Overview

Renko Chart Trading

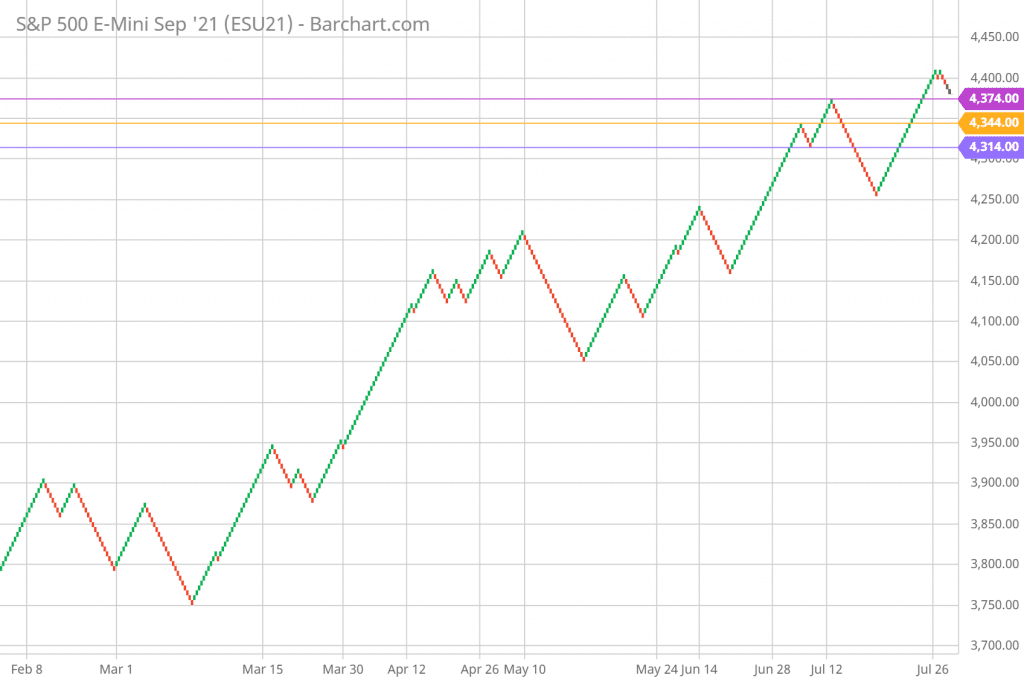

The SP 500 FUTURES began the day higher and remained there for the majority of the day, but then reversed course and closed lower. The record high of 4,422 was maintained, and the consolidation pattern continued. The daily Renko chart trading pattern clearly shows a positive trend that is currently stalled. The consolidation could signal a challenging upward climb in the near future. It could last until the release of the July Non-farm Payroll on Friday. Then we’ll be able to see where the market is headed.

According to Renko chart trading patterns and technical analysis, the SP 500’s bullish trend is continuing. The ascending trendline is getting close to the 4,300 level. However, it is currently under pressure, trading below the record high of 4,422 and closing below the 4,400 level once again. If the market breaks above 4,422 or below 4,300, we’ll have a better idea of where it’s heading. Otherwise, the trend of consolidation is expected to continue. Investors should be mindful, however, that starting a new long position at this time should be done with caution. Right now, writing covered calls on the stocks you hold to provide downside protection is a viable option.

- The traditional 6-point brick size is used in the Renko chart.

- The next significant upward hurdle is the all-time high of 4,422.

- On the down side, 4,374 serves as the initial line of defense, followed by 4,344. The 4,314 level is significant since the bullish trend line is approaching the 4,300 level.

How to Apply Renko Chart Trading Patterns and Technical Analysis in Trading – Support, Resistance, and Trendline

Today’s SP 500 Futures closed a little under the 4,400 mark. It struggled to break through the record high of 4,422. The all-time high of 4,422 looks to be a major obstacle. The futures is quite likely to fall further toward the 4,350 range and retest the support level at 4,344. Despite the fact that there is no evidence of a trend reversal at the moment, the consolidation pattern has persisted. It must remain above 4,300 in order to sustain the bullish trend. Otherwise, the ascending trendline will be disrupted, complicating matters.

Daily Renko Chart

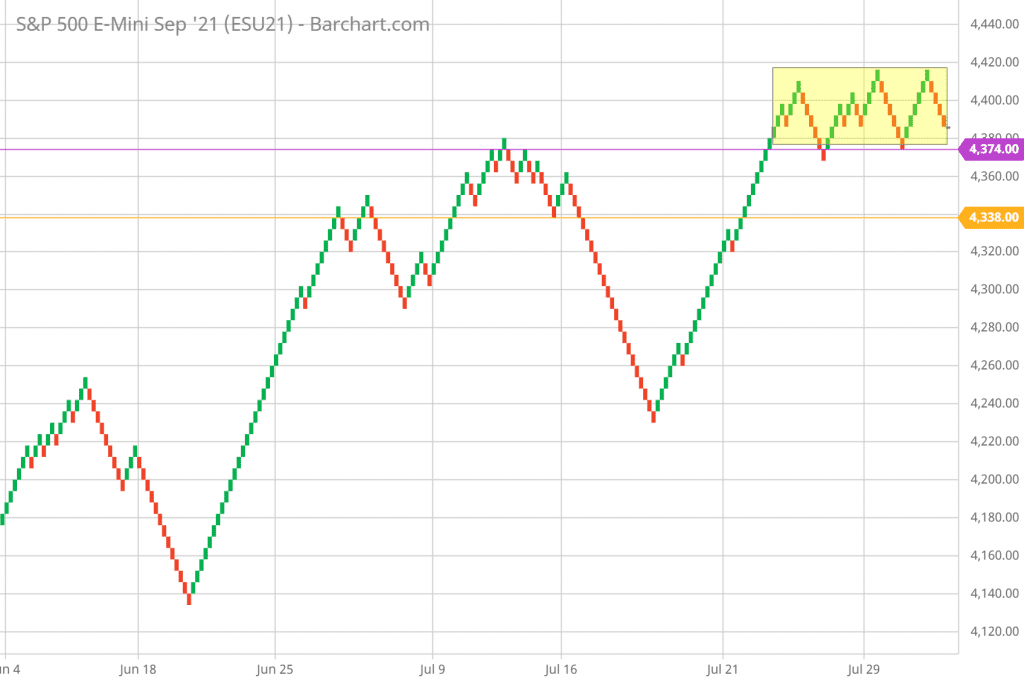

The hourly chart plainly shows that there is a consolidation taking place. For some time, the futures have been oscillating between 4,370 and 4,422. The current trading range is shown by the yellow zone on the chart. If the price goes below 4,370, it will enter the next trading zone and seek support at 4,344. If the slide continues, the next support level will be at 4,280. The rising trendline, on the other hand, is now at 4,300. A drop below 4,300 is bad news for the bulls. If buyers can sustain their bullish momentum and break over 4,422, further highs are likely.

Hourly Renko Chart

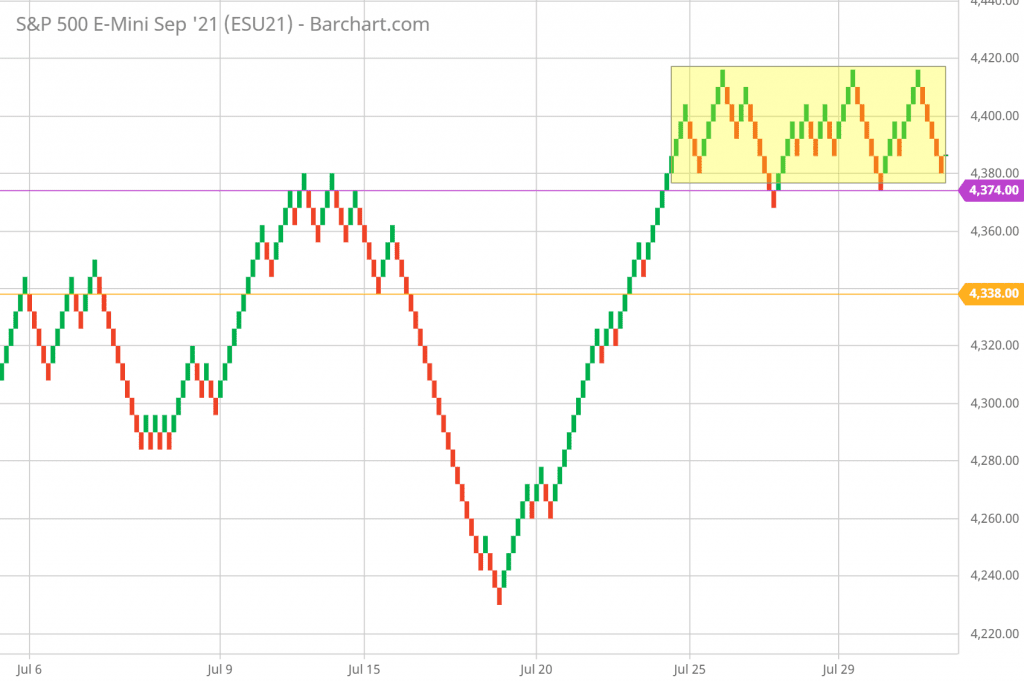

The 5-minute Renko chart, like the hourly chart, shows a consolidation pattern, as indicated in the yellow zone. If the support levels around 4,370 or 4,380 fail to hold, the next level of support is at about 4,350. If it continues to fall, the next level of support is at 4,280. The bulls must decisively break out of the current trading range of 4,370 to 4,422 in order to propel the market higher.

5-Minute Renko Chart

Renko Chart Trading: More Resources

- How Do Renko Charts Work? A Trader’s Guide

- How to Use Renko Charts for Stock Trading?

- Renko Chart Buy Sell Signals – a How-to Guide

- What Is a Renko Chart and How I Use It in Trading

- Buy-Write Covered Calls Strategy Should Generate More Income

- What Is a W Double Bottom Pattern and How to Profit from It?