Overview

SP 500 Forecast Today and Renko Chart Trading

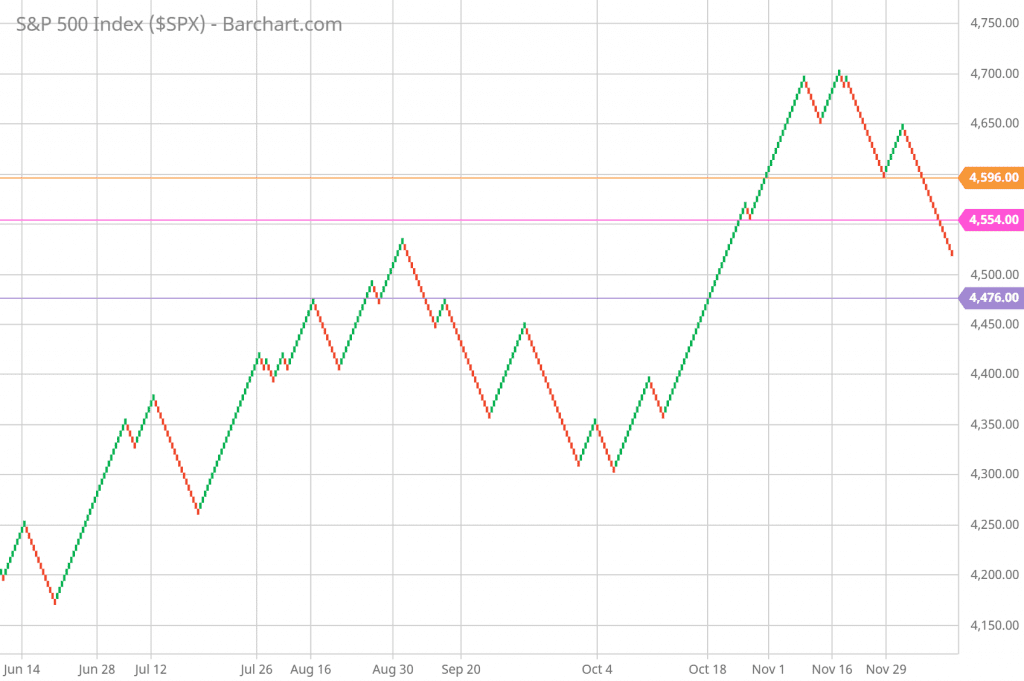

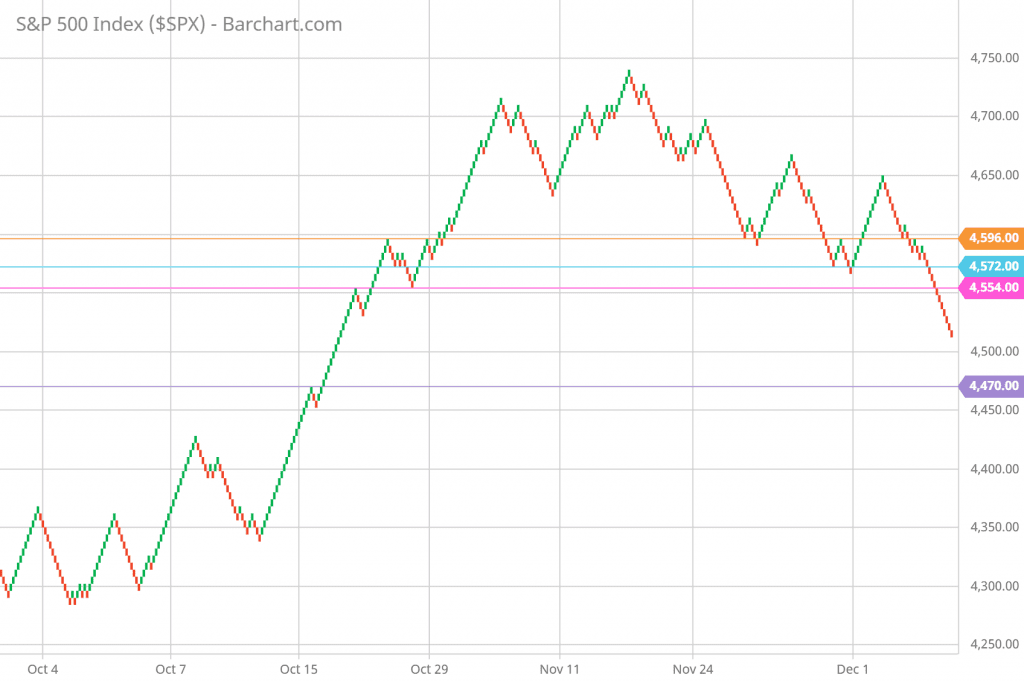

As a result of the COVID scare, the $SPX has continued its precipitous decline. With today’s SP 500 trading patterns and forecast on the Renko chart, it appears as if that psychological support of 4,500 is now under threat of being crossed. Since bullish momentum has begun to fade, the index is currently in search of a reliable support level to hold onto for the time being. $SPX has breached a number of key support levels, including 4,596 and 4,554. Minor support exists near 4,494, but the next level of more reliable support will not be reached until the price reaches 4,476, which is a significant drop from the high of 4,718.

Writing Covered Calls

Covered call writing on stocks that you already own is a great strategy for providing downside protection for your investment portfolio. When compared to other investment strategies, covered call writing provides you with the opportunity to earn more money, increase your level of safety, and increase your chances of making a profit on your investments. In trading, writing out-of-the-money calls is an excellent strategy to use if you have faith and confidence in the underlying stock you are investing in. If you are not confident in the stock’s performance, you could consider selling calls that are at or near the strike price.

It is especially important to note that the level of protection provided by in-the-money calls is significantly greater than the level of protection provided by out-of-the-money calls, particularly in a downtrending market.

- The traditional 6-point brick size is used in the Renko chart.

- On the upside, the 4,554 region serves as an immediate resistance level, followed by 4,596.

- On the downside, 4,500 is the first level of support, followed by 4,494, and subsequently 4,476.

SP 500 Forecast and Charts

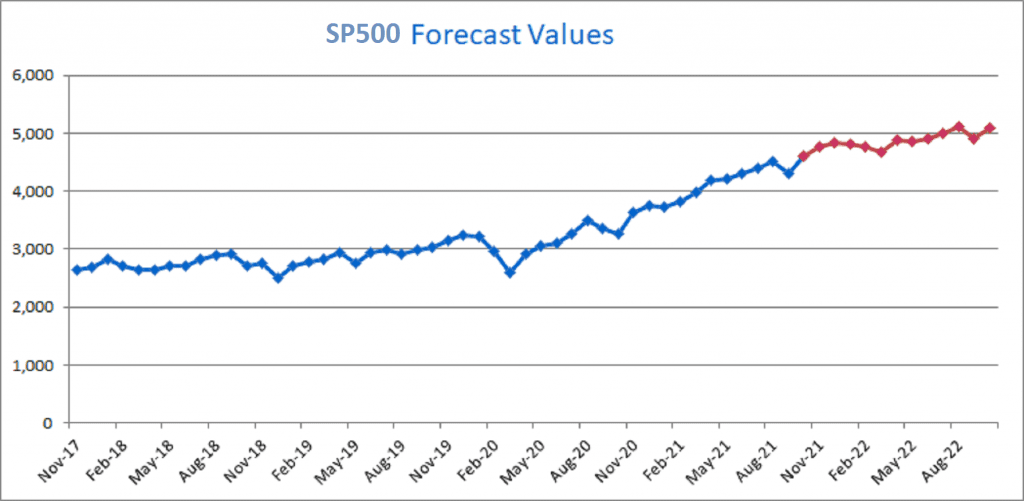

A number of different algorithms are used to carry out the calculations. In addition to historical S&P 500 values over the previous five years, this forecast takes into account other variables such as stock market indices and economic data to arrive at its forecast.

November 15, 2021

The first S&P 500 forecast was completed in early November, immediately following the previous month’s close. It is anticipated that the $SPX will continue its upward trend in the foreseeable future, according to the forecast model depicted below. However, it appears that there is only a limited amount of room for upward movement left, and that the trend will begin to plateau in the coming months. It represented an upward movement that was followed by a retracement.

At that point in time, we have no way of knowing when the retracement will take place or how severe the ramifications will be. However, the fact remains that it is sending a message to investors, advising them to proceed with caution in the meantime.

Month Forecast Nov-21 4,775 Dec-21 4,838 Jan-22 4,812 Feb-22 4,762 Mar-22 4,677 Apr-22 4,892 May-22 4,851 Jun-22 4,896 Jul-22 4,987 Aug-22 5,116 Sep-22 4,912 Oct-22 5,080

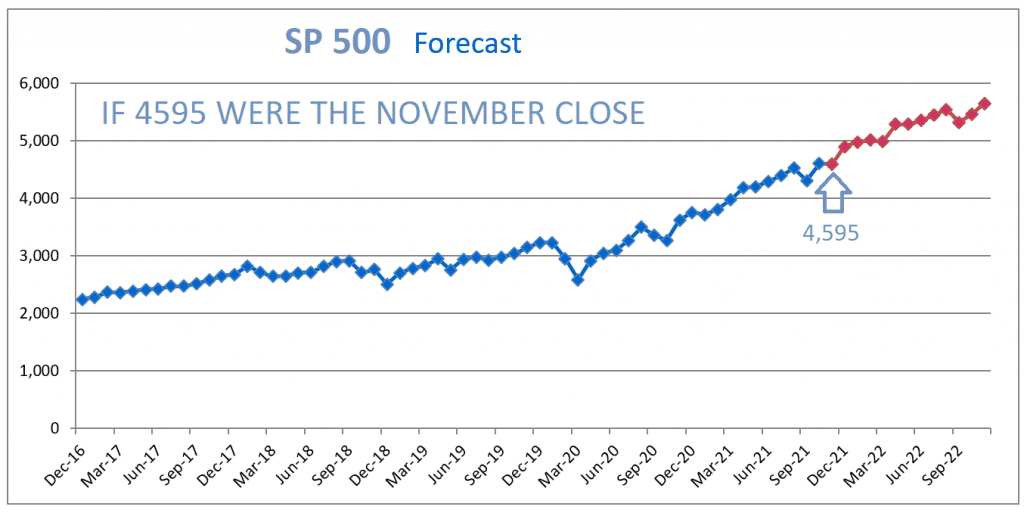

November 26, 2021

The second $SPX forecast was completed on November 26, 2021, with calculations based on the closing price of SP 500 on that day as the basis. According to the forecast model depicted below, the $SPX will resume its upward trend with a vengeance before coming to a grinding halt near the 5,000 mark. It appears to indicate that the stock market’s decline on Friday was a correction rather than a reversal.

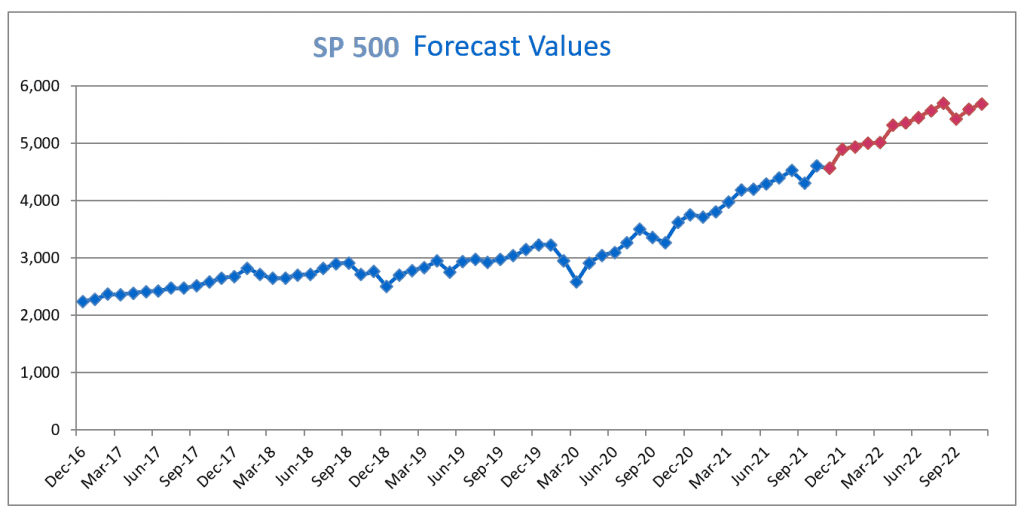

December 1, 2021

The forecast for today is based on the closing price of the SP 500 for November, which was 4,567. As can be seen on the chart, it continued to show signs of a sharp upward move in December before beginning to stall near the 5,000 level. It is strikingly similar to the model from the previous Friday.

Month Forecast Dec-21 4,902 Jan-22 4,941 Feb-22 5,009 Mar-22 5,009 Apr-22 5,318 May-22 5,356 Jun-22 5,453 Jul-22 5,569 Aug-22 5,697 Sep-22 5,429 Oct-22 5,601 Nov-22 5,690

SP 500 Forecast and Chart

Daily Renko Chart Trading

In the short term, the $SPX is very close to the psychological support level of 4,500. In addition, there is some minor support near 4,494. We shall see whether the $SPX is able to recover from its current low point. The index could potentially test the support strength near 4,450, followed by 4,400, if the bearish sentiment persists. On the upside, the first resistance level would be 4,554, which would be followed by 4,596.

Daily Renko Chart

A closer look at the pattern on the 5-minute chart shows that many important support levels have been broken, making it appear more bearish. As of right now, the next support level is 4,470, which is the previous high. It remains to be seen whether the $SPX will be able to halt its decline at this point. Because of the recent steep decline, it is highly likely that the market will experience a rebound. On the upside, there are three significant resistance levels ahead of us. They are 4,554, 4,572, and 4,596, respectively.

5-Minute Renko Chart

Renko Chart Trading: More Resources

- How Do Renko Charts Work? A Trader’s Guide

- How to Use Renko Charts for Stock Trading?

- Renko Chart Buy Sell Signals – a How-to Guide

- What Is a Renko Chart and How I Use It in Trading

- Buy-Write Covered Calls Strategy Should Generate More Income

- What Is a W Double Bottom Pattern and How to Profit from It?