Overview September 3, 2021

In this post, we will explore SP 500 Renko charts in greater detail, as well as Renko chart trading strategies. We will also perform a technical analysis on Renko charts spanning multiple time horizons.

Contents

Analysis and Forecast for the S&P 500

What Happened Today?

The SP 500 FUTURES continued to rise. The record high is 4,549. Technical analysis and trading patterns on a Renko chart suggest the SP 500’s bullish trend is still going strong. The uptrend line is almost at $4,390. At present, the index is trading more than 150 points above this rising trendline, indicating that the upward trend is still very much intact. Friday’s price movement mirrored conflicting reactions to a poor US jobs data that cast doubt on the speed of economic recovery and undermined the case for Federal Reserve tapering in the short term.

Future Outlook

On the upside, there isn’t much of a barrier in sight because the price has risen to new highs. Higher highs are likely if the price breaks through 4,549. On the downside, there is a lot of support on the way. The previous high of 4,470 acts as the first level of support, with 4,410 and 4,374 following closely behind.

For more information on the technical analysis of Renko charts, please see this post, which contains more in-depth examples of the techniques.

Summary

- The traditional 6-point brick size is used in the Renko chart.

- On the upside, the recent record high of 4,549 serves as a small barrier.

- The previous high of 4,470 is the first line of support on the downside, followed by 4,410 and finally 4,374.

How to Apply Technical Analysis and Renko Chart Trading Patterns

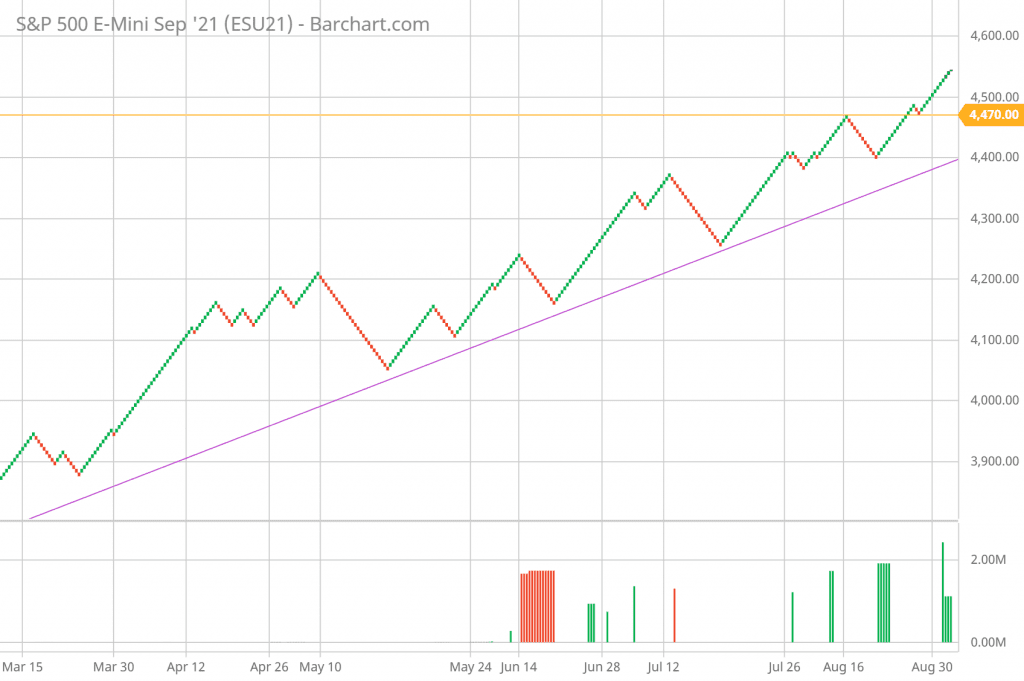

Daily Renko Chart

The major trend is upward, according to the daily Renko chart pattern and technical analysis. A break above 4,549 indicates that the current uptrend will continue. As the ascending trendline approaches 4,390, a break below it will likely break the rising trendline and shift the primary trend to the negative. The upward resistance is insignificant. A breach of 4,549 will send the price rising. The first significant defense, on the other hand, is 4,470. If the futures retest this level and are able to rebound from it, the rising trend will not be jeopardized.

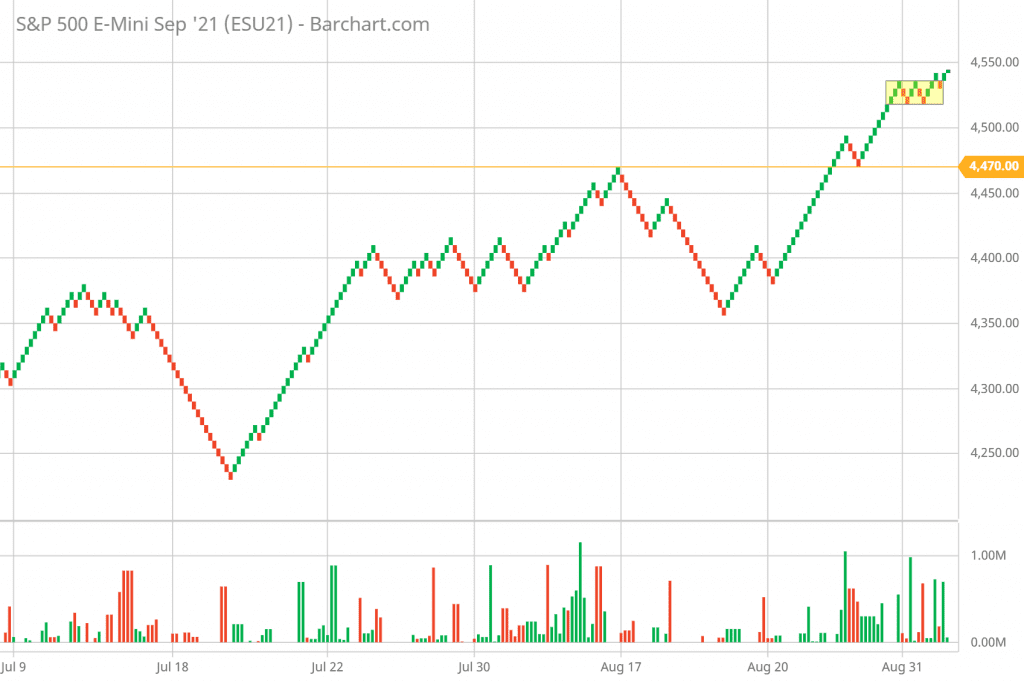

Hourly Renko Chart

We can plainly observe on the hourly chart that the price is now slightly above the yellow zone between 4,518 and 4,536. The W pattern, double bottom, created in the yellow region, might offer the SP Futures with the strong support needed to sprint higher. A break below the W support line, 4,518, will almost certainly halt the bullish trend. The previous high of 4,494 may offer some support. If this level of support does not hold, the next level of support is 4,470.

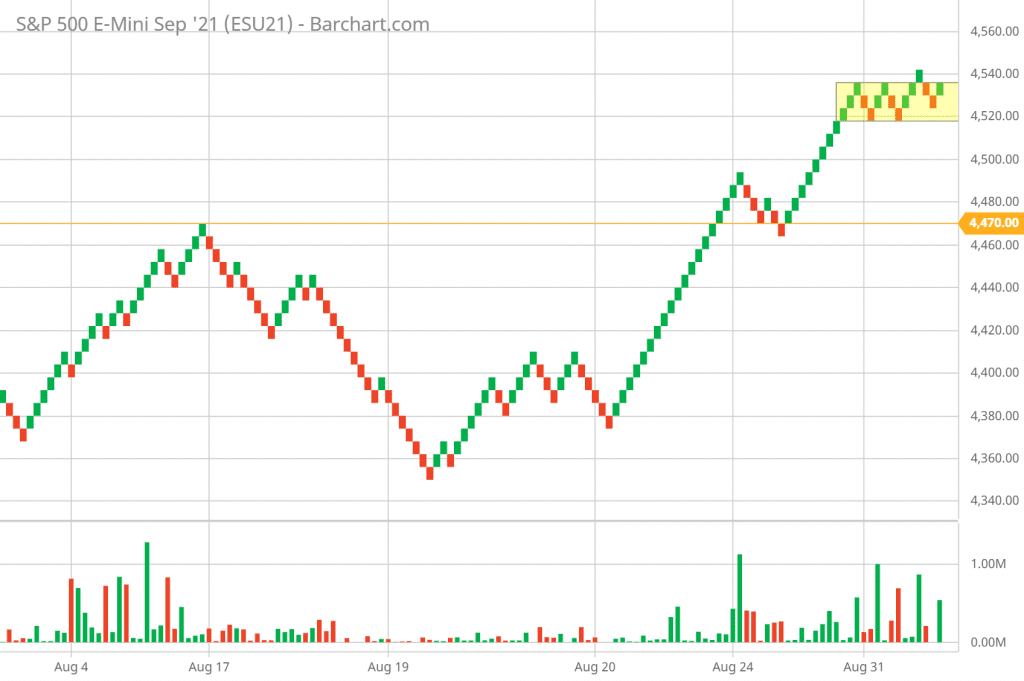

5-Minute Renko Chart

The 5-minute chart looks similar to the hourly chart. The yellow region between 4,518 and 4,536 is important. If the price can break out of this range and rise above 4,549, the positive momentum will continue, and new highs will be achieved. However, if the price falls below the bottom of the yellow region, 4,518, the powerful bullish momentum may be stifled. A break below 4,518 will very certainly result in a retest of 4,494 or 4,470.

Renko Chart Trading: More Resources

- How Do Renko Charts Work? A Trader’s Guide

- How to Use Renko Charts for Stock Trading?

- Renko Chart Buy Sell Signals – a How-to Guide

- What Is a Renko Chart and How I Use It in Trading

- Buy-Write Covered Calls Strategy Should Generate More Income

- What Is a W Double Bottom Pattern and How to Profit from It?