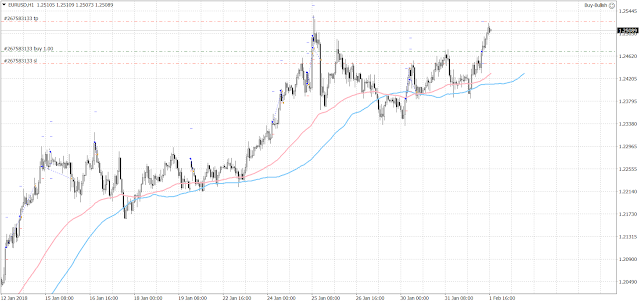

The euro moved higher and reclaimed 1.25 before tomorrow’s U.S. job report.

The EUR/USD began to move higher during the European session, and throughout the U.S. session. The U.S. 10-year treasury yields soared today from 2.73% to 2.78%; however, the higher yields were unable to stop the U.S. dollar drifting lower against its counterparts.

Yesterday, the FOMC announcement provided no surprises. The interest rates were left unchanged. There will be 2 to 3 more rate hikes. The Fed also expected solid economic growth in the U.S., rising inflation, and a tight labor market. The euro drifted sideways after the rate decision.

While the U.S. is expecting the inflation to rise, the ECB is not. One would think it should have pushed euro lower against the U.S. dollar, right? So far, it is not the case.

There was one buy position opened today from my MT4 EA. It has not been closed yet.

The strategy can be found here.

The latest result can be found here.