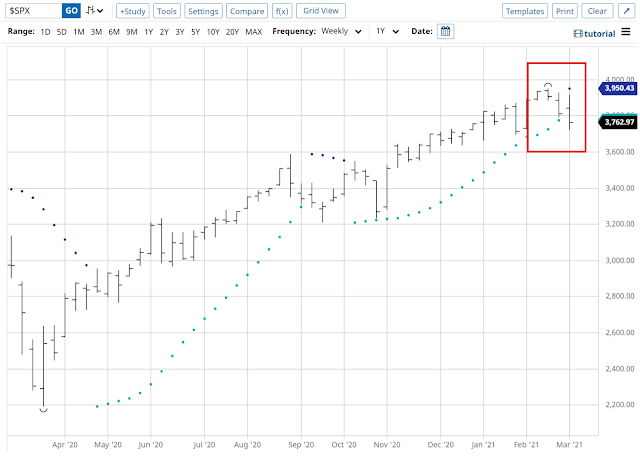

- SP500 Weekly Parabolic SAR turned bearish.

- Market reacted negatively because of Powell’s comment.

- It’s a healthy correction, and does not look like a reversal of the bullish trend at the moment.

- Overall, the market sentiment is still very bullish.

Last week, I was suspecting that the index’s Parabolic SAR indicator might change the direction soon on the weekly chart. It did today. The trigger of the selloff appeared to be a combination of Jerome Powell’s comments, “… the violent sell-off in Treasuries last week was “notable and caught my attention” but was not “disorderly” or likely to push long-term rates so high the Fed might have to intervene more forcefully ..,” and the rise of the bond yield.

If this is a minor correction, it might be only 200 points. This means the recent high is 3950. 3750 would be the bottom. Today’s low is 3723. We may begin to see a rebound even though the Parabolic SAR indicator just changed. We know Parabolic SAR is a lagging indicator.

If this is a medium correction, similar to the one we had between August and October last year, there will be another 200 points to go. 3950 – 400 = 3550.

“Don’t try to catch a falling knife,” somehow came to my mind. The Parabolic SAR indicator will somehow confirm a bottom and a buying opportunity none the less.