Overview

Renko Chart Trading

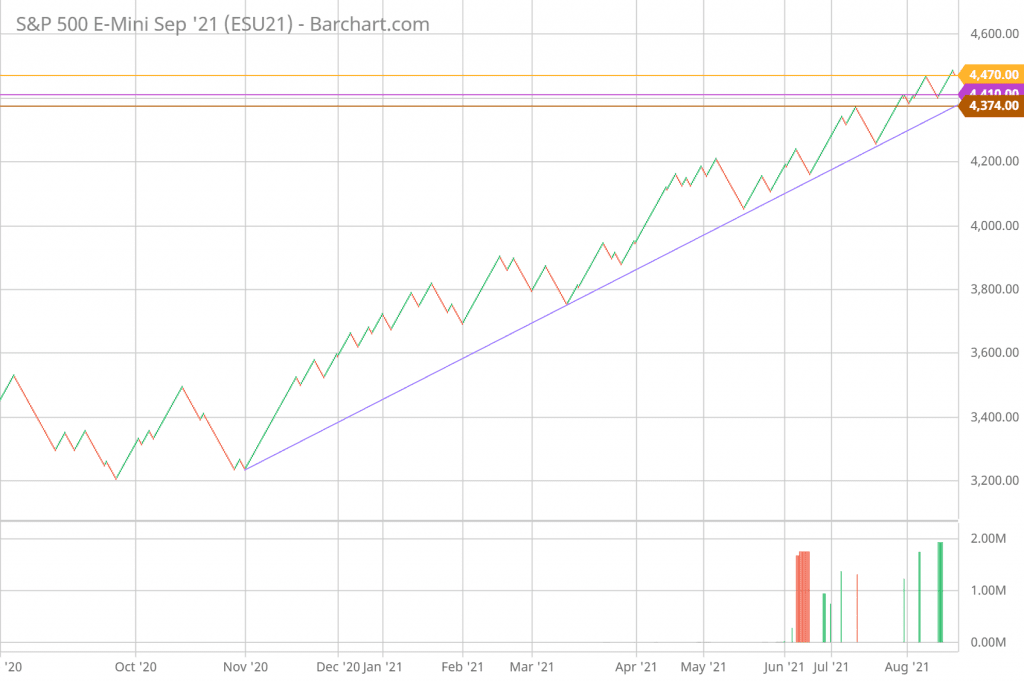

The SP 500 FUTURES has been rising. It has been on a steady ascent since it plummeted to a low of 4,347 on August 18, 2021 and reversed, and it has yet again displayed a phenomenal V-shape reversal. The recovery was remarkable, and futures prices reached new highs. The most recent high was 4,498 yesterday. It did recede a little today. It is now at the prior support level of 4,470. According to Renko chart trading patterns and technical analysis, the SP 500’s bullish trend is still intact. The ascending trendline is getting close to the 4,374 level. The index is currently 100 points above this rising trendline, indicating that the trend is still highly positive.

On the upside, there isn’t much resistance in sight. Higher highs are likely if the price breaks above 4,498. On the downside, there is a lot of support on the horizon. The first level of support is located at 4,470, followed by 4,410 and 4,374. The main concern is that there isn’t a lot of support between 4,470 and 4,410. If 4,470 is broken, the subsequent downward correction may be severe. The difference between 4,470 and 4,410 is 60 points. Investors should be aware that starting a new long position at this point should be done with caution. Writing covered calls on the equities you own to give downside protection is a viable option right now.

- The traditional 6-point brick size is used in the Renko chart.

- On the upside, the minor barrier is 4,498.

- On the down side, 4,470 is the first line of defense, followed by 4,410 and 4,374.

How to Apply Renko Chart Trading Patterns and Technical Analysis in Trading – Support, Resistance, and Trendline

Futures climbed 151 points, or 3.5 percent, in six trading days from the August 18 low of 4,347 to the August 25 high of 4,498. That is very incredible. It remains to be seen whether the SP 500 Futures can continue to climb. We did have some retracement today. It is now trading close to the previous support level of 4,470. This level is noteworthy since there wasn’t much support until about 4,410. If the support level of 4,470 is breached, the 60-point difference translates into a 1.5-percentage-point loss.

Daily Renko Chart

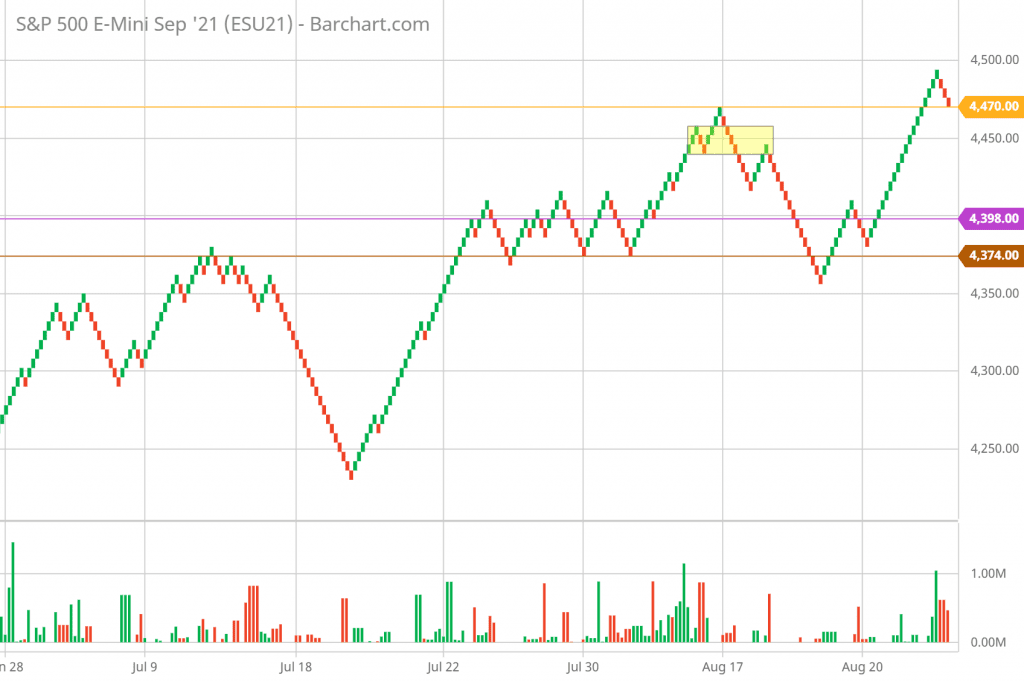

The price is back at the crossroads on the hourly chart. 4,470 is important since it was the previous high and is now functioning as a support level. If this level is not able to hold, the yellow region between 4,440 and 4,458 may be able to halt the slide, but we will have to wait and watch how it plays out. Between 4,374 and 4,410 is a more strong support region. If it does correct downward to this level, it will be a 1.5 to 2% drop from the present level. However, if the bulls return after a one-day break, they can easily drive prices higher.

Hourly Renko Chart

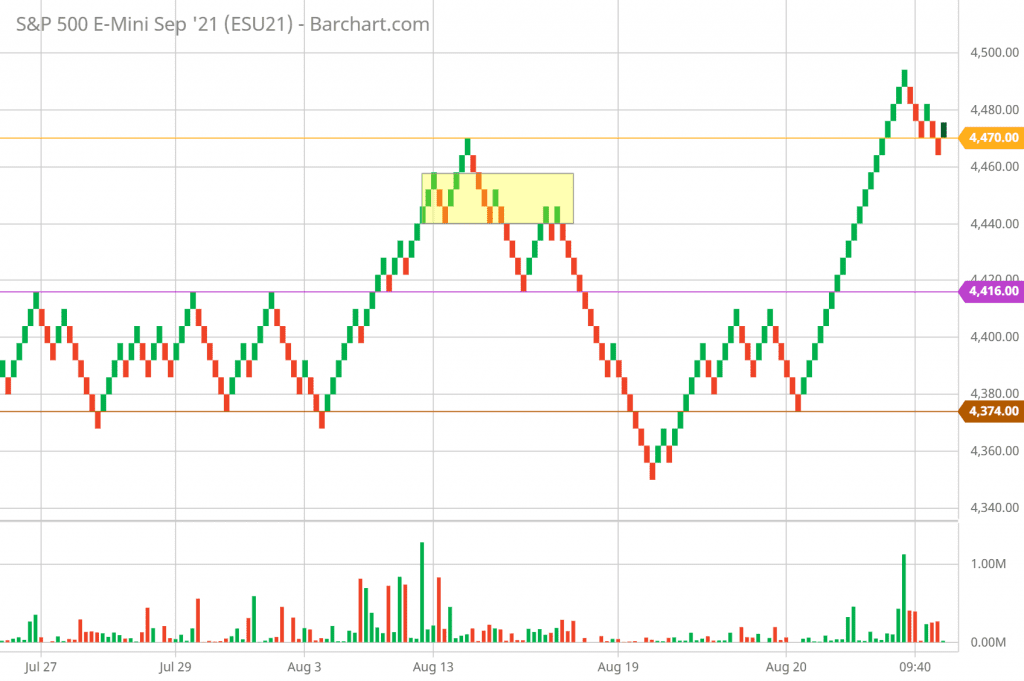

It creates a graph similar to the hourly chart in the 5-minute chart. 4,470 is significant since it was the previous high and is now acting as a support level. If this level cannot be maintained, the yellow zone between 4,440 and 4,458 may be able to stop the decline. Otherwise, we’re looking at a range of 4,374 to 4,416 to halt the drop. Except for the recent high of 4,498 on the upside, there isn’t much resistance in sight.

5-Minute Renko Chart

Renko Chart Trading: More Resources

- How Do Renko Charts Work? A Trader’s Guide

- How to Use Renko Charts for Stock Trading?

- Renko Chart Buy Sell Signals – a How-to Guide

- What Is a Renko Chart and How I Use It in Trading

- Buy-Write Covered Calls Strategy Should Generate More Income

- What Is a W Double Bottom Pattern and How to Profit from It?