Overview

Renko Chart Trading

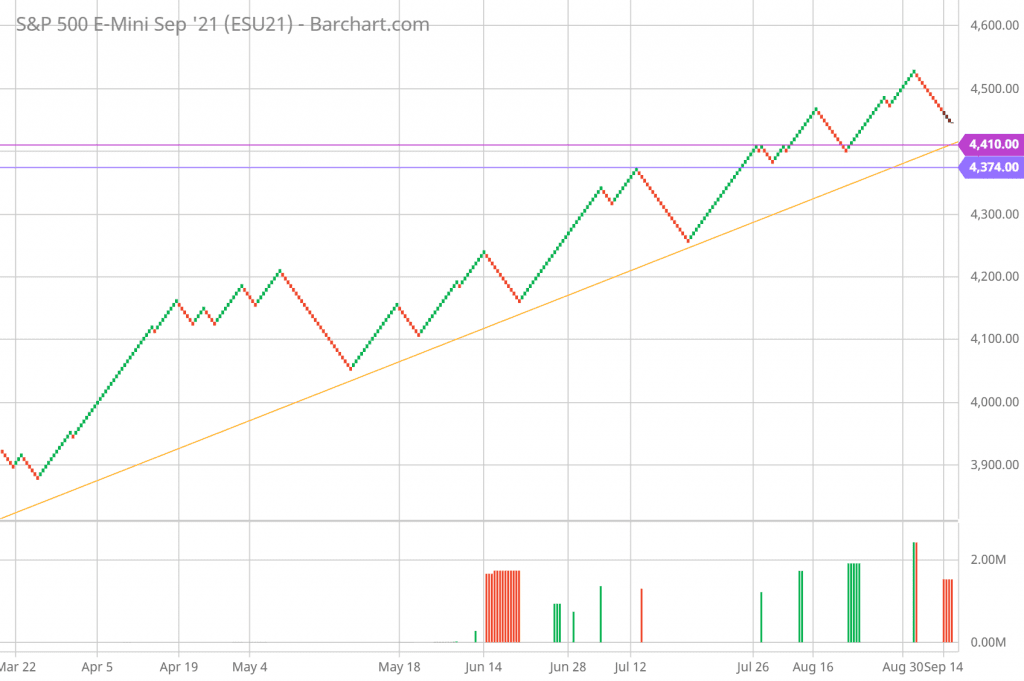

Today’s SP 500 FUTURES had a strong start, but it couldn’t maintain its gains. In the end, the day was a flop. According to Renko chart trading patterns and technical analysis, the ascending trendline running from 3234 to 3750 is approaching the 4,410 level. The bullish trend appears to be intact overall, but it may be in jeopardy. Only roughly 30 points separate the futures from this crucial support level. The long-term ascending trendline will be broken if 4,410 loses way. For the bulls, this is not going to be good news. Although the 4,374 support level is close by, it is crucial that the futures close above 4,410 to keep the bullish trend going.

The bulls have their work cut out for them. On the upside, the bulls are currently confronted with the 4,470 resistance area. Above 4,470, the prior W, double bottom, support at 4,518 becomes an even more difficult resistance level. The 4,410 support level is critical on the downside, with 4,374 close behind. The long-term rising trendline will be broken if the price closes below 4,410. In such a situation, futures will enter a correction period, potentially halting the bullish trend.

At this point, taking on a new long position should be done with prudence. Writing covered calls on equities you own to provide downside protection is a realistic alternative for the time being.

- The traditional 6-point brick size is used in the Renko chart.

- On the upside, the 4,470 region serves as an immediate hurdle, followed by the 4,518 resistance level.

- On the downside, 4,410 is the first level of support, followed by 4,374.

How to Apply Renko Chart Trading Patterns and Technical Analysis in Trading – Support, Resistance, and Trendline

The bulls face challenges ahead, despite the price being above the primary upward trendline, according to the daily Renko chart pattern and technical analysis. The current bullish momentum has been stifled as a result of the recent fall. If the price falls below 4,410, the rising trendline will be broken, reversing the fundamental trend. Staying above 4,410 is important for the bulls right now. If the market closes below 4,410, it will almost likely become a sideway market, taking longer to re-establish bullish momentum.

Daily Renko Chart

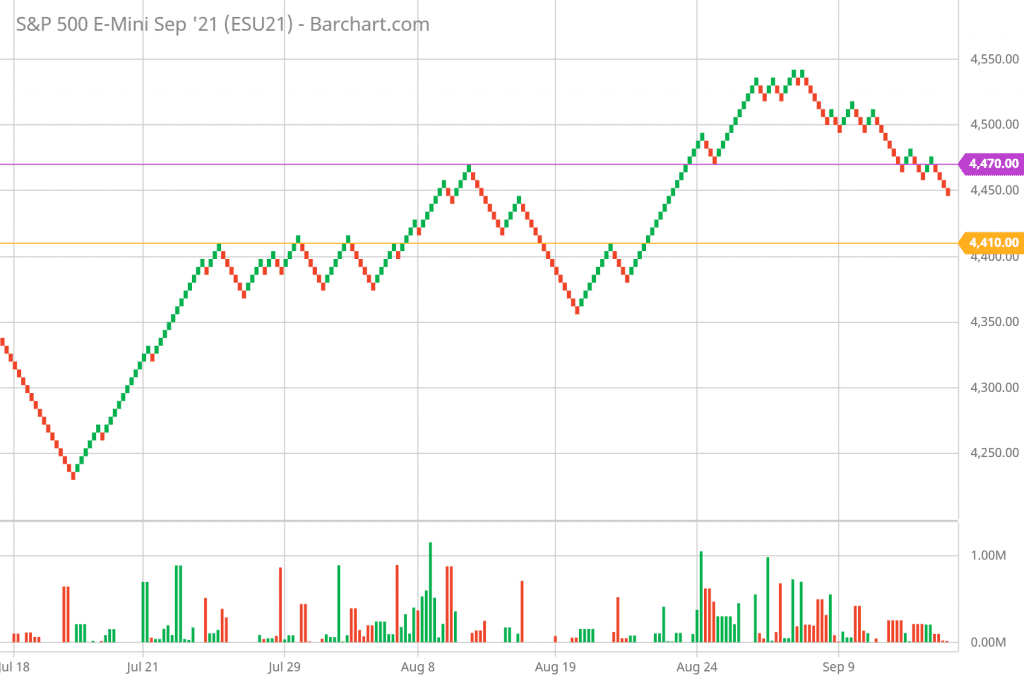

On the hourly Renko chart, the futures continued to fall. It has dropped below the last support level of 4,470 and is approaching the critical support level of 4,410. When the futures fell below 4,410, the bulls’ situation became more tough. Right now, the focus will be on 4,410, which should provide significant support in halting the decline. If 4,410 gives way on the hourly chart, the next support is near 4,370. However, if the price falls below 4,410, the bulls’ prospects are bleak.

Hourly Renko Chart

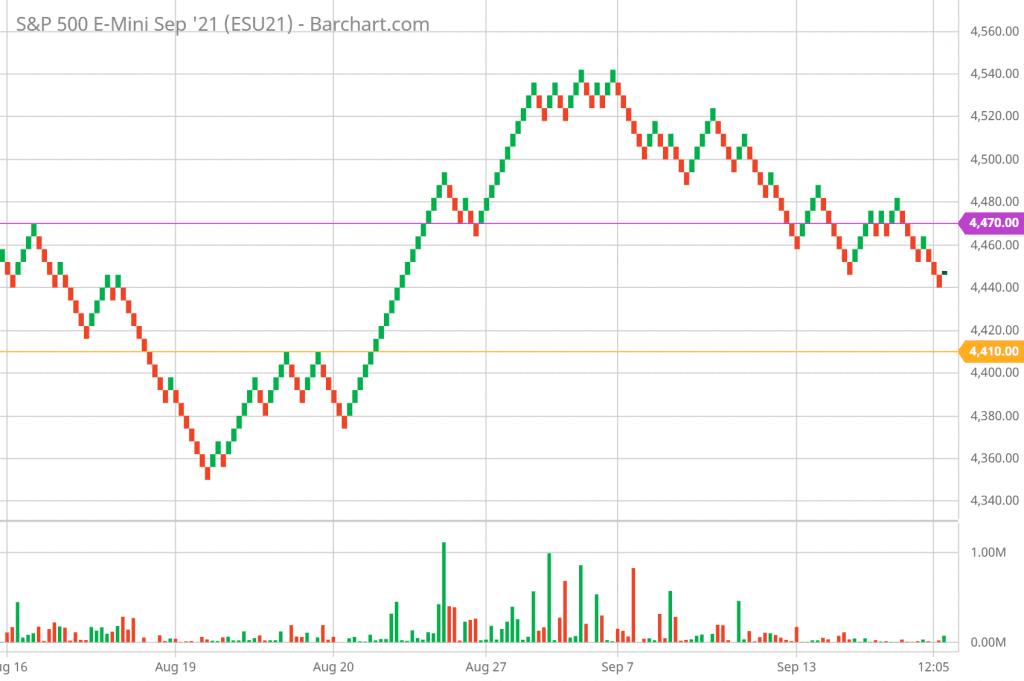

The bulls’ prospects appear to be grim on the 5-minute chart. The futures contract is currently trading at the 4,440 support level. On the upside, there are some roadblocks in the way. The first will be the area between 4,460 and 4,480. To reestablish bullish momentum, the bulls must recapture 4,518. The next support level on the downside is near 4,410, followed by the 4,360 to 4,380 range.

5-Minute Renko Chart

Renko Chart Trading: More Resources

- How Do Renko Charts Work? A Trader’s Guide

- How to Use Renko Charts for Stock Trading?

- Renko Chart Buy Sell Signals – a How-to Guide

- What Is a Renko Chart and How I Use It in Trading

- Buy-Write Covered Calls Strategy Should Generate More Income

- What Is a W Double Bottom Pattern and How to Profit from It?