reading inflation figures that showed the rate of price decline had stalled. This means the Federal Reserve’s fight against inflation will continue for some time.

Factors like the recent strong employment report, which again underlined the strength of the labor market, have led our forecast model to predict a sideways trend in the near future. And the Federal Reserve’s suggestions that it plans to keep hiking interest rates, and the recent earnings season reports that have shown mixed results.

Together, these factors point to a potentially volatile market in the near future as Wall Street struggles to establish clear paths. Thus, uncertainty makes the investment climate risky.

Month Forecast Mar-23 10,282 Apr-23 10,281 May-23 10,186 Jun-23 10,312 Jul-23 10,743 Aug-23 10,926 Sep-23 10,397 Oct-23 10,376 Nov-23 10,744 Dec-23 10,526 Jan-24 10,717 Feb-24 10,506

February 2023, NASDAQ Outlook

The NASDAQ index gained over 10% in January. As a result, our forecasting algorithm generated a major change in the direction of the index. The model has consistently predicted a downward trend for NASDAQ over the past few months. However, the index is now expected to trend sideways, contrary to earlier predictions.

Data on the gross domestic product and the job market show that the U.S. economy is still in good shape. But inflation data suggest that the Fed’s policy is starting to slow the rate at which prices are going up. Nevertheless, inflation and interest rates continued to weigh on stock values.

The recession remained a topic of discussion. In the coming months, it may determine if it can manage a “soft landing” for the U.S. economy without causing a recession. Moderating inflation and predictions of slower Fed tightening have been positive for markets. However, the economy will decline in the second half of 2023 as a result of the Fed’s past tightening. As a result, earnings projections will be lowered, acting as a drag on equities.

Month Forecast Feb-23 10,127 Mar-23 9,990 Apr-23 10,045 May-23 9,983 Jun-23 10,132 Jul-23 10,568 Aug-23 10,771 Sep-23 10,265 Oct-23 10,255 Nov-23 10,639 Dec-23 10,450 Jan-24 10,649

January 2023, NASDAQ Outlook

Wall Street will likely continue to focus on inflation and interest rates over the first three months of 2023. By March 2023, the bond market expects the Fed to have raised rates by at least another 50 basis points. The Federal Reserve has raised interest rates rapidly so far without sending the economy into a downturn. But new economic reports show that a recession at the start of 2023 is now more likely than ever. When hiring slows down a lot, it should be a sign that the economy is about to go into a recession. To date, the job market has shown remarkable resilience.

When the economy is bad, some market sectors do better than others because their earnings tend to be more stable and consistent. Investors often look to defensive sectors like healthcare, utilities, and consumer staples when assessing risk. Sometimes the eye of a hurricane might make it appear as though the storm has passed. However, the worst of its force is still to come. According to the projection model, the NASDAQ has not yet hit rock bottom. It is predicted to fall further in 2023.

Month Forecast Jan-23 9,943 Feb-23 9,263 Mar-23 8,679

October 2022, NASDAQ Outlook

The markets have been hampered by inflation and rising interest rates throughout the better part of 2022. The cost of living and consumer goods alike have all increased. Customers are more wary than ever before about where, when, and how they spend their hard-earned cash. Inflation fears, interest rate hikes, and the prospect of a recession have all contributed to months of market volatility. And unfortunately, this pattern will continue.

The earnings season for the third quarter also begins in October, adding to the pressure from worsening macroeconomic conditions. Earnings information for October should be quite telling. The upcoming quarterly earnings reports from companies will be important. What companies say about the rest of the year and next year is going to be the main focus of investors.

To avoid losing money in today’s volatile market, it’s best to sit on the sidelines and save up. Deals can still be had if one knows where to look. The rule of thumb in the current market is to invest in stable, high-yielding, high-quality companies. When inflation finally begins to fall, these businesses will reap the rewards. The current environment supports the idea that you should diversify your investments. Real assets, such as commodities and natural resources equities, could be a good fit for some investors’ investment portfolios.

In spite of the model’s most recent predictions, a temporary relief bounce in the index was still possible before a prolonged downturn during the rest of 2022 and into 2023.

Month Forecast Oct-22 11,629 Nov-22 11,590 Dec-22 11,387 Jan-23 10,321 Feb-23 9,684 Mar-23 9,424 Apr-23 8,227

September 2022, NASDAQ Outlook

The forecast model suggested that the market would not make a big comeback in the coming months. Before the downtrend starts again, the index will move sideways.

The Fed’s aggressive position on interest rates will continue to rule the markets. In the past few months, as interest rates have gone up, the housing market has slowed down. On the other hand, there is still a lot of demand for workers in the job market. The job numbers stayed strong. How fast the Fed can change its monetary policy depends on how well the job market is doing.

The Fed’s plans to stop inflation will be closely watched by the markets to see if they will hurt the economy. Powell told the markets that the Fed wouldn’t change its policy until inflation was under control, even if that hurt the U.S. economy.

Month Forecast Sep-22 12,152 Oct-22 12,700 Nov-22 12,689 Dec-22 12,564 Jan-23 11,339 Feb-23 10,702 Mar-23 10,536 Apr-23 9,034 May-23 8,558 Jun-23 7,802 Jul-23 8,461 Aug-23 8,071

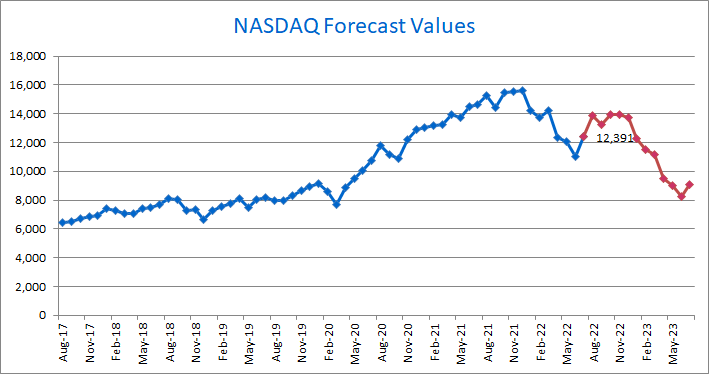

August 1, 2022, NASDAQ Forecast

The NASDAQ closed at 12,391 in July. The forecast had projected a substantial recovery for months, and it finally materialized in July. The projection model anticipated that the market would be volatile throughout the remainder of 2022 and into 2023. It continued to forecast a corrective upward movement before the downward trend resumed.

Some economic data is weak, but not the labor market data. Company hiring continues to be robust. This quarter’s earnings are better than expected, and many expect a rosy next quarter or rest of the year. Uncertainty remains over whether inflation will be tamed soon and whether rate hikes will slow economic growth. Markets will remain volatile as a result.

Month Forecast Aug-22 13,846 Sep-22 13,239 Oct-22 13,967 Nov-22 13,957 Dec-22 13,754 Jan-23 12,305 Feb-23 11,501 Mar-23 11,190 Apr-23 9,503 May-23 8,994 Jun-23 8,256 Jul-23 9,101

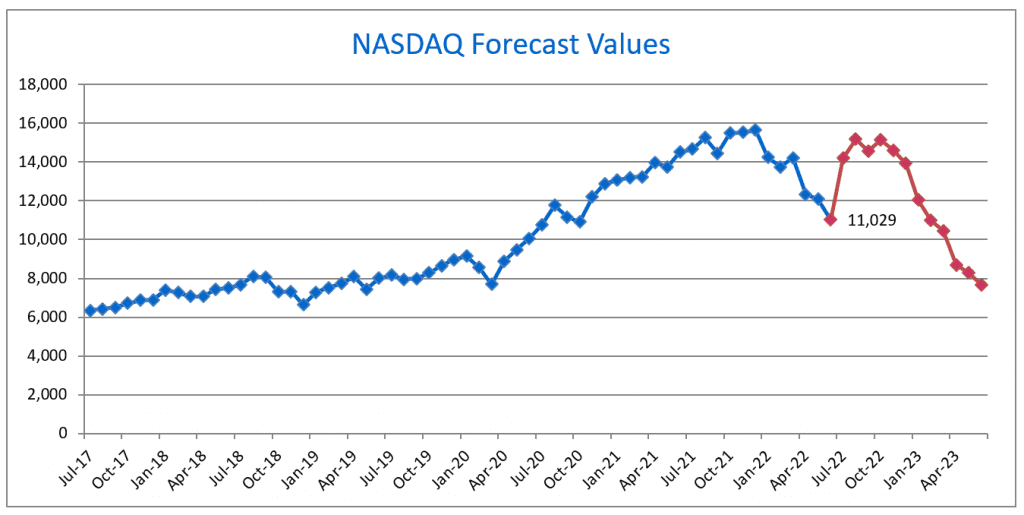

July 1, 2022, NASDAQ Forecast

On June 30, 2022, the NASDAQ index closed at 11,029. Since setting a new all-time high of 16,212 in 2021, the NASDAQ index has been under pressure. The market was expected to be volatile for the rest of 2022, according to the projection model. It predicted a significant increase in the not-too-distant future, followed by a dramatic decline.

The NASDAQ index has suffered the most as interest rates have risen. The Federal Reserve raised interest rates by 75 basis points in June to combat inflation and will continue to do so in the future. Investors fear that rising interest rates will trigger a recession. Interest rate increases reduce the present value of future earnings. For this reason, growth and technology companies have become less appealing.

Rising food, energy, and commodity prices may limit consumer spending. As a result, both business profits and economic growth would suffer. COVID’s influence on international trade is growing as shipping costs rise and the frequency of delays rises. Because of the situation in Ukraine and China’s zero COVID policy, this slowdown is more severe than expected. Earnings should be the primary driver of stock prices in the future, rather than macroeconomic factors. To this end, there is a strong possibility that market volatility will continue.

Month Forecast Jul-22 14,190 Aug-22 15,175 Sep-22 14,574 Oct-22 15,138 Nov-22 14,602 Dec-22 13,922 Jan-23 12,042 Feb-23 10,980 Mar-23 10,469 Apr-23 8,702 May-23 8,288 Jun-23 7,687

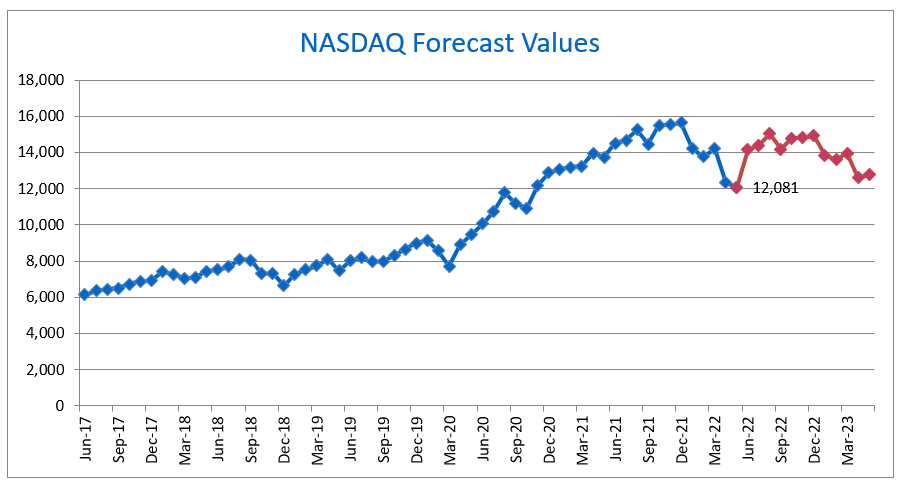

June 1, 2022, NASDAQ Forecast

On May 31, 2022, the NASDAQ index closed at 12,081. Since reaching an all-time high of 16,212 in 2021, the NASDAQ index has been under pressure. For the rest of 2022, the forecast model predicted a sideways and then declining trend.

Rising interest rates have hurt the NASDAQ index the most. The Fed will continue to do so in order to combat inflation. Investors fear that higher rates could cause a recession. Higher yields discount future earnings, making growth and tech stocks less attractive. Food, energy, and commodity costs may slow consumer spending, hurting business earnings and economic growth. COVID’s impact on global trade continues to grow as shipping costs climb and delays become routine. High energy costs push up shipping expenses, and a trucking manpower shortage compounds the issue. Inflation and supply chain concerns may last until 2022. Volatility will likely continue.

Month Forecast Jun-22 14,143 Jul-22 14,394 Aug-22 15,027 Sep-22 14,192 Oct-22 14,777 Nov-22 14,810 Dec-22 14,921 Jan-23 13,857 Feb-23 13,597 Mar-23 13,947 Apr-23 12,612 May-23 12,769

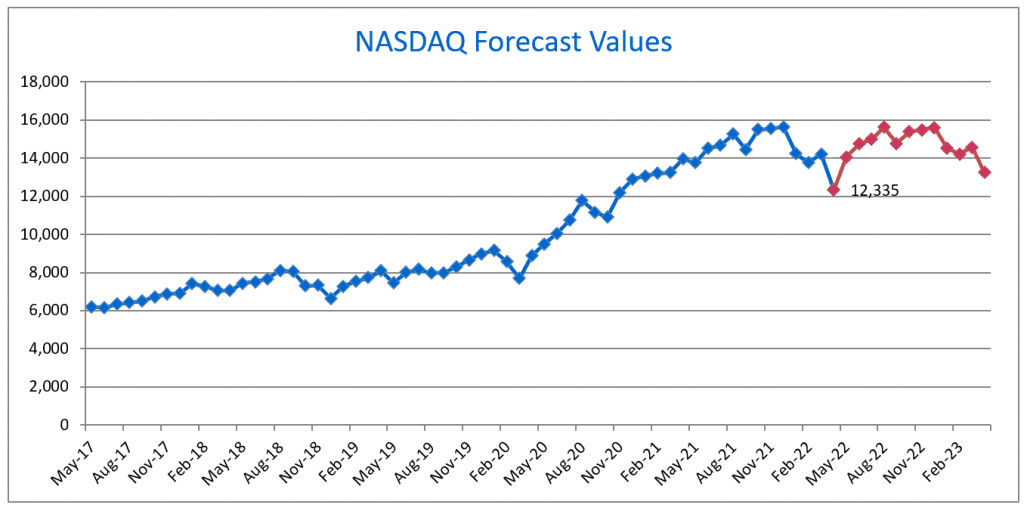

May 1, 2022, NASDAQ Forecast

On April 29, 2022, the NASDAQ index closed at 12,335. The NASDAQ index, which hit an all-time high of 16,212 in 2021, has been under pressure ever since. The forecast model expected a sideways and then declining trend for the rest of 2022.

The NASDAQ index has been trading between 14,000 and 16,000 since June, but it finally fell below 14,000 this month. The Federal Reserve has raised interest rates by 0.75 percent this year and will keep doing so to combat rising inflation and warn against the economic consequences of Russia’s invasion of Ukraine. Higher food, energy, and commodity prices may soon slow consumer spending, affecting corporate earnings and slowing economic growth.

COVID’s impact on global trade continues to grow as shipping costs rise and delays become routine. High energy costs drive up shipping costs, and a labor shortage among trucking companies compounds the issue. Inflation and supply chain issues are likely to continue through 2022. Price and market volatility will probably continue.

Month Forecast May-22 14,025 Jun-22 14,743 Jul-22 14,982 Aug-22 15,622 Sep-22 14,757 Oct-22 15,382 Nov-22 15,475 Dec-22 15,600 Jan-23 14,509 Feb-23 14,217 Mar-23 14,576 Apr-23 13,232

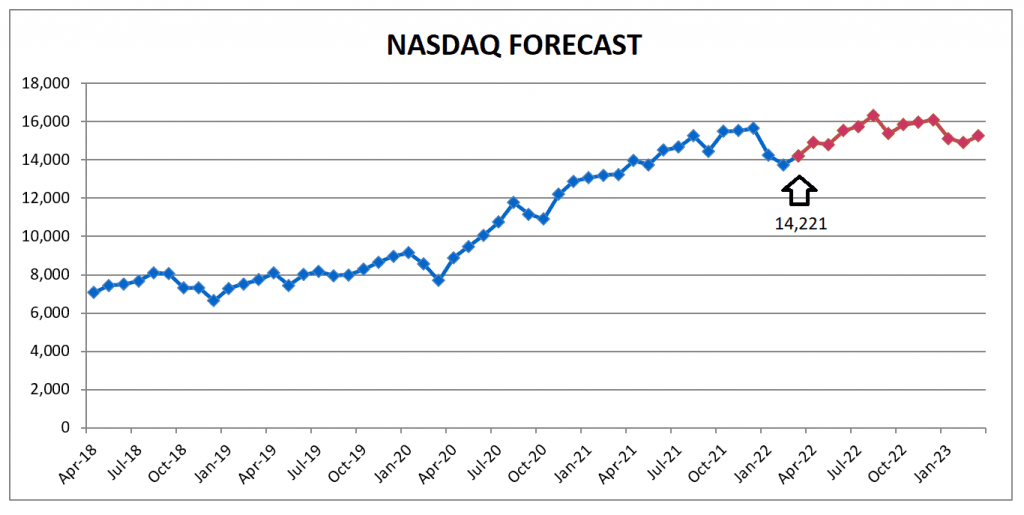

April 1, 2022, NASDAQ Forecast

On March 31, 2022, the NASDAQ index closed at 14,220. The NASDAQ index, which hit an all-time high of 16,212 in 2021, has been under pressure ever since. The forecast model still predicted that the index would rise slightly before settling into a steady pattern for the rest of 2022.

The NASDAQ index stayed between 14,000 and 16,000, as did the model projection. The Federal Reserve is raising interest rates to combat growing inflation and warn about the economic consequences of Russia’s invasion of Ukraine. Constrained consumer spending may soon impact corporate earnings and so hinder economic growth. Equities confront a double threat as the Federal Reserve tightens its monetary policies and the Russian-Ukrainian conflict may slow economic growth. Inflation and supply chain problems will probably persist. Price and market volatility are likely to remain.

Month Forecast Apr-22 14,897 May-22 14,801 Jun-22 15,533 Jul-22 15,750 Aug-22 16,330 Sep-22 15,370 Oct-22 15,845 Nov-22 15,968 Dec-22 16,095 Jan-23 15,114 Feb-23 14,911 Mar-23 15,258

The forecast model continued to predict a gain in the NASDAQ index based on the March closing price. It indicated a small upward rise in the following months before grinding to a halt. This might mean a setback in the near term. Due to the uncertainty, investors should proceed with caution. One thing to examine is using a covered call strategy.

SP 500 Forecast

The forecast for the SP 500 is also available. You can read about it here.

Disclaimer: The opinions shared in this article are my own and should not be construed as financial advice. It is essential for readers to independently research and consult with financial experts before making investment decisions. This content is for informational purposes only, and individual financial situations may vary. Past performance is not indicative of future results. I am not a licensed financial advisor, and readers are advised to exercise caution and seek personalized guidance based on their specific financial circumstances.