Table of Contents

In the ever-evolving landscape of financial markets, the synergy between Renko and indicators has become a powerful fusion that can revolutionize your trading success. Combining the unique insights of Renko charts with the precision of technical indicators offers traders innovative ways to analyze market trends. In this article, we’ll explore five strategies that demonstrate the seamless integration of Renko and indicators, discussing their pros, cons, risks, and the importance of combining fundamental analysis for a holistic trading approach.

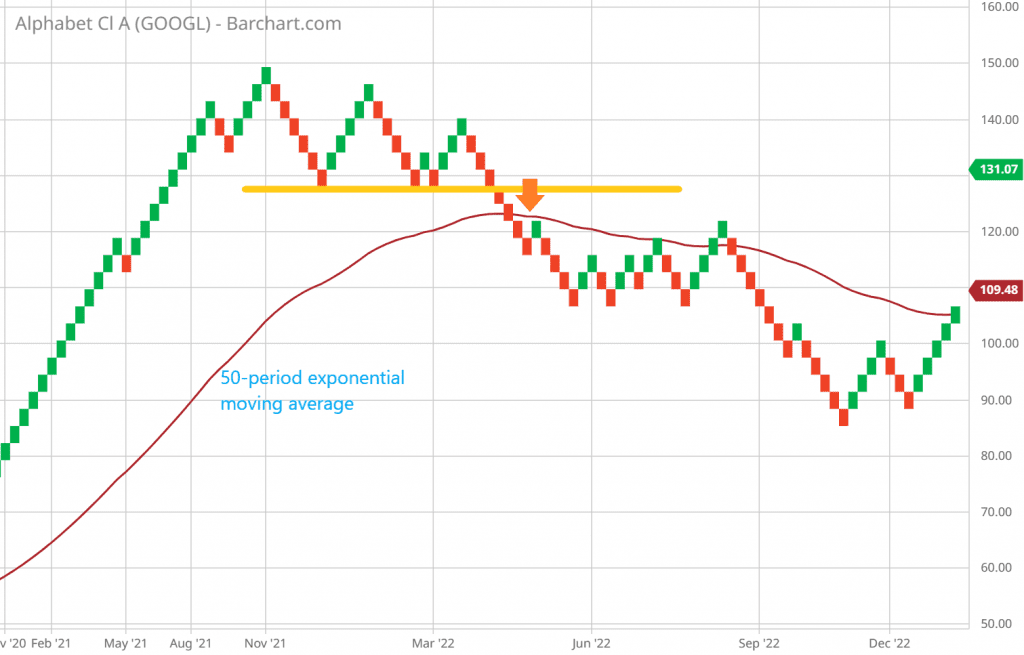

Strategy 1: Moving Averages Amplified

The fusion of Renko and indicators like moving averages brings a new dimension to trend analysis. Renko’s ability to eliminate noise complements the smoothing effect of moving averages, delivering clearer signals. For instance, combining Renko with a 50-period exponential moving average enables traders to capture trends with heightened precision. By identifying scenarios where Renko bars consistently stay above the moving average, you can spot strong bullish trends. However, it’s essential to consider the lagging response of moving averages, which might result in missed opportunities during rapid market changes.

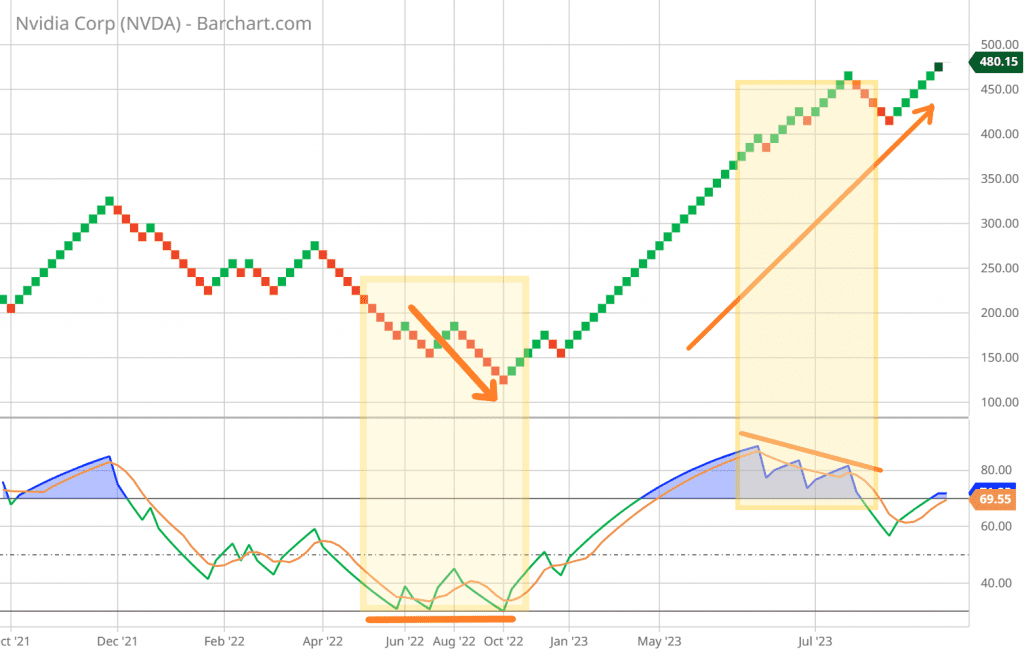

Strategy 2: RSI and Renko – Perfecting Entry and Exit Points

The Relative Strength Index (RSI) is a popular momentum indicator that, when integrated with Renko, refines trade timing. When RSI crosses overbought or oversold thresholds on a Renko chart, it signals potential reversals. Imagine observing an overbought RSI reading (above 70) while Renko bars indicate a clear bearish trend – this hints at an imminent price correction. This synergy empowers traders with insights for entry and exit decisions. However, be mindful of instances where RSI lags during robust trends, leading to premature exits or late entries.

Strategy 3: Bollinger Bands and Renko – Riding Volatility

The powerful pairing of Bollinger Bands and Renko charts capitalizes on volatility analysis. Renko’s time-agnostic price movements align seamlessly with Bollinger Bands’ adaptability to market volatility. This combination aids in identifying consolidation periods and potential breakouts. For instance, Renko bars piercing the upper Bollinger Band during a strong uptrend suggests a continuation of bullish momentum. Nevertheless, traders should remain cautious of false signals that may arise during periods of low volatility.

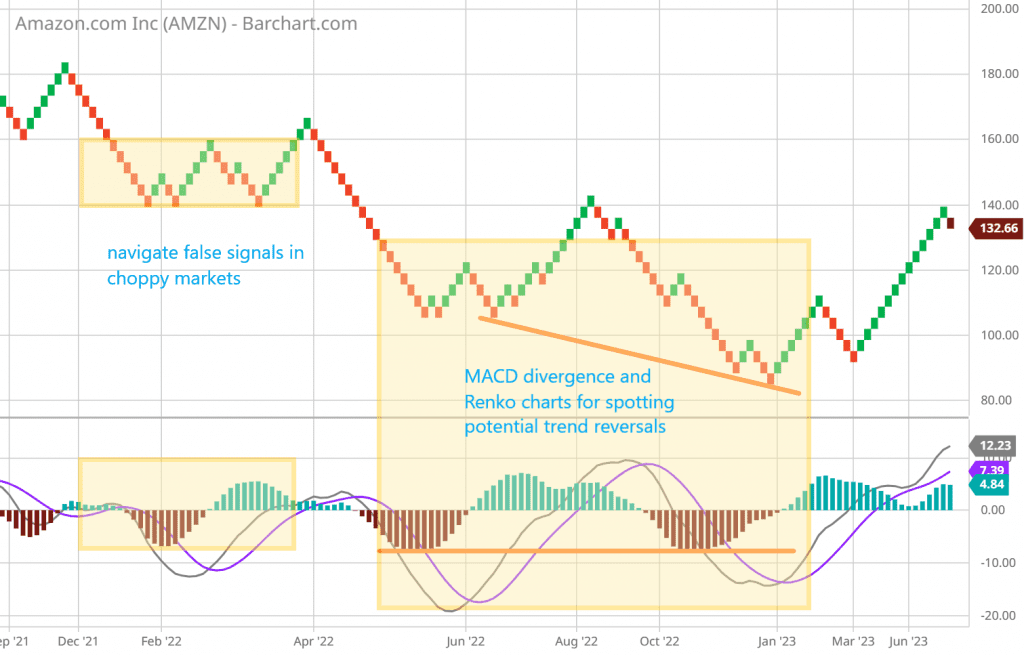

Strategy 4: MACD Divergence on Renko – Spotting Trend Reversals

Integrating Moving Average Convergence Divergence (MACD) divergence patterns with Renko charts enhances trend reversal identification. This synergy excels at recognizing potential turning points. When Renko bars make higher highs, but the MACD histogram indicates lower highs, it might signal an impending trend change. However, it’s essential to navigate through false signals that could emerge during choppy market conditions.

Strategy 5: Fibonacci Retracements with Renko – Precision in Price Levels

Renko’s distinct charting approach, combined with Fibonacci retracement levels, offers unparalleled precision in identifying support and resistance zones. This synergy provides traders with accurate potential turning points. Keep in mind that Renko’s disregard for time may occasionally lead to misalignment with conventional Fibonacci time intervals. However, aligning key Fibonacci retracement levels with significant Renko reversal patterns strengthens the likelihood of accurate predictions.

Advanced Renko Chart Strategies for Experienced Traders

5 Dynamic Renko Chart Indicators for Supercharged Analysis

The Power of Combining Fundamental Analysis with Indicator-Based Analysis

Amidst the prowess of Renko and indicators, fundamental analysis plays a pivotal role. While indicators offer insights into price trends and momentum, fundamental analysis provides a broader context for informed decisions. Economic data releases, geopolitical events, and earnings reports can significantly impact asset prices. Combining fundamental analysis with indicator-based strategies empowers traders with a comprehensive understanding. Imagine leveraging the power of Renko and indicators alongside insights from central bank decisions or quarterly earnings reports – this holistic approach enhances decision-making confidence.

Pros and Cons of the Renko and Indicators Synergy

| Aspect | Details | Comparisons | Pros | Cons |

|---|---|---|---|---|

| Noise Reduction | Renko’s noise elimination complements indicator signals. | Renko provides clearer signals compared to traditional time-based charts. | Improved signal quality; better trend identification. | False signals can still occur, affecting accuracy. |

| Enhanced Timing | Renko-indicator synergy refines entry and exit points. | Renko’s precise timing complements indicators’ momentum readings. | Optimized trade timing; maximized profit potential. | Lagging indicators may lead to missed rapid changes. |

| Adaptability | Renko’s unique charting complements indicator effectiveness. | Renko adapts well to various market conditions. | Effective in diverse market scenarios. | Complex strategy implementation; steep learning curve. |

Pros:

- Noise Reduction: Renko’s noise elimination complements indicators, leading to clearer signals.

- Enhanced Timing: Combining Renko and indicators refines entry and exit points for better timing.

- Adaptability: Indicators’ effectiveness in various conditions pairs well with Renko’s unique charting.

Cons:

- False Signals: Indicators can generate false signals, potentially leading to incorrect decisions.

- Lagging Indicators: Some indicators may lag during rapid market changes, causing missed opportunities.

- Complexity: Implementing these strategies requires a deep understanding of both Renko charts and indicators.

Lagging Indicator: Economic, Business and Technical

Risk Management: Navigating the Challenges

While the Renko-indicator synergy presents exciting opportunities, risk management remains paramount. Traders should:

- Backtest Thoroughly: Prior to implementing these strategies, backtesting is crucial to understand their performance in various market conditions.

- Diversify Indicators: Relying solely on one indicator may amplify risks. Diversify by combining indicators with complementary strengths.

- Stay Updated: Markets evolve, and what works today might not work tomorrow. Continuous learning and adaptation are vital.

In conclusion, the synergy between Renko charts and technical indicators offers a compelling approach to trading success. Each strategy has its strengths and weaknesses, and their effectiveness hinges on a trader’s ability to adapt, learn, and effectively manage risk. By harnessing the power of this dynamic fusion and integrating fundamental analysis, traders can unlock a new realm of possibilities in the financial markets.