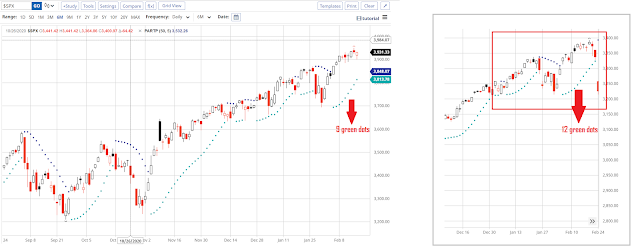

I applied the Parabolic SAR on the S&P 500 daily chart today. It looked quite similar to the times from January, 2020 to February 19, 2020. Based on the patterns from the past few years, when Parabolic SAR turns green, the index rises between 100 and 300 points. Each period lasts from 10 to 25 trading days before some sort of correction takes over, which can be minor or major.

The last time it turned green at 3836 on 2/4/2021. It climbed as high as 114 points. Today, S&P 500 was on the 9th green-dot up-trend day. What if…

- We are close to the highest point and the correction is imminent. We may still have a few up days yet because the current green dot sits at 3813. It is going up at about 20 points per day.

- 3836 was the starting point when the dot turned green. Based on the past patterns, each period the index could climb up to 300 points; therefore, 3836 + 300 = 4136. The index closed at 3931. We still have 100 to 200 points to go yet.